CO2 emissions tax targets vehicles based on their carbon output, encouraging the use of environmentally friendly technologies to reduce greenhouse gases. Engine displacement tax, on the other hand, is calculated according to the size of the engine, often penalizing larger engines regardless of their actual emissions. While both taxes aim to regulate vehicle impact, CO2 emissions tax more directly promotes sustainability by linking fees to environmental performance.

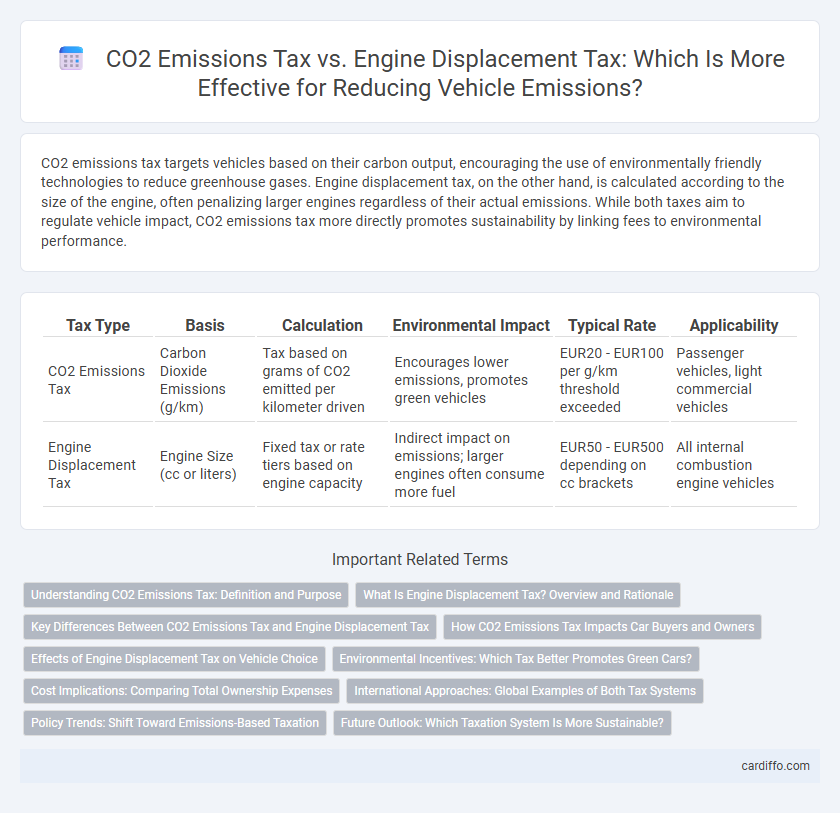

Table of Comparison

| Tax Type | Basis | Calculation | Environmental Impact | Typical Rate | Applicability |

|---|---|---|---|---|---|

| CO2 Emissions Tax | Carbon Dioxide Emissions (g/km) | Tax based on grams of CO2 emitted per kilometer driven | Encourages lower emissions, promotes green vehicles | EUR20 - EUR100 per g/km threshold exceeded | Passenger vehicles, light commercial vehicles |

| Engine Displacement Tax | Engine Size (cc or liters) | Fixed tax or rate tiers based on engine capacity | Indirect impact on emissions; larger engines often consume more fuel | EUR50 - EUR500 depending on cc brackets | All internal combustion engine vehicles |

Understanding CO2 Emissions Tax: Definition and Purpose

CO2 Emissions Tax is a fiscal measure designed to reduce carbon dioxide output by taxing vehicles based on their emissions levels, directly linking environmental impact to cost. This tax incentivizes the adoption of cleaner technologies and promotes sustainable transportation alternatives by imposing higher fees on vehicles with greater CO2 emissions. Compared to Engine Displacement Tax, which charges based on the size of the engine regardless of emissions, CO2 Emissions Tax offers a more precise assessment of environmental harm, targeting pollution rather than engine capacity.

What Is Engine Displacement Tax? Overview and Rationale

Engine Displacement Tax is a vehicle tax based on the size of the engine's cylinder capacity, typically measured in cubic centimeters (cc) or liters, which directly correlates with fuel consumption and emissions levels. This tax incentivizes the purchase of smaller, more fuel-efficient engines by imposing higher charges on vehicles with larger displacements, aiming to reduce environmental impact and carbon dioxide emissions. Governments implement Engine Displacement Tax as a key policy to promote cleaner transportation alternatives and encourage manufacturers to develop low-emission engine technologies.

Key Differences Between CO2 Emissions Tax and Engine Displacement Tax

CO2 Emissions Tax is calculated based on the precise amount of carbon dioxide a vehicle emits, incentivizing lower emission technologies and environmental sustainability. Engine Displacement Tax is determined by the engine size measured in liters or cubic centimeters, focusing on engine capacity rather than actual pollution levels. The key difference lies in CO2 Emissions Tax targeting environmental impact directly, while Engine Displacement Tax emphasizes engine performance metrics without specific regard to emissions.

How CO2 Emissions Tax Impacts Car Buyers and Owners

CO2 Emissions Tax directly influences car buyers by encouraging the purchase of low-emission vehicles through higher costs on high-emission models, which leads to reduced environmental impact. Car owners face increased operational expenses under this tax structure, motivating long-term choices in fuel efficiency and maintenance. The tax incentivizes manufacturers to produce environmentally friendly cars, shaping the automotive market towards sustainability.

Effects of Engine Displacement Tax on Vehicle Choice

Engine displacement tax directly influences consumer preferences by making larger engines more expensive, encouraging the purchase of vehicles with smaller, more fuel-efficient engines. This financial incentive reduces overall fuel consumption and lowers CO2 emissions from the transportation sector. Market analysis shows a shift in sales toward compact models in regions with high engine displacement taxes, demonstrating its effectiveness in shaping vehicle choice.

Environmental Incentives: Which Tax Better Promotes Green Cars?

CO2 Emissions Tax directly targets the amount of carbon dioxide released by vehicles, incentivizing manufacturers and consumers to choose low-emission or electric cars. Engine Displacement Tax is based on engine size, which does not necessarily correlate with actual environmental impact or fuel efficiency. Therefore, CO2 Emissions Tax better promotes green cars by aligning tax burdens with real-world environmental performance and encouraging sustainable transportation choices.

Cost Implications: Comparing Total Ownership Expenses

CO2 emissions tax directly correlates with a vehicle's environmental impact, often resulting in higher annual fees for cars with greater emissions, increasing total ownership expenses significantly. Engine displacement tax is based on engine size and typically imposes fixed charges that may not reflect actual environmental harm but affect upfront and recurring costs differently. Comparing these taxes highlights that CO2 emissions tax incentivizes lower emissions through cost savings, while engine displacement tax focuses on engine capacity, impacting vehicle choice and long-term financial burden.

International Approaches: Global Examples of Both Tax Systems

Countries like Sweden and Japan implement CO2 emissions tax to incentivize lower greenhouse gas outputs by charging based on actual emissions levels measured in grams per kilometer. In contrast, Germany and Italy typically use engine displacement tax systems where vehicles are taxed according to engine size in cubic centimeters (cc), encouraging the use of smaller engines. Both systems reflect global efforts to reduce environmental impact through fiscal policies targeting either carbon output or engine capacity.

Policy Trends: Shift Toward Emissions-Based Taxation

Governments worldwide are increasingly adopting CO2 emissions tax policies to incentivize lower carbon footprints and combat climate change, shifting away from traditional engine displacement taxes that primarily target vehicle size. Emissions-based taxation directly aligns with global environmental goals by charging based on actual pollutant output rather than engine volume, encouraging the adoption of cleaner technologies and electric vehicles. This policy trend reflects growing regulatory emphasis on sustainability and measurable reductions in greenhouse gas emissions from the transportation sector.

Future Outlook: Which Taxation System Is More Sustainable?

CO2 Emissions Tax directly targets carbon output, promoting cleaner engines and renewable energy integration, which aligns with global climate goals and regulatory trends. Engine Displacement Tax, based on engine size, may not accurately reflect environmental impact, potentially discouraging innovation in low-emission technologies. Future sustainability favors CO2 Emissions Tax as it incentivizes reduction of greenhouse gases and supports long-term ecological balance over arbitrary displacement measures.

CO2 Emissions Tax vs Engine Displacement Tax Infographic

cardiffo.com

cardiffo.com