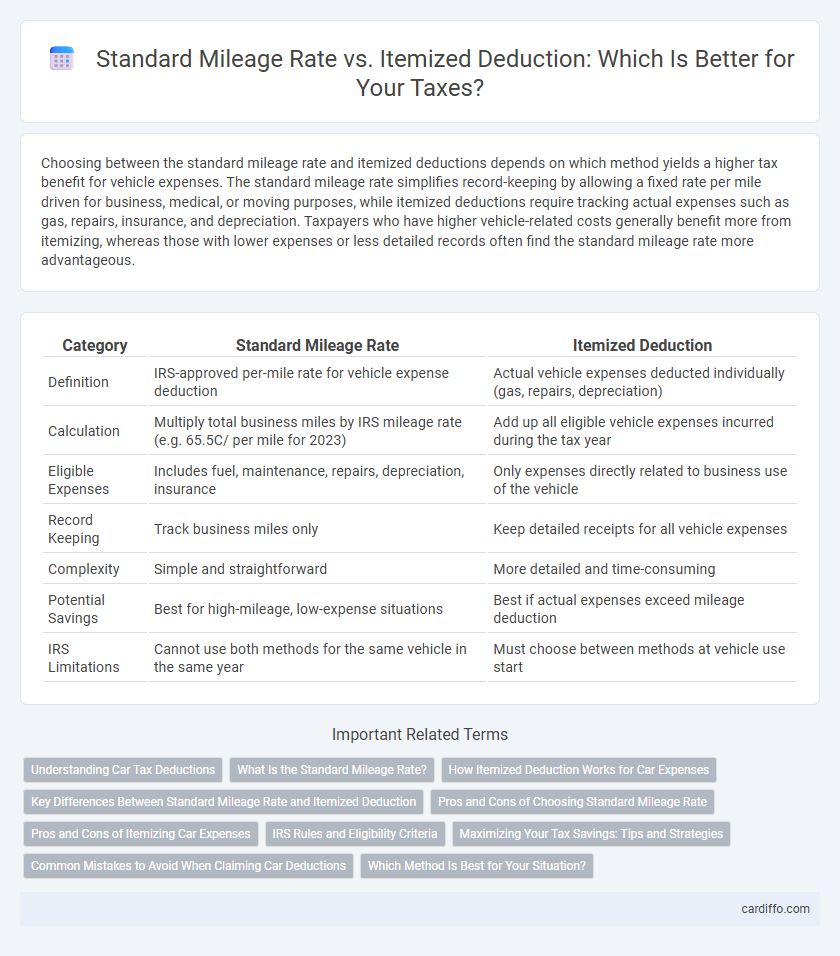

Choosing between the standard mileage rate and itemized deductions depends on which method yields a higher tax benefit for vehicle expenses. The standard mileage rate simplifies record-keeping by allowing a fixed rate per mile driven for business, medical, or moving purposes, while itemized deductions require tracking actual expenses such as gas, repairs, insurance, and depreciation. Taxpayers who have higher vehicle-related costs generally benefit more from itemizing, whereas those with lower expenses or less detailed records often find the standard mileage rate more advantageous.

Table of Comparison

| Category | Standard Mileage Rate | Itemized Deduction |

|---|---|---|

| Definition | IRS-approved per-mile rate for vehicle expense deduction | Actual vehicle expenses deducted individually (gas, repairs, depreciation) |

| Calculation | Multiply total business miles by IRS mileage rate (e.g. 65.5C/ per mile for 2023) | Add up all eligible vehicle expenses incurred during the tax year |

| Eligible Expenses | Includes fuel, maintenance, repairs, depreciation, insurance | Only expenses directly related to business use of the vehicle |

| Record Keeping | Track business miles only | Keep detailed receipts for all vehicle expenses |

| Complexity | Simple and straightforward | More detailed and time-consuming |

| Potential Savings | Best for high-mileage, low-expense situations | Best if actual expenses exceed mileage deduction |

| IRS Limitations | Cannot use both methods for the same vehicle in the same year | Must choose between methods at vehicle use start |

Understanding Car Tax Deductions

Car tax deductions differ significantly between the Standard Mileage Rate and Itemized Deduction methods, each impacting taxable income based on vehicle usage. The Standard Mileage Rate offers a fixed rate per mile driven for business purposes, simplifying record-keeping but limiting deduction flexibility. Itemizing actual expenses like gas, maintenance, depreciation, and insurance often yields higher deductions for high-cost vehicles or extensive business use, requiring detailed documentation.

What Is the Standard Mileage Rate?

The standard mileage rate is a simplified method used by the IRS to calculate deductible vehicle expenses for business, medical, or moving purposes. It allows taxpayers to multiply the number of business miles driven by a fixed rate per mile, which the IRS updates annually to reflect costs like fuel, maintenance, and depreciation. This rate offers a straightforward alternative to itemizing actual vehicle expenses, saving time and reducing the complexity of tax recordkeeping.

How Itemized Deduction Works for Car Expenses

Itemized deductions for car expenses allow taxpayers to claim actual vehicle-related costs instead of using the standard mileage rate, covering expenses such as gas, maintenance, repairs, insurance, and depreciation. To qualify, detailed records of all car-related expenses and the percentage of business use must be maintained to calculate the deductible amount accurately. This method can maximize tax savings when actual expenses exceed the IRS standard mileage rate for business mileage.

Key Differences Between Standard Mileage Rate and Itemized Deduction

The standard mileage rate simplifies vehicle expense deductions by allowing taxpayers to multiply their business miles driven by the IRS-established rate, currently 65.5 cents per mile for 2023. Itemized deductions require tracking actual vehicle expenses such as gas, maintenance, insurance, and depreciation, providing a potentially larger deduction at the expense of detailed record-keeping. Choosing between the two depends on factors like total business miles, actual vehicle costs, and tax filing convenience, with the standard mileage rate favoring simplicity and itemized deductions maximizing specific expenses.

Pros and Cons of Choosing Standard Mileage Rate

The Standard Mileage Rate simplifies tax reporting by allowing a fixed rate per mile driven for business use, eliminating the need to track actual vehicle expenses like gas, maintenance, and depreciation. This method offers convenience and time savings but may result in lower deductions for drivers with high vehicle-related costs or expensive cars. Taxpayers must evaluate their total vehicle expenses against the IRS standard mileage rate, as using it prevents deducting actual costs and applies only to business miles, excluding commuting.

Pros and Cons of Itemizing Car Expenses

Itemizing car expenses allows taxpayers to deduct actual costs such as gas, maintenance, insurance, and depreciation, potentially resulting in a larger deduction for high vehicle usage or expensive upkeep. However, this method requires meticulous record-keeping and can be time-consuming compared to the simplicity of the standard mileage rate. Taxpayers must weigh the benefit of precise expense tracking against the convenience and consistency of the standard mileage deduction.

IRS Rules and Eligibility Criteria

The IRS sets the Standard Mileage Rate annually, allowing taxpayers to deduct a fixed amount per mile driven for business, medical, moving, or charitable purposes, simplifying record-keeping and maximizing deductions for eligible vehicle use. Itemized deductions require detailed documentation of actual vehicle expenses, including gas, maintenance, insurance, and depreciation, offering potentially higher deductions but requiring stringent record-keeping and eligibility verification. Taxpayers must choose between the Standard Mileage Rate and Itemized Deduction based on eligibility criteria such as vehicle type, ownership status, and whether depreciation deductions were claimed previously, adhering strictly to IRS guidelines to ensure compliance and optimize tax benefits.

Maximizing Your Tax Savings: Tips and Strategies

Choosing between the standard mileage rate and itemized deductions depends on detailed record-keeping and understanding IRS guidelines to maximize tax savings. Applying the 2024 IRS standard mileage rate of 65.5 cents per mile for business use often simplifies calculations but may yield lower deductions compared to itemizing actual vehicle expenses like gas, maintenance, and depreciation. Taxpayers should calculate both methods annually, considering factors such as total mileage and vehicle costs, to determine the most beneficial option for reducing taxable income effectively.

Common Mistakes to Avoid When Claiming Car Deductions

Taxpayers often err by switching between the standard mileage rate and itemized deductions within the same tax year, leading to disallowed claims by the IRS. Failing to maintain accurate mileage logs or neglecting to separate personal and business use miles can result in audit triggers and reduced deductions. Misunderstanding eligible expenses for itemized deductions, such as including non-deductible costs like commuting miles, diminishes potential tax benefits and complicates recordkeeping.

Which Method Is Best for Your Situation?

Choosing between the standard mileage rate and itemized deduction depends on your specific vehicle expenses and record-keeping preferences. The standard mileage rate is simpler and often benefits taxpayers with lower vehicle-related costs, offering a fixed per-mile deduction set annually by the IRS. Itemizing deductions can yield greater tax savings if actual expenses such as gas, repairs, insurance, and depreciation exceed the standard mileage rate, but it requires thorough documentation and accurate tracking.

Standard Mileage Rate vs Itemized Deduction Infographic

cardiffo.com

cardiffo.com