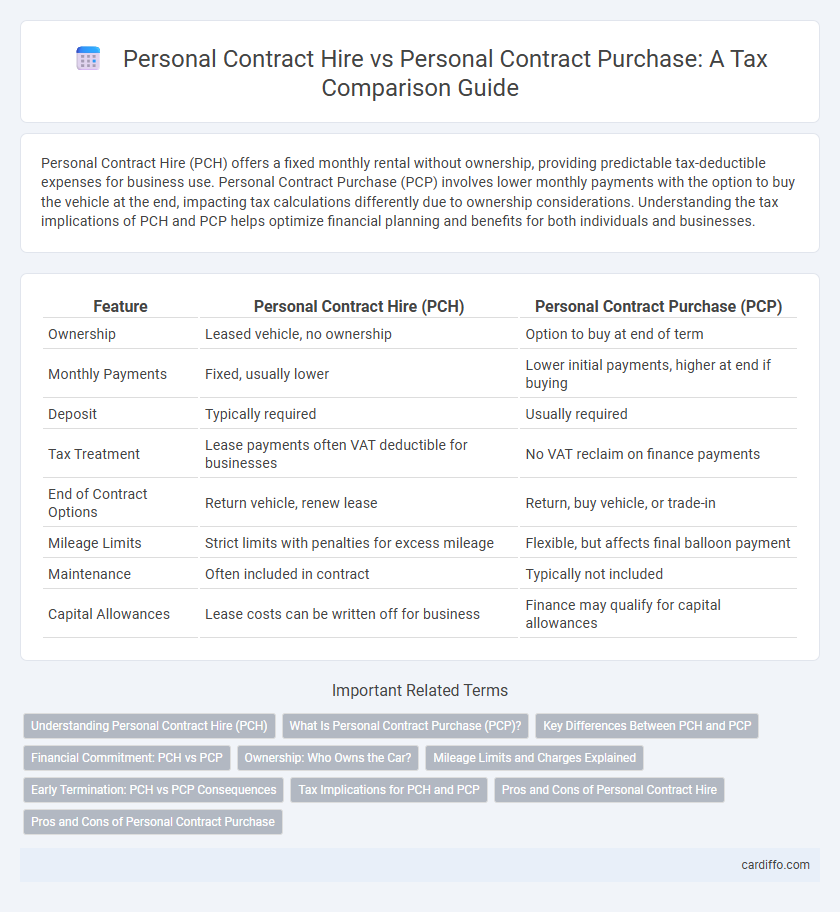

Personal Contract Hire (PCH) offers a fixed monthly rental without ownership, providing predictable tax-deductible expenses for business use. Personal Contract Purchase (PCP) involves lower monthly payments with the option to buy the vehicle at the end, impacting tax calculations differently due to ownership considerations. Understanding the tax implications of PCH and PCP helps optimize financial planning and benefits for both individuals and businesses.

Table of Comparison

| Feature | Personal Contract Hire (PCH) | Personal Contract Purchase (PCP) |

|---|---|---|

| Ownership | Leased vehicle, no ownership | Option to buy at end of term |

| Monthly Payments | Fixed, usually lower | Lower initial payments, higher at end if buying |

| Deposit | Typically required | Usually required |

| Tax Treatment | Lease payments often VAT deductible for businesses | No VAT reclaim on finance payments |

| End of Contract Options | Return vehicle, renew lease | Return, buy vehicle, or trade-in |

| Mileage Limits | Strict limits with penalties for excess mileage | Flexible, but affects final balloon payment |

| Maintenance | Often included in contract | Typically not included |

| Capital Allowances | Lease costs can be written off for business | Finance may qualify for capital allowances |

Understanding Personal Contract Hire (PCH)

Personal Contract Hire (PCH) is a car leasing option where individuals pay fixed monthly rentals to use a vehicle over a set period without owning it. It offers predictable tax allowances and expense deductions, often favoring businesses or individuals seeking VAT recovery on lease payments. Compared to Personal Contract Purchase (PCP), PCH reduces financial risk by eliminating balloon payments and residual value concerns at the contract's end.

What Is Personal Contract Purchase (PCP)?

Personal Contract Purchase (PCP) is a car financing option that allows individuals to make lower monthly payments compared to traditional loans by spreading the vehicle's depreciation cost over the contract term. At the end of the PCP agreement, the customer can choose to pay a final balloon payment to own the car, return it without additional charges, or trade it in for a new model. PCP agreements often include mileage limits and condition requirements, impacting the final cost and potential tax implications for personal use or business purposes.

Key Differences Between PCH and PCP

Personal Contract Hire (PCH) involves renting a vehicle for a fixed period with no option to own it, while Personal Contract Purchase (PCP) allows the option to buy the car at the end of the contract by paying a balloon payment. PCH payments are treated as a business expense when used for work, potentially providing tax relief, whereas PCP may have capital allowances implications if used for business purposes. Ownership and taxation treatment differ significantly, with PCP offering potential asset ownership and PCH being purely a leasing agreement.

Financial Commitment: PCH vs PCP

Personal Contract Hire (PCH) requires fixed monthly payments throughout the contract term, with no ownership option at the end, minimizing financial risk related to residual values. Personal Contract Purchase (PCP) involves lower monthly payments but includes a balloon payment to own the vehicle, leading to potentially higher overall financial commitment if the purchase option is exercised. Tax implications for PCH are generally straightforward as it's treated as a rental expense, whereas PCP may affect capital allowances and VAT recovery depending on ownership status and business use.

Ownership: Who Owns the Car?

In Personal Contract Hire (PCH), the finance company retains ownership of the car throughout the contract period, and the driver simply pays to use the vehicle without acquiring ownership rights. Personal Contract Purchase (PCP) offers a flexible option where the driver can choose to buy the car at the end of the agreement by paying the Guaranteed Minimum Future Value (GMFV), transferring ownership from the finance company to the driver. Understanding the distinction in ownership is crucial for tax planning, as PCP buyers may benefit from capital allowances or claiming VAT, whereas PCH users classify the payments as business expenses without asset ownership implications.

Mileage Limits and Charges Explained

Personal Contract Hire (PCH) typically imposes strict mileage limits, with excess mileage charges applied if the agreed mileage is exceeded, affecting overall cost and lease affordability. Personal Contract Purchase (PCP) also enforces mileage limits, but offers more flexibility since any excess mileage charges can be offset if the vehicle is purchased at the end of the contract. Understanding the specific mileage allowances and potential penalties in both PCH and PCP agreements is crucial for optimizing tax efficiency and minimizing unexpected financial burdens.

Early Termination: PCH vs PCP Consequences

Early termination of a Personal Contract Hire (PCH) agreement often results in significant penalties, including immediate payment of outstanding rentals and potential damage fees due to full lease term commitment. In contrast, Personal Contract Purchase (PCP) allows greater flexibility, as customers can settle the outstanding balloon payment and own the vehicle or return it with possible equity offsetting termination costs. Tax implications differ: PCH payments are fully deductible for business use, whereas PCP combines rental and finance elements, affecting VAT reclaim and capital allowances differently.

Tax Implications for PCH and PCP

Personal Contract Hire (PCH) payments are treated as rental expenses, allowing businesses to claim back VAT on the monthly rentals, while the vehicle remains off the company's balance sheet. In contrast, Personal Contract Purchase (PCP) involves finance agreements where VAT on the purchase price is usually not reclaimable, but businesses can claim capital allowances on the vehicle's depreciation if owned. For tax purposes, PCH provides more straightforward expense treatment, whereas PCP offers potential benefits through capital allowances but with more complex tax implications due to the option to purchase the vehicle at the end.

Pros and Cons of Personal Contract Hire

Personal Contract Hire (PCH) offers lower monthly payments and fixed contract terms, making budgeting easier for taxpayers seeking predictable expenses. However, PCH does not build vehicle ownership or equity since the car must be returned at the end of the lease, limiting asset accumulation benefits. Mileage restrictions and potential excess wear charges can increase overall costs, requiring careful consideration of personal driving habits and contract conditions.

Pros and Cons of Personal Contract Purchase

Personal Contract Purchase (PCP) offers lower monthly payments compared to traditional finance options, making it an attractive choice for budget-conscious individuals seeking to drive newer vehicles with optional ownership at the end of the term. The flexibility to either buy the car outright, return it, or trade it in provides consumers with multiple exit strategies, but it often comes with higher overall costs and potential mileage and condition restrictions. PCP agreements may also carry higher interest rates and require a significant final balloon payment for ownership, which could impact tax deductions and financial planning for both private individuals and business users.

Personal Contract Hire vs Personal Contract Purchase Infographic

cardiffo.com

cardiffo.com