Personal Contract Purchase (PCP) offers lower monthly payments and the flexibility to purchase, return, or trade the vehicle at the end of the term, impacting taxable benefits based on vehicle depreciation and mileage limits. Hire Purchase (HP) involves higher monthly payments but results in full ownership of the vehicle once all installments are paid, affecting tax relief as the asset can be capitalized and depreciated over time. Understanding the tax treatment differences for PCP and HP helps optimize financial planning and potential deductible expenses for individuals and businesses.

Table of Comparison

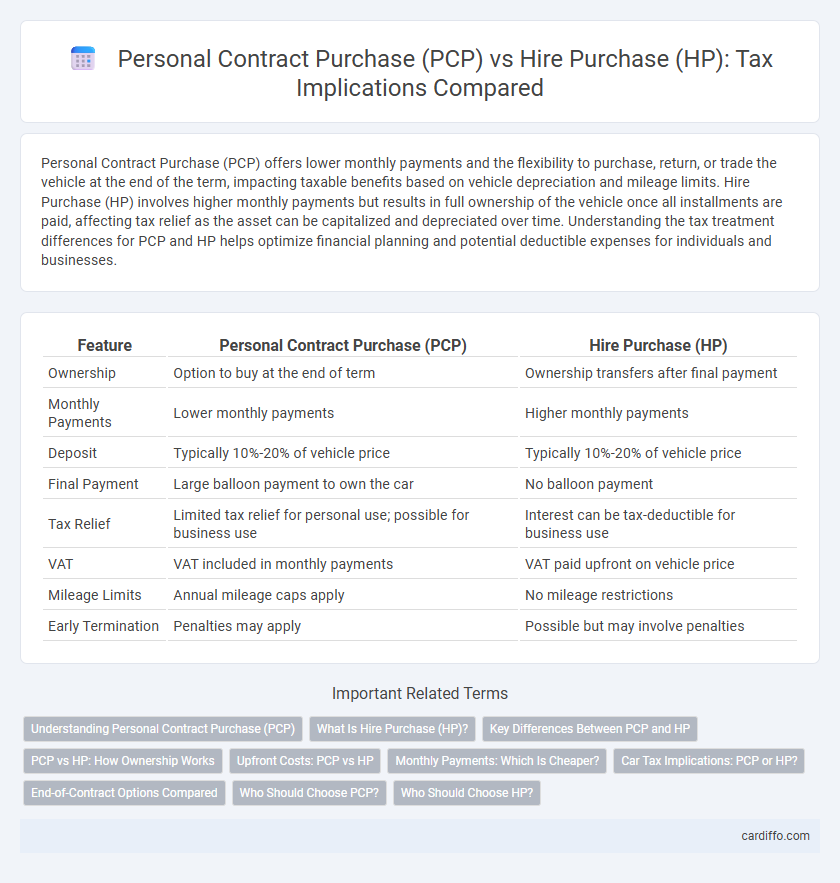

| Feature | Personal Contract Purchase (PCP) | Hire Purchase (HP) |

|---|---|---|

| Ownership | Option to buy at the end of term | Ownership transfers after final payment |

| Monthly Payments | Lower monthly payments | Higher monthly payments |

| Deposit | Typically 10%-20% of vehicle price | Typically 10%-20% of vehicle price |

| Final Payment | Large balloon payment to own the car | No balloon payment |

| Tax Relief | Limited tax relief for personal use; possible for business use | Interest can be tax-deductible for business use |

| VAT | VAT included in monthly payments | VAT paid upfront on vehicle price |

| Mileage Limits | Annual mileage caps apply | No mileage restrictions |

| Early Termination | Penalties may apply | Possible but may involve penalties |

Understanding Personal Contract Purchase (PCP)

Personal Contract Purchase (PCP) is a flexible car finance option that allows individuals to pay lower monthly installments compared to Hire Purchase (HP), with a final balloon payment if choosing to keep the vehicle. PCP agreements clearly outline tax implications, including VAT treatment on deposits and potential benefit-in-kind tax if the car is used for business purposes. Understanding the precise tax consequences of PCP helps drivers optimize their financial planning, especially regarding allowable expenses and capital allowances.

What Is Hire Purchase (HP)?

Hire Purchase (HP) is a finance agreement where a consumer pays a deposit followed by fixed monthly installments to gradually own a vehicle. Ownership is transferred only after the final payment, allowing businesses and individuals to spread the cost while using the asset. HP agreements are often favored for clear ownership terms, fixed interest rates, and potential tax benefits like VAT recovery and capital allowances.

Key Differences Between PCP and HP

Personal Contract Purchase (PCP) allows lower monthly payments with a balloon payment option at the end, while Hire Purchase (HP) requires fixed monthly payments over the contract term with ownership transfer at the last payment. PCP offers flexibility with the choice to buy, return, or trade the vehicle after the agreement, unlike HP where the vehicle is owned after the final installment. Tax implications differ as PCP often treats payments as rental with no immediate ownership tax relief, whereas HP ownership can enable VAT reclaim and depreciation allowances during the contract.

PCP vs HP: How Ownership Works

Personal Contract Purchase (PCP) allows drivers to pay lower monthly installments by deferring a large final payment called the Guaranteed Minimum Future Value (GMFV) to own the vehicle outright at the end of the term. Hire Purchase (HP) involves spreading the total cost of the car over fixed monthly payments, with ownership transferring automatically after the final installment is paid. Tax implications differ as PCP repayments often have lower VAT recovery for businesses, while HP repayments may allow full VAT reclaim depending on the vehicle usage.

Upfront Costs: PCP vs HP

Personal Contract Purchase (PCP) typically requires a lower upfront cost, often just the first monthly payment and a deposit, making it accessible for those with limited initial funds. Hire Purchase (HP) demands a higher initial down payment, usually a larger percentage of the vehicle's price, increasing overall upfront expenditure. Understanding the difference in initial payments affects budgeting and tax implications for both options.

Monthly Payments: Which Is Cheaper?

Personal Contract Purchase (PCP) typically offers lower monthly payments compared to Hire Purchase (HP) due to its structure of paying based on the vehicle's depreciation rather than its entire value. Hire Purchase spreads the total cost of the vehicle, including interest, evenly over the contract term, resulting in higher monthly repayments. For tax purposes, understanding that PCP monthly payments may be lower but can lead to larger final payments is crucial for budgeting and claiming allowable expenses.

Car Tax Implications: PCP or HP?

Personal Contract Purchase (PCP) allows lower monthly payments but may incur higher overall car tax if the vehicle retains high CO2 emissions at the end of the term, as the buyer faces potential tax changes when purchasing the car outright. Hire Purchase (HP) spreads the cost evenly and typically results in straightforward car tax payments based on vehicle emissions throughout the ownership period, with no surprise tax hikes after the agreement ends. Choosing between PCP and HP depends on vehicle depreciation, anticipated annual mileage, and how ownership timing affects applicable Vehicle Excise Duty (VED) rates tied to CO2 emissions thresholds.

End-of-Contract Options Compared

Personal Contract Purchase (PCP) offers flexible end-of-contract options such as returning the vehicle, making a final balloon payment to own the car, or trading it in for a new one, which can affect tax planning based on residual values and potential Capital Allowances. Hire Purchase (HP) requires the full payment spread over the contract term with ownership transferring after the last installment, allowing businesses to reclaim VAT on each payment and claim capital allowances throughout the agreement. Understanding the differences in asset ownership and VAT treatment is crucial for optimizing tax efficiency with PCP and HP agreements.

Who Should Choose PCP?

Individuals who prefer lower monthly payments and plan to upgrade their vehicle regularly should consider Personal Contract Purchase (PCP) as a flexible financing option. PCP suits drivers who want the option to buy the car at the end of the term, make a final balloon payment, or simply return the vehicle without further obligation. This method often benefits those seeking to minimize capital expenditure while maintaining the latest model, with tax implications favoring business use through potential VAT and capital allowances.

Who Should Choose HP?

Hire Purchase (HP) is ideal for individuals seeking straightforward ownership without large upfront costs, particularly those with stable credit history who prefer predictable monthly payments. It suits buyers intending to keep the vehicle long-term, as ownership is secured after the final installment without any balloon payments. HP is often favored by small business owners or those wanting to claim capital allowances for tax purposes, as it allows recording the asset on the balance sheet.

Personal Contract Purchase (PCP) vs Hire Purchase (HP) Infographic

cardiffo.com

cardiffo.com