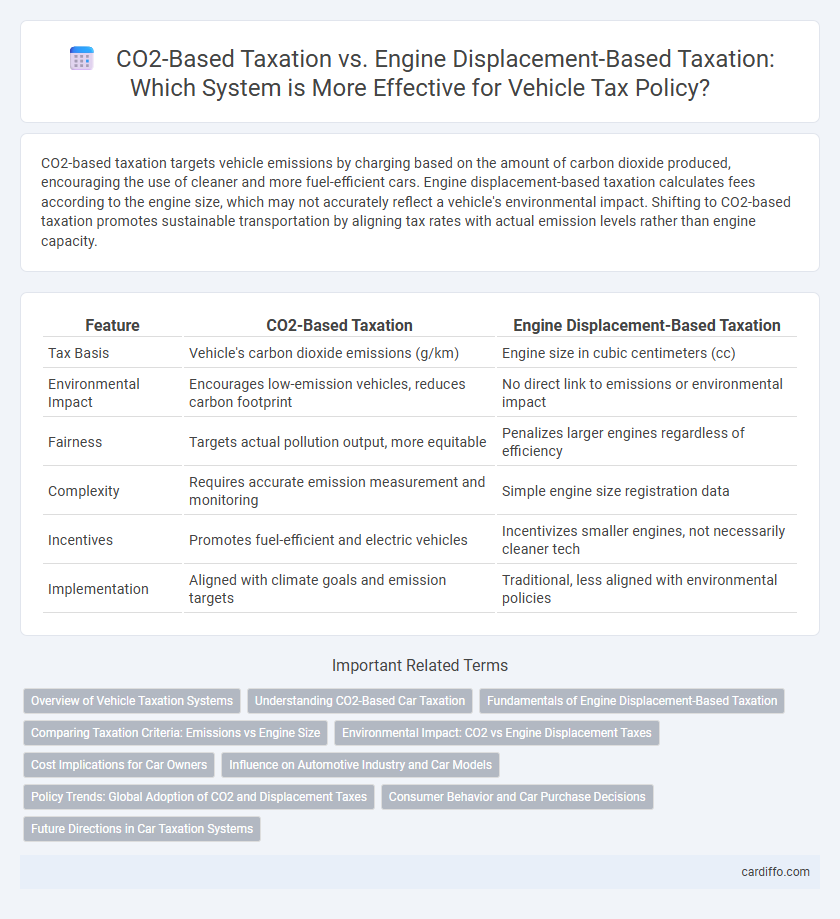

CO2-based taxation targets vehicle emissions by charging based on the amount of carbon dioxide produced, encouraging the use of cleaner and more fuel-efficient cars. Engine displacement-based taxation calculates fees according to the engine size, which may not accurately reflect a vehicle's environmental impact. Shifting to CO2-based taxation promotes sustainable transportation by aligning tax rates with actual emission levels rather than engine capacity.

Table of Comparison

| Feature | CO2-Based Taxation | Engine Displacement-Based Taxation |

|---|---|---|

| Tax Basis | Vehicle's carbon dioxide emissions (g/km) | Engine size in cubic centimeters (cc) |

| Environmental Impact | Encourages low-emission vehicles, reduces carbon footprint | No direct link to emissions or environmental impact |

| Fairness | Targets actual pollution output, more equitable | Penalizes larger engines regardless of efficiency |

| Complexity | Requires accurate emission measurement and monitoring | Simple engine size registration data |

| Incentives | Promotes fuel-efficient and electric vehicles | Incentivizes smaller engines, not necessarily cleaner tech |

| Implementation | Aligned with climate goals and emission targets | Traditional, less aligned with environmental policies |

Overview of Vehicle Taxation Systems

Vehicle taxation systems vary significantly, with CO2-based taxation focusing on environmental impact by charging fees proportional to carbon emissions, promoting eco-friendly driving habits. Engine displacement-based taxation relies on engine size measured in cubic centimeters (cc), incentivizing smaller engines but often overlooking actual pollution levels. Governments increasingly prefer CO2-based models to align fiscal policies with climate goals and reduce overall greenhouse gas emissions from the transportation sector.

Understanding CO2-Based Car Taxation

CO2-based car taxation calculates vehicle taxes based on carbon dioxide emissions, incentivizing lower emissions and promoting environmental sustainability. This method aligns tax rates with actual environmental impact, unlike engine displacement-based taxation which taxes simply by engine size regardless of emissions efficiency. Many governments adopt CO2-based taxation to encourage cleaner technologies and reduce national greenhouse gas emissions.

Fundamentals of Engine Displacement-Based Taxation

Engine displacement-based taxation primarily relies on the cubic capacity of the engine, measured in liters or cubic centimeters, to determine tax rates, often correlating with fuel consumption and vehicle size. This method provides a straightforward metric tied to engine size rather than actual emissions, leading to potential discrepancies in environmental impact assessments. Unlike CO2-based taxation, it may not effectively incentivize reductions in carbon emissions since it does not account for advances in engine technology or fuel efficiency.

Comparing Taxation Criteria: Emissions vs Engine Size

CO2-based taxation targets vehicle emissions, incentivizing lower carbon output by charging fees proportional to measured exhaust pollutants, which directly correlates with environmental impact. Engine displacement-based taxation imposes fees based on engine size measured in liters or cubic centimeters, indirectly linking to fuel consumption but often failing to reflect actual emissions due to varying engine technologies. Prioritizing CO2 emissions for taxation aligns fiscal policy with climate goals by penalizing high greenhouse gas emitters, while engine displacement criteria risk outdated metrics that overlook efficiency improvements and hybrid technologies.

Environmental Impact: CO2 vs Engine Displacement Taxes

CO2-based taxation directly targets greenhouse gas emissions by imposing fees based on the vehicle's actual carbon output, encouraging the adoption of low-emission and electric vehicles. Engine displacement-based taxes, measured by engine size in liters or cubic centimeters, often fail to accurately reflect environmental impact since larger engines do not always correlate with higher CO2 emissions due to advances in fuel efficiency. Implementing CO2-focused tax policies results in more effective reductions in carbon footprints and aligns with global climate goals by incentivizing cleaner technology.

Cost Implications for Car Owners

CO2-based taxation directly correlates tax costs with a vehicle's carbon emissions, incentivizing low-emission and electric cars while potentially reducing overall fuel expenses for owners. Engine displacement-based taxation imposes higher fees on larger engines regardless of actual emissions, often penalizing performance vehicles without reflecting their environmental impact. For car owners, CO2-based taxes can lead to cost savings over time if opting for fuel-efficient models, whereas displacement-based taxes might result in consistently higher costs independent of fuel economy.

Influence on Automotive Industry and Car Models

CO2-based taxation incentivizes automakers to prioritize fuel efficiency and lower emissions, driving innovation in electric and hybrid vehicle development. Engine displacement-based taxation traditionally penalizes larger engines, encouraging the production of smaller, less powerful cars with lower weight and performance. The shift towards CO2-focused taxes reshapes car models by emphasizing sustainable technologies over sheer engine size, influencing design, manufacturing, and market offerings globally.

Policy Trends: Global Adoption of CO2 and Displacement Taxes

Governments worldwide increasingly adopt CO2-based taxation to incentivize lower emissions and align with climate goals, with countries like Sweden and the Netherlands leading in comprehensive carbon pricing frameworks. Engine displacement-based taxes persist in regions such as Southeast Asia, reflecting traditional vehicle registration systems but often failing to account for actual environmental impact. Policy trends indicate a gradual shift toward hybrid models combining CO2 emissions data and engine size, aiming for more precise revenue generation and ecological effectiveness.

Consumer Behavior and Car Purchase Decisions

CO2-based taxation incentivizes consumers to prioritize fuel-efficient and low-emission vehicles, directly influencing car purchase decisions toward environmentally friendly models. In contrast, engine displacement-based taxation primarily targets vehicle size and power, often overlooking actual emissions, which may lead buyers to choose cars based on price or performance rather than environmental impact. This shift toward CO2-focused taxes promotes sustainable consumption patterns and accelerates market adoption of electric and hybrid vehicles.

Future Directions in Car Taxation Systems

Future directions in car taxation systems emphasize CO2-based taxation due to its direct correlation with environmental impact and carbon emissions reduction goals. Shifting from traditional engine displacement-based taxation enables progressive penalties aligned with actual fuel efficiency and emission levels, encouraging adoption of low-emission and electric vehicles. Integration of real-time emission monitoring technologies facilitates dynamic tax adjustments, promoting sustainable transportation policies and climate-driven regulatory frameworks.

CO2-based taxation vs engine displacement-based taxation Infographic

cardiffo.com

cardiffo.com