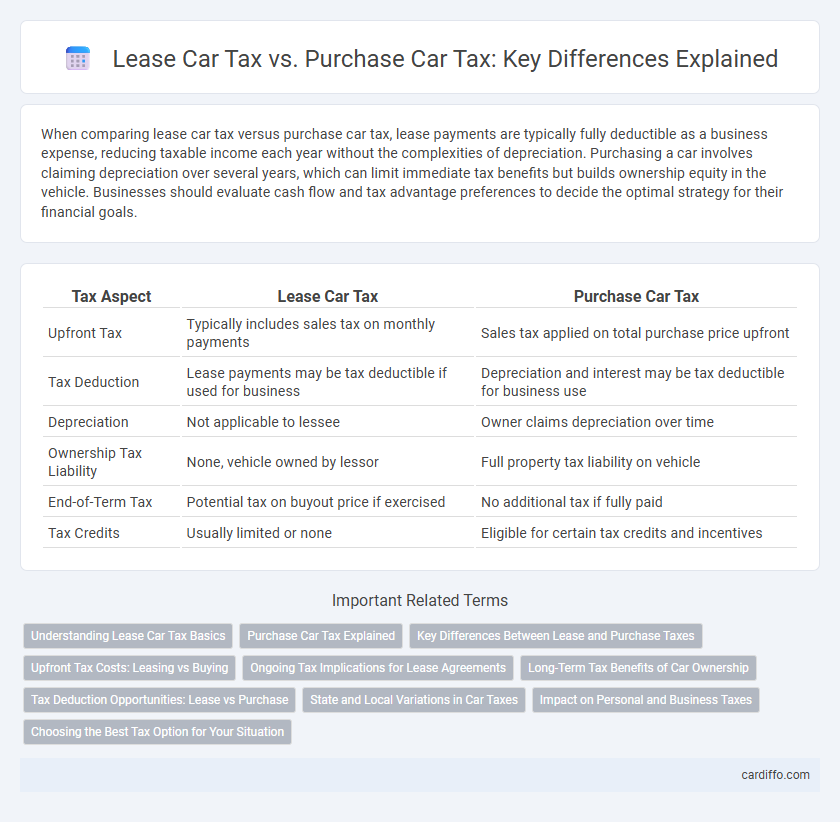

When comparing lease car tax versus purchase car tax, lease payments are typically fully deductible as a business expense, reducing taxable income each year without the complexities of depreciation. Purchasing a car involves claiming depreciation over several years, which can limit immediate tax benefits but builds ownership equity in the vehicle. Businesses should evaluate cash flow and tax advantage preferences to decide the optimal strategy for their financial goals.

Table of Comparison

| Tax Aspect | Lease Car Tax | Purchase Car Tax |

|---|---|---|

| Upfront Tax | Typically includes sales tax on monthly payments | Sales tax applied on total purchase price upfront |

| Tax Deduction | Lease payments may be tax deductible if used for business | Depreciation and interest may be tax deductible for business use |

| Depreciation | Not applicable to lessee | Owner claims depreciation over time |

| Ownership Tax Liability | None, vehicle owned by lessor | Full property tax liability on vehicle |

| End-of-Term Tax | Potential tax on buyout price if exercised | No additional tax if fully paid |

| Tax Credits | Usually limited or none | Eligible for certain tax credits and incentives |

Understanding Lease Car Tax Basics

Lease car tax is typically calculated based on the monthly lease payments rather than the vehicle's full purchase price, resulting in potentially lower taxable amounts compared to buying a car outright. Sales tax on a lease is often spread across the lease term, reducing upfront tax costs, whereas purchasing a car requires paying sales tax on the total price at the time of sale. Understanding these differences helps businesses and individuals optimize tax liabilities when deciding between leasing or purchasing vehicles.

Purchase Car Tax Explained

Purchase car tax primarily involves paying sales tax on the vehicle's total purchase price, which can vary by state and often includes additional fees such as title and registration. The tax paid on a purchased car is typically a one-time expense, contrasting with lease car tax where monthly payments are taxed throughout the lease term. Understanding purchase car tax helps buyers accurately calculate the total cost of ownership, factoring in potential tax credits or incentives that may apply.

Key Differences Between Lease and Purchase Taxes

Lease car taxes typically involve paying sales tax only on the monthly lease payments, resulting in lower upfront costs and monthly expenses, while purchase car taxes require paying sales tax on the entire vehicle price at the time of purchase. Depreciation limits and tax deductions differ, as lease payments can often be deducted as a business expense, whereas purchased cars offer depreciation tax credits over several years. Ownership status affects tax benefits; buyers gain asset ownership and potential resale value advantages, whereas lessees do not claim ownership, influencing long-term tax implications.

Upfront Tax Costs: Leasing vs Buying

Upfront tax costs for leasing a car typically involve paying sales tax on the monthly lease payments rather than the entire vehicle price, reducing initial out-of-pocket expenses. In contrast, purchasing a car requires paying sales tax on the total purchase price upfront, which can significantly increase the initial financial burden. Understanding these tax implications helps taxpayers optimize cash flow and long-term tax benefits depending on their financial strategy and vehicle usage.

Ongoing Tax Implications for Lease Agreements

Lease car tax involves ongoing monthly payments where the lessee pays sales tax on each installment, often resulting in lower upfront tax compared to purchasing; however, lease agreements typically do not allow for asset depreciation deductions. Purchase car tax requires paying sales tax upfront on the full vehicle price, enabling the owner to claim depreciation and interest deductions over time, impacting overall taxable income. Understanding these ongoing tax implications helps businesses optimize cash flow and tax benefits based on their vehicle acquisition strategy.

Long-Term Tax Benefits of Car Ownership

Lease car tax advantages often include the ability to deduct lease payments as business expenses, reducing taxable income in the short term. Purchasing a car provides long-term tax benefits through depreciation deductions, especially using Section 179 and bonus depreciation, which can significantly lower taxable income over several years. Ownership also allows for asset equity buildup, offering potential tax advantages upon resale or trade-in that leasing does not provide.

Tax Deduction Opportunities: Lease vs Purchase

Tax deduction opportunities vary significantly between leasing and purchasing a car. Leasing allows for deducting lease payments as a business expense, often leading to consistent monthly deductions without the complexities of depreciation. Purchasing a car enables deduction of depreciation costs and interest on auto loans, but these benefits typically require detailed record-keeping and adherence to capital asset tax rules.

State and Local Variations in Car Taxes

State and local variations in car taxes significantly impact whether leasing or purchasing a vehicle is more cost-effective for taxpayers. Some states tax the entire lease payment while others only tax the portion representing use during the tax year, whereas purchase taxes are often based on the vehicle's total sale price or assessed value. Understanding these differences, including specific state rates and exemptions, helps optimize tax planning and minimizes overall vehicle-related tax liabilities.

Impact on Personal and Business Taxes

Lease car tax deductions typically allow businesses to deduct monthly lease payments as operating expenses, reducing taxable income more consistently over the lease term. Purchasing a car offers opportunities for accelerated depreciation deductions, such as Section 179 expensing and bonus depreciation, which can significantly lower taxable income in the purchase year. Personal tax impact varies; leased vehicles often have limited deductible expenses, while owned vehicles may provide tax benefits through mileage deduction or depreciation if used for business purposes.

Choosing the Best Tax Option for Your Situation

Lease car tax often involves lower upfront costs and deducting monthly lease payments as a business expense, which can provide cash flow advantages. Purchasing a car enables depreciation deductions, such as Section 179 and bonus depreciation, allowing business owners to recover vehicle costs over time. Evaluating your financial situation, including expected mileage, usage, and tax bracket, is crucial to determining whether leasing or buying maximizes your tax benefits.

Lease car tax vs purchase car tax Infographic

cardiffo.com

cardiffo.com