CO2 emissions thresholds prioritize environmental impact by regulating vehicles based on their carbon output, encouraging manufacturers to develop cleaner technologies. Engine size thresholds focus on the physical capacity of an engine, often correlating to fuel consumption but not directly to emissions, potentially overlooking greener engines with larger displacements. Understanding the distinction between these criteria is crucial for tax policies aiming to balance environmental goals with vehicle performance and consumer choices.

Table of Comparison

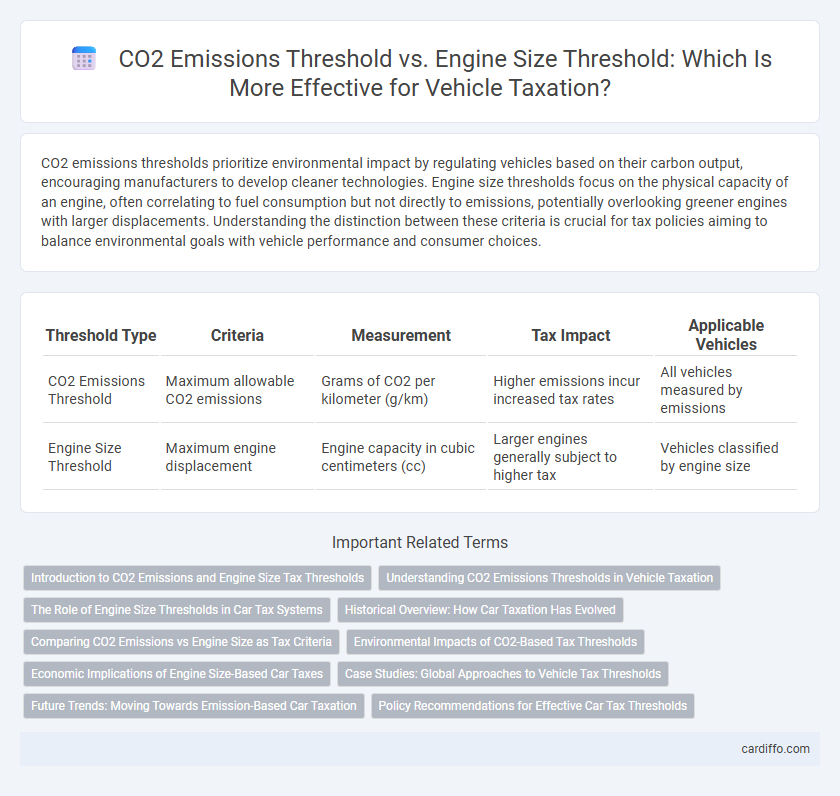

| Threshold Type | Criteria | Measurement | Tax Impact | Applicable Vehicles |

|---|---|---|---|---|

| CO2 Emissions Threshold | Maximum allowable CO2 emissions | Grams of CO2 per kilometer (g/km) | Higher emissions incur increased tax rates | All vehicles measured by emissions |

| Engine Size Threshold | Maximum engine displacement | Engine capacity in cubic centimeters (cc) | Larger engines generally subject to higher tax | Vehicles classified by engine size |

Introduction to CO2 Emissions and Engine Size Tax Thresholds

CO2 emissions thresholds determine tax rates based on the amount of carbon dioxide produced by a vehicle, encouraging lower emissions to reduce environmental impact. Engine size thresholds classify taxable vehicles by engine displacement, where larger engines typically incur higher taxes due to increased fuel consumption and emissions. Tax policies incorporating both CO2 emissions and engine size promote sustainable vehicle choices through fiscal incentives targeting environmental performance and engine efficiency.

Understanding CO2 Emissions Thresholds in Vehicle Taxation

CO2 emissions thresholds are critical in vehicle taxation as they directly impact the tax rates imposed on vehicles based on their environmental footprint, measured in grams of CO2 per kilometer. These thresholds serve as a more accurate metric than engine size, reflecting actual emissions rather than just engine displacement, thus promoting eco-friendly vehicle choices. Understanding these limits helps consumers and manufacturers anticipate tax liabilities and encourages the development of low-emission technologies.

The Role of Engine Size Thresholds in Car Tax Systems

Engine size thresholds play a critical role in car tax systems by determining tax brackets based on the vehicle's engine displacement, often measured in liters or cubic centimeters. Unlike CO2 emissions thresholds, which focus on environmental impact, engine size thresholds provide a straightforward metric tied to vehicle performance and fuel consumption, influencing tax rates accordingly. This approach simplifies tax categorization but may not directly incentivize reductions in carbon emissions compared to CO2-based tax models.

Historical Overview: How Car Taxation Has Evolved

Car taxation has historically shifted from engine size thresholds to CO2 emissions thresholds to better align with environmental objectives and climate policy goals. Early tax systems primarily used engine displacement as a proxy for vehicle efficiency, but evolving regulatory frameworks now prioritize carbon emissions to incentivize lower greenhouse gas emissions. This transition reflects broader trends in sustainable taxation designed to reduce fossil fuel dependency and promote cleaner automotive technologies.

Comparing CO2 Emissions vs Engine Size as Tax Criteria

CO2 emissions serve as a more precise tax criterion than engine size because they directly reflect the environmental impact of a vehicle, influencing tax rates based on actual pollution levels. Engine size thresholds often fail to account for technological advancements and fuel efficiency variations, leading to less accurate taxation of emissions. Tax policies increasingly prioritize CO2 emissions to incentivize cleaner vehicle designs and reduce overall carbon footprints.

Environmental Impacts of CO2-Based Tax Thresholds

CO2 emissions thresholds in tax policies directly target the environmental impact of vehicles by incentivizing lower emissions, promoting cleaner air and reducing greenhouse gases. Engine size thresholds, while simpler to regulate, often fail to accurately reflect a vehicle's environmental footprint, potentially allowing high-emission engines to evade stricter taxation. Implementing CO2-based tax thresholds aligns fiscal measures with environmental goals, driving innovation in fuel efficiency and accelerating the shift toward sustainable transportation.

Economic Implications of Engine Size-Based Car Taxes

Engine size-based car taxes create economic incentives that favor smaller engines, potentially reducing fuel consumption but often ignoring actual CO2 emissions efficiency. This approach can distort market behavior by penalizing vehicles with larger engines regardless of their environmental performance, leading to potential inefficiencies in tax revenue allocation. Comparing CO2 emissions thresholds with engine size thresholds highlights the economic trade-offs between environmental impact accuracy and administrative simplicity in taxation policy.

Case Studies: Global Approaches to Vehicle Tax Thresholds

Global case studies of vehicle tax thresholds reveal varied approaches in balancing CO2 emissions thresholds against engine size thresholds to optimize environmental impact and fiscal policy. European countries primarily adopt CO2 emissions thresholds to incentivize low-emission vehicles, whereas countries like Japan and South Korea integrate engine size thresholds to address fuel efficiency and air quality. These threshold mechanisms influence vehicle taxation structures, drive consumer behavior towards cleaner technologies, and align with national pollution reduction targets.

Future Trends: Moving Towards Emission-Based Car Taxation

Future trends in automotive taxation indicate a shift from engine size thresholds to CO2 emissions thresholds, aligning tax policies with environmental impact. Emission-based car taxation incentivizes the adoption of low-emission vehicles and supports governments' climate objectives. This transition reflects growing regulatory emphasis on reducing carbon footprints and promoting sustainable transportation solutions.

Policy Recommendations for Effective Car Tax Thresholds

Effective car tax policies should align CO2 emissions thresholds with engine size thresholds to incentivize lower-emission vehicles without penalizing advancements in engine technology. Setting dynamic CO2 emission limits that reflect real-world fuel efficiency data ensures equitable taxation across vehicle categories. Policymakers must integrate emissions monitoring and engine capacity standards to promote sustainable transportation while supporting innovation in automotive engineering.

CO2 Emissions Threshold vs Engine Size Threshold Infographic

cardiffo.com

cardiffo.com