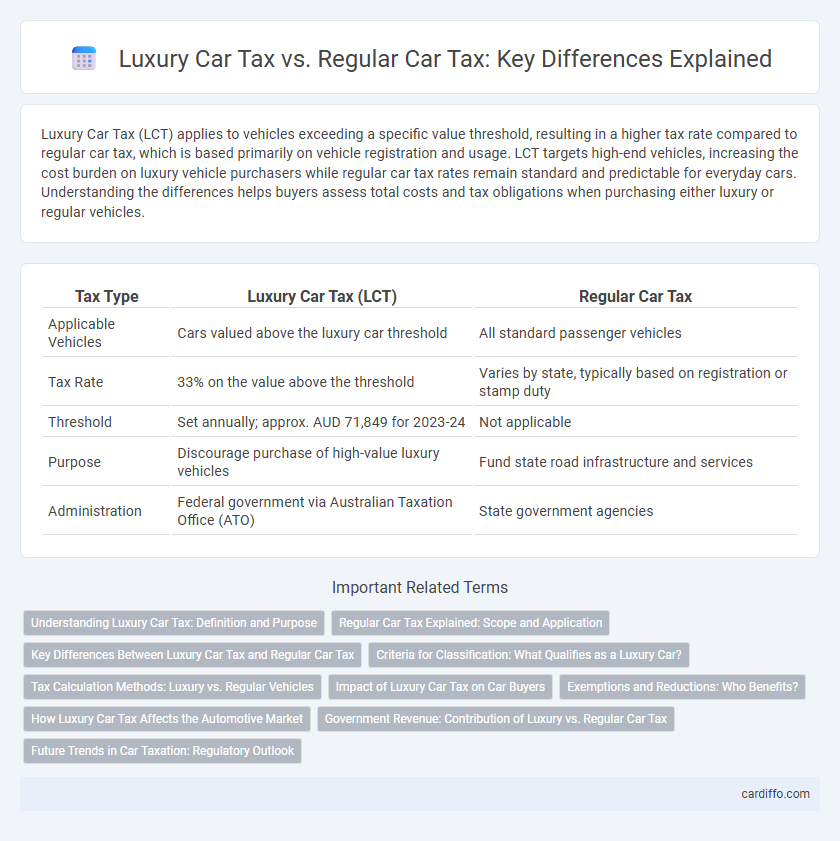

Luxury Car Tax (LCT) applies to vehicles exceeding a specific value threshold, resulting in a higher tax rate compared to regular car tax, which is based primarily on vehicle registration and usage. LCT targets high-end vehicles, increasing the cost burden on luxury vehicle purchasers while regular car tax rates remain standard and predictable for everyday cars. Understanding the differences helps buyers assess total costs and tax obligations when purchasing either luxury or regular vehicles.

Table of Comparison

| Tax Type | Luxury Car Tax (LCT) | Regular Car Tax |

|---|---|---|

| Applicable Vehicles | Cars valued above the luxury car threshold | All standard passenger vehicles |

| Tax Rate | 33% on the value above the threshold | Varies by state, typically based on registration or stamp duty |

| Threshold | Set annually; approx. AUD 71,849 for 2023-24 | Not applicable |

| Purpose | Discourage purchase of high-value luxury vehicles | Fund state road infrastructure and services |

| Administration | Federal government via Australian Taxation Office (ATO) | State government agencies |

Understanding Luxury Car Tax: Definition and Purpose

Luxury Car Tax (LCT) is a federal tax applied to vehicles exceeding a specific value threshold, designed to target high-cost luxury vehicles and reduce their affordability. The purpose of LCT is to generate additional revenue from luxury vehicle sales, distinguishable from the standard GST applied to all car purchases. Understanding LCT involves recognizing its impact on pricing, eligibility criteria, and the threshold value that triggers the tax, which varies annually based on government regulations.

Regular Car Tax Explained: Scope and Application

Regular car tax applies to passenger vehicles used primarily for personal or business purposes that do not exceed the luxury car tax threshold set by government regulations. This tax is calculated based on the vehicle's value, engine capacity, and fuel type, ensuring a standardized fiscal contribution across common vehicle categories. The scope includes both new and used cars, with rates varying according to state-specific transport authority guidelines.

Key Differences Between Luxury Car Tax and Regular Car Tax

Luxury Car Tax (LCT) applies to vehicles valued above the LCT threshold, typically luxury or high-priced cars, while regular car tax is standard vehicle registration and fuel taxes applied to all cars regardless of price. LCT is calculated as a percentage (usually 33%) on the amount exceeding the threshold, creating a higher tax burden for expensive vehicles compared to regular cars. Regular car tax includes annual registration fees and fuel excise taxes that are uniformly applied, with no additional surcharge based on vehicle price.

Criteria for Classification: What Qualifies as a Luxury Car?

Luxury car tax applies to vehicles exceeding a specified price threshold set by the Australian Taxation Office, currently at $71,849 for fuel-efficient vehicles and $84,916 for others, distinguishing luxury cars from regular ones. The classification considers the car's base price excluding luxury car tax and GST, engine size, and certain inclusions like optional extras, which can affect whether a vehicle qualifies for luxury tax. Regular car tax applies to vehicles priced below these thresholds, subjecting them to standard GST and stamp duty without the additional luxury car tax surcharge.

Tax Calculation Methods: Luxury vs. Regular Vehicles

Luxury Car Tax (LCT) is calculated on the amount exceeding the luxury car threshold, applying a higher rate compared to the standard Goods and Services Tax (GST) on regular vehicles. For regular cars, the tax is simply the GST at 10% of the purchase price, including any dealer delivery charges. LCT applies a rate of 33% on the value above the threshold for luxury vehicles priced over the set limit, significantly increasing the tax liability compared to regular vehicles.

Impact of Luxury Car Tax on Car Buyers

Luxury Car Tax (LCT) imposes a higher rate on vehicles exceeding the luxury car threshold, significantly increasing the purchase cost for buyers compared to Regular Car Tax. This tax impacts car buyers by reducing affordability and often steering purchases towards less expensive or non-luxury vehicles. The increased financial burden also influences market demand and buyer decisions in premium automotive segments.

Exemptions and Reductions: Who Benefits?

Luxury Car Tax (LCT) offers exemptions and reductions primarily for fuel-efficient vehicles, private sales, and vehicles used by disabled individuals, whereas regular car tax generally applies without such specific benefits. Exemptions under LCT are designed to encourage environmentally friendly choices and support accessibility needs, benefiting manufacturers and consumers aligned with these criteria. Regular car tax reductions tend to be less targeted, focusing more on general incentives like lower engine capacity or age-based depreciation.

How Luxury Car Tax Affects the Automotive Market

Luxury Car Tax (LCT) significantly influences the automotive market by increasing the cost of high-priced vehicles, thereby affecting consumer purchasing decisions and reducing demand for luxury models. This tax, applied on cars exceeding the luxury car threshold price, encourages buyers to opt for standard vehicles that are subject only to regular car tax rates. As a result, the LCT shapes market dynamics by incentivizing manufacturers to offer more competitively priced vehicles and impacts overall sales distribution between luxury and non-luxury cars.

Government Revenue: Contribution of Luxury vs. Regular Car Tax

Luxury Car Tax (LCT) significantly contributes to government revenue by targeting high-value vehicles with an additional tax rate, thereby generating higher per-vehicle tax receipts compared to the regular car tax imposed on all passenger cars. Regular car tax, collected through vehicle registration and stamp duties, provides a consistent revenue stream due to the high volume of standard car sales, although at a lower rate per vehicle. The combined effect of LCT and regular car tax sustains government funding for infrastructure and road safety programs, balancing revenue from luxury consumer spending and mass market vehicle ownership.

Future Trends in Car Taxation: Regulatory Outlook

Future trends in car taxation indicate a shift toward stricter regulations on Luxury Car Tax (LCT) to curb environmental impact by targeting high-emission vehicles. Governments are expected to increase the LCT threshold and introduce incentives for electric and hybrid luxury cars, differentiating it from regular car tax structures that remain primarily mileage- or ownership-based. Regulatory outlooks also emphasize integrating carbon pricing mechanisms into both luxury and regular car tax policies to promote sustainable vehicle choices and reduce overall carbon footprints.

Luxury Car Tax vs Regular Car Tax Infographic

cardiffo.com

cardiffo.com