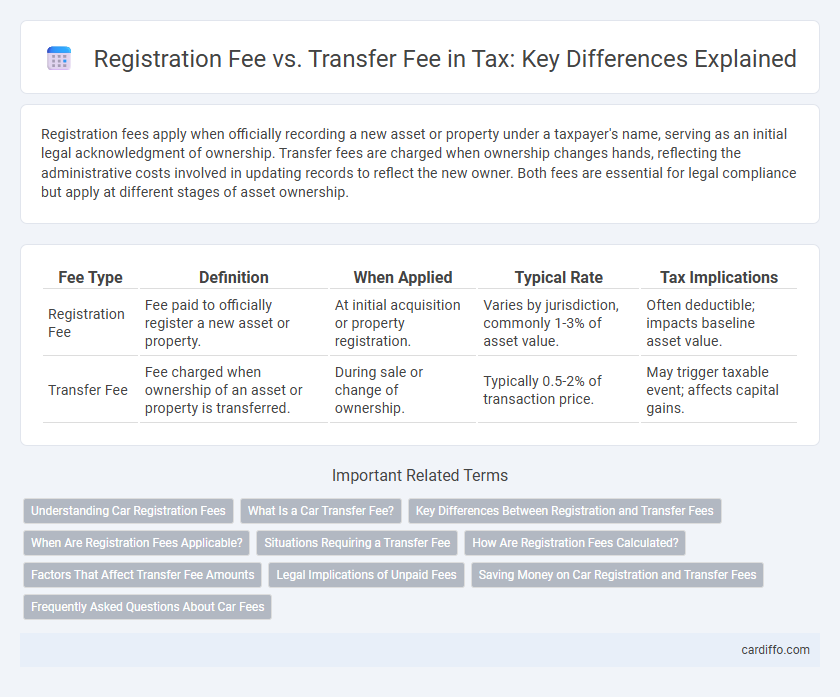

Registration fees apply when officially recording a new asset or property under a taxpayer's name, serving as an initial legal acknowledgment of ownership. Transfer fees are charged when ownership changes hands, reflecting the administrative costs involved in updating records to reflect the new owner. Both fees are essential for legal compliance but apply at different stages of asset ownership.

Table of Comparison

| Fee Type | Definition | When Applied | Typical Rate | Tax Implications |

|---|---|---|---|---|

| Registration Fee | Fee paid to officially register a new asset or property. | At initial acquisition or property registration. | Varies by jurisdiction, commonly 1-3% of asset value. | Often deductible; impacts baseline asset value. |

| Transfer Fee | Fee charged when ownership of an asset or property is transferred. | During sale or change of ownership. | Typically 0.5-2% of transaction price. | May trigger taxable event; affects capital gains. |

Understanding Car Registration Fees

Car registration fees are mandatory payments required to legally register a vehicle with a state's Department of Motor Vehicles (DMV), covering administrative costs and vehicle identification. Transfer fees occur when ownership of a vehicle changes, reflecting the administrative processing of title transfer and updating registration records. Understanding the distinction between these fees helps vehicle owners anticipate costs related to both initial registration and ownership changes.

What Is a Car Transfer Fee?

A car transfer fee is a charge imposed by the government or relevant authority when ownership of a vehicle is transferred from one person to another. This fee covers the administrative costs associated with updating the vehicle's title and registration records to reflect the new owner. Unlike the registration fee, which is paid periodically to keep a vehicle legally registered for use on public roads, the transfer fee is a one-time payment specific to the ownership change process.

Key Differences Between Registration and Transfer Fees

Registration fees are one-time payments made to legally record a new property or asset under an individual's name, establishing initial ownership and official documentation. Transfer fees occur when ownership changes hands, covering administrative costs and taxes related to transferring title from one party to another. Key differences include timing, with registration fees paid at first ownership and transfer fees triggered by subsequent sales, as well as variations in fee structure and taxable basis determined by property value and local regulations.

When Are Registration Fees Applicable?

Registration fees are applicable when a new asset or property is being officially recorded or documented under a legal or governmental framework. These fees usually apply during the initial ownership registration, such as buying real estate, vehicles, or intellectual property. Transfer fees, in contrast, are charged when ownership changes hands after the initial registration.

Situations Requiring a Transfer Fee

Situations requiring a transfer fee typically arise when ownership of an asset, such as real estate or a vehicle, changes hands, necessitating the legal recording of the transfer. Unlike a registration fee, which is paid to initially register an asset with the relevant authority, a transfer fee is imposed on the conveyance process, reflecting the administrative costs of updating ownership records. Transfer fees are commonly triggered during property sales, inheritance transfers, or gift transactions, highlighting their role in maintaining accurate public records and ensuring proper tax compliance.

How Are Registration Fees Calculated?

Registration fees are typically calculated based on the property's assessed value or purchase price, often involving a fixed percentage rate determined by local tax authorities. Factors such as property type, location, and transaction value influence the exact fee amount, with some jurisdictions applying tiered rates or exemptions. Accurate fee assessment requires referencing specific municipal or state tax codes governing property registrations.

Factors That Affect Transfer Fee Amounts

Transfer fee amounts vary significantly based on property value, location, and type of transaction involved. Government regulations and local tax rates also play a crucial role in determining the exact fee structure for property transfers. Seller incentives or exemptions may further impact the final transfer fee calculation.

Legal Implications of Unpaid Fees

Unpaid registration fees can result in legal penalties such as fines, interest accrual, and potential suspension of business licenses, directly impacting a company's operational legitimacy. Transfer fees left unsettled may trigger disputes over ownership rights and create obstacles in the legal transfer of assets or property, potentially leading to litigation and enforcement actions. Both unpaid fees undermine compliance with tax authorities, increasing the risk of audits, liens, and prolonged legal battles that can severely affect financial standing and reputation.

Saving Money on Car Registration and Transfer Fees

Saving money on car registration and transfer fees involves understanding the distinct cost structures and timing associated with each process. Registration fees typically cover the vehicle's legal permission to operate within a jurisdiction and may vary based on vehicle type, weight, and usage, whereas transfer fees are charged when ownership changes hands, often incorporating administrative and title processing costs. Careful planning, such as aligning registration renewal with transfer timing, can minimize redundant payments and leverage discounts or exemptions, resulting in significant cost savings.

Frequently Asked Questions About Car Fees

Car registration fees cover the cost of officially recording a vehicle under your name with the state's Department of Motor Vehicles (DMV), typically required annually or biannually. Transfer fees apply when ownership changes hands, such as during a sale or gift, covering administrative costs for updating the vehicle's title to the new owner. Understanding the difference between these fees helps avoid confusion during vehicle transactions and ensures compliance with state tax regulations.

registration fee vs transfer fee Infographic

cardiffo.com

cardiffo.com