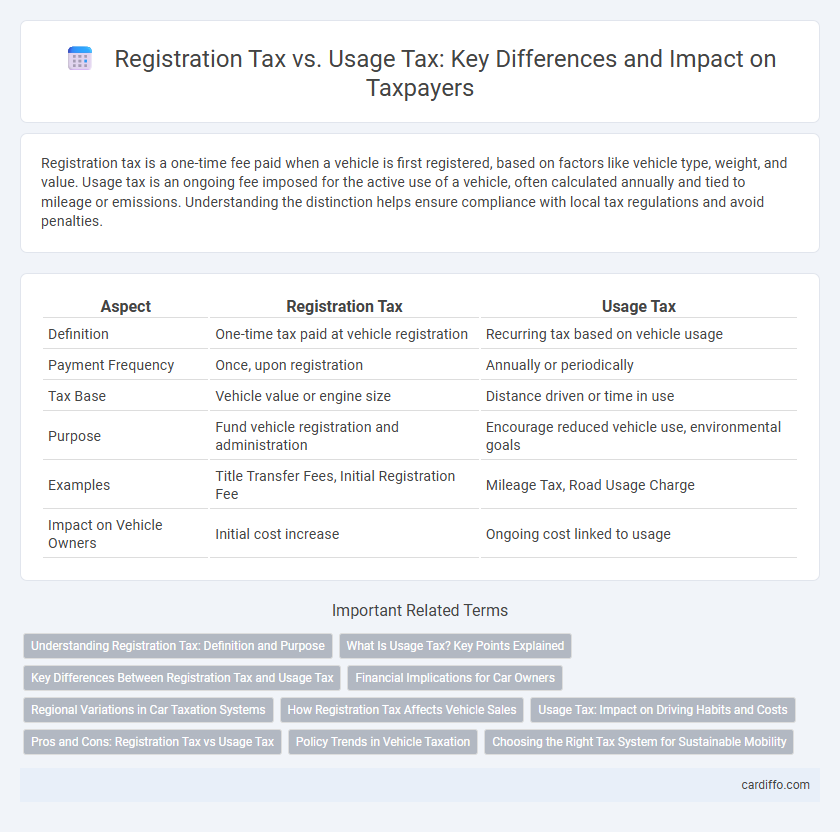

Registration tax is a one-time fee paid when a vehicle is first registered, based on factors like vehicle type, weight, and value. Usage tax is an ongoing fee imposed for the active use of a vehicle, often calculated annually and tied to mileage or emissions. Understanding the distinction helps ensure compliance with local tax regulations and avoid penalties.

Table of Comparison

| Aspect | Registration Tax | Usage Tax |

|---|---|---|

| Definition | One-time tax paid at vehicle registration | Recurring tax based on vehicle usage |

| Payment Frequency | Once, upon registration | Annually or periodically |

| Tax Base | Vehicle value or engine size | Distance driven or time in use |

| Purpose | Fund vehicle registration and administration | Encourage reduced vehicle use, environmental goals |

| Examples | Title Transfer Fees, Initial Registration Fee | Mileage Tax, Road Usage Charge |

| Impact on Vehicle Owners | Initial cost increase | Ongoing cost linked to usage |

Understanding Registration Tax: Definition and Purpose

Registration tax is a one-time levy imposed on the initial registration of assets such as vehicles or property, serving as a legal requirement for ownership transfer and regulatory compliance. It primarily functions to fund administrative processes and infrastructure development linked to the registered asset. Recognizing its role helps distinguish it from recurring usage taxes that apply during the asset's operational period.

What Is Usage Tax? Key Points Explained

Usage tax is a type of tax imposed on the use, consumption, or storage of goods and services that were purchased without paying the applicable sales tax, often on out-of-state or online purchases. It ensures tax compliance by compensating for sales tax not collected at the point of sale, typically calculated based on the item's purchase price and applicable local tax rates. Businesses and individuals are responsible for reporting and remitting usage tax to their state's tax authority, which helps maintain revenue for public services.

Key Differences Between Registration Tax and Usage Tax

Registration tax is a one-time fee imposed when a vehicle or asset is initially registered, reflecting ownership transfer or acquisition. Usage tax is a recurring tax based on the ongoing use or consumption of an asset, such as mileage-driven taxes on vehicles or taxes on utilities. Key differences include timing, with registration tax paid upfront and usage tax charged periodically, and tax base, where registration tax is linked to the asset's value at acquisition, whereas usage tax depends on frequency or extent of use.

Financial Implications for Car Owners

Registration tax is a one-time financial obligation imposed when acquiring a vehicle, significantly impacting the initial purchase cost and requiring upfront capital. Usage tax, often calculated based on annual mileage or vehicle emissions, affects ongoing expenses and can influence long-term ownership budgeting due to its recurring nature. Car owners need to consider both taxes to accurately assess the total cost of vehicle ownership and plan their finances accordingly.

Regional Variations in Car Taxation Systems

Regional variations in car taxation systems significantly influence both registration tax and usage tax rates, with European countries like Germany imposing high registration taxes based on vehicle emissions, while Scandinavian nations often prioritize usage tax calculated on annual mileage or fuel consumption. In the United States, registration taxes vary widely by state, frequently linked to vehicle value or weight, whereas usage taxes such as fuel taxes remain more uniform but subject to regional adjustments. Understanding these differences is crucial for car owners and businesses to optimize tax liabilities according to local regulations and environmental policies.

How Registration Tax Affects Vehicle Sales

Registration tax significantly influences vehicle sales by increasing the upfront cost buyers must pay, often deterring potential purchasers or shifting demand toward lower-cost or used vehicles. This tax is typically a one-time fee based on factors like vehicle value, weight, or emissions, affecting consumer decisions and manufacturer pricing strategies. Higher registration taxes can reduce new vehicle sales volume while enhancing government revenue from vehicle registrations.

Usage Tax: Impact on Driving Habits and Costs

Usage tax directly affects driving habits by increasing the overall cost of vehicle operation, often leading drivers to reduce mileage or opt for more fuel-efficient vehicles. Unlike registration tax, which is a fixed annual fee based on vehicle ownership, usage tax varies with actual vehicle use, incentivizing reduced road time and contributing to lower emissions. This dynamic shifts financial responsibility toward consumption, impacting individual decisions and broader traffic patterns.

Pros and Cons: Registration Tax vs Usage Tax

Registration Tax requires a one-time payment based on vehicle value or weight, offering simplicity and predictability but often leading to higher upfront costs; Usage Tax, calculated continuously through mileage or fuel consumption, encourages environmentally friendly driving habits and fair cost distribution but involves ongoing administrative tracking and potential variability in expenses. Businesses benefit from Registration Tax's budget certainty, while Usage Tax aligns better with sustainability goals and pays-per-use fairness. Consumers seeking long-term savings may prefer Usage Tax despite its complexity, whereas those prioritizing convenience might opt for Registration Tax despite the initial expense.

Policy Trends in Vehicle Taxation

Governments increasingly shift from traditional registration tax models toward usage-based taxation to promote environmentally sustainable vehicle use and reduce urban congestion. Usage tax policies leverage telematics and real-time data to charge drivers based on actual mileage and road usage, incentivizing reduced emissions and more efficient transportation habits. This dynamic approach reflects a global policy trend prioritizing equitable tax frameworks that align fiscal measures with environmental and infrastructural goals.

Choosing the Right Tax System for Sustainable Mobility

Registration tax is a one-time fee imposed when a vehicle is first registered, encouraging consumers to consider environmental impact upfront, while usage tax is levied based on actual vehicle use, promoting sustained behavioral changes toward eco-friendly transportation. Selecting the appropriate tax system depends on objectives like reducing carbon emissions, with registration taxes driving cleaner initial choices and usage taxes incentivizing long-term sustainable mobility practices. Integrating both systems can balance immediate environmental impacts with ongoing usage patterns to foster greener transport solutions.

Registration Tax vs Usage Tax Infographic

cardiffo.com

cardiffo.com