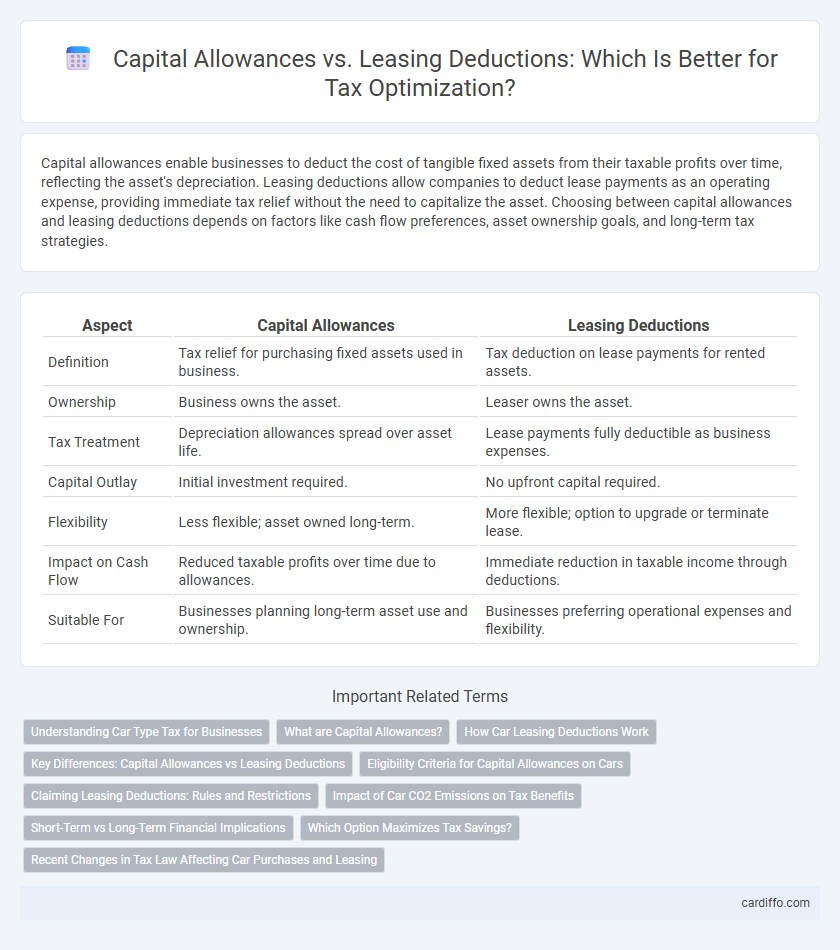

Capital allowances enable businesses to deduct the cost of tangible fixed assets from their taxable profits over time, reflecting the asset's depreciation. Leasing deductions allow companies to deduct lease payments as an operating expense, providing immediate tax relief without the need to capitalize the asset. Choosing between capital allowances and leasing deductions depends on factors like cash flow preferences, asset ownership goals, and long-term tax strategies.

Table of Comparison

| Aspect | Capital Allowances | Leasing Deductions |

|---|---|---|

| Definition | Tax relief for purchasing fixed assets used in business. | Tax deduction on lease payments for rented assets. |

| Ownership | Business owns the asset. | Leaser owns the asset. |

| Tax Treatment | Depreciation allowances spread over asset life. | Lease payments fully deductible as business expenses. |

| Capital Outlay | Initial investment required. | No upfront capital required. |

| Flexibility | Less flexible; asset owned long-term. | More flexible; option to upgrade or terminate lease. |

| Impact on Cash Flow | Reduced taxable profits over time due to allowances. | Immediate reduction in taxable income through deductions. |

| Suitable For | Businesses planning long-term asset use and ownership. | Businesses preferring operational expenses and flexibility. |

Understanding Car Type Tax for Businesses

Capital allowances enable businesses to claim tax relief on the purchase price of qualifying cars, often influenced by CO2 emissions and whether the vehicle is new or used, with lower-emission cars qualifying for higher allowances. Leasing deductions allow businesses to deduct lease payments as an expense, but the tax benefit varies depending on the car's CO2 emissions, with higher emission vehicles subject to limited deductibility. Understanding the specific tax treatment of cars, categorized by emission bands and ownership type, is crucial for optimizing capital allowances versus leasing deductions in business tax strategies.

What are Capital Allowances?

Capital allowances are tax reliefs that businesses can claim on qualifying capital expenditure, reducing taxable profits by deducting the cost of assets such as machinery, equipment, or buildings over time. These allowances enable companies to write off the value of tangible fixed assets against their taxable income, reflecting asset depreciation for tax purposes. Unlike leasing deductions, which cover lease payments, capital allowances apply to owned assets and follow specific rates and schedules determined by tax authorities.

How Car Leasing Deductions Work

Car leasing deductions allow businesses to claim a portion of the lease payments as an expense, reducing taxable income without the need to own the vehicle outright. Unlike capital allowances, which involve claiming depreciation on owned business assets over several years, leasing deductions are typically simpler and recorded directly as operating expenses in the accounting period. This method provides immediate tax relief, especially useful for companies managing cash flow and avoiding long-term asset commitments.

Key Differences: Capital Allowances vs Leasing Deductions

Capital allowances provide tax relief on capital expenditure by allowing businesses to deduct the cost of qualifying assets over time, reflecting asset depreciation. Leasing deductions enable businesses to deduct lease payments as an operating expense, offering immediate tax relief without capitalizing the asset. The key difference lies in ownership; capital allowances apply to owned assets, while leasing deductions relate to rented or leased assets.

Eligibility Criteria for Capital Allowances on Cars

Capital allowances on cars apply when a vehicle is purchased outright and used for business purposes, with eligibility depending on factors such as CO2 emissions, type of vehicle, and whether it is new or second-hand. Cars with low emissions often qualify for higher rates of capital allowances, providing significant tax relief over time compared to standard vehicles. Leasing deductions, by contrast, are available when a vehicle is leased rather than owned, with eligibility criteria differing primarily in terms of monthly lease payments and restrictions on private use.

Claiming Leasing Deductions: Rules and Restrictions

Claiming leasing deductions requires adherence to specific tax rules and restrictions, which vary depending on the type of asset and lease agreement. Only operating leases typically qualify for deductions, with finance leases often treated as asset purchases, limiting deductibility. Strict documentation and substantiation are mandatory to validate leasing deductions and avoid disallowance during tax audits.

Impact of Car CO2 Emissions on Tax Benefits

Capital allowances for business vehicles are heavily influenced by their CO2 emissions, with lower-emission cars qualifying for enhanced deductions, thereby reducing taxable profits more effectively. Leasing deductions also vary based on CO2 emissions, as vehicles with higher emissions often face stricter limits or reduced benefit allowances under tax regulations. Understanding the emission thresholds is crucial for maximizing tax benefits in both capital allowances and leasing deduction claims.

Short-Term vs Long-Term Financial Implications

Capital allowances provide tax relief by allowing businesses to deduct the cost of qualifying assets over several years, benefiting long-term financial planning through gradual depreciation. Leasing deductions offer immediate expense recognition, improving short-term cash flow but potentially resulting in higher cumulative costs over time. Assessing the trade-off between upfront leasing deductions and sustainable capital allowances is crucial for optimizing tax efficiency based on an organization's financial horizon.

Which Option Maximizes Tax Savings?

Capital allowances provide substantial tax relief by allowing businesses to deduct the cost of qualifying assets over time, reducing taxable profits significantly. Leasing deductions offer more immediate and flexible expense recognition, often benefiting companies with short-term or fluctuating asset needs. Evaluating company cash flow, asset usage duration, and tax position is crucial to determine which option maximizes overall tax savings.

Recent Changes in Tax Law Affecting Car Purchases and Leasing

Recent tax law changes have adjusted the capital allowances available for business vehicle purchases, particularly affecting electric and low-emission cars with increased first-year allowances. Leasing deductions now face stricter limits on deductible expenses based on the vehicle's CO2 emissions and contract terms, reducing the tax efficiency of certain leases. These updates necessitate careful evaluation of whether capital allowances or leasing deductions provide more favorable tax treatment for company cars.

Capital Allowances vs Leasing Deductions Infographic

cardiffo.com

cardiffo.com