Private use adjustment applies when an asset or expense is used for both personal and business purposes, requiring a proportional allocation of deductions to reflect only the business-related portion. Full business use allows full tax deductions without adjustments, as the asset or expense is exclusively utilized for business activities. Proper documentation is essential to substantiate the allocation and avoid tax penalties.

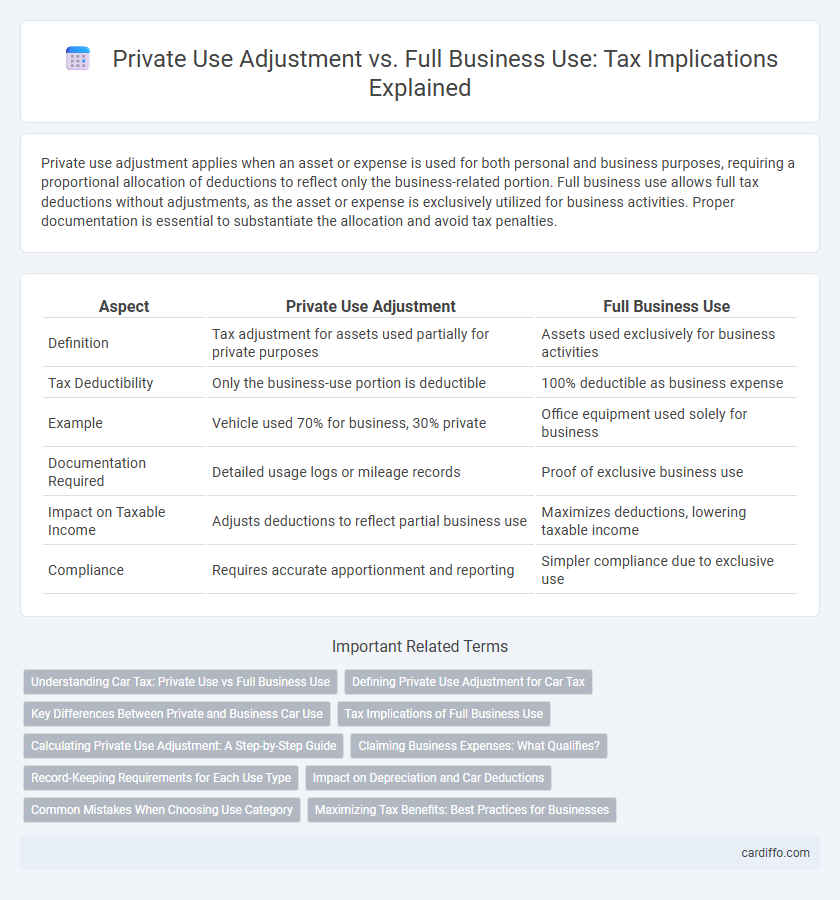

Table of Comparison

| Aspect | Private Use Adjustment | Full Business Use |

|---|---|---|

| Definition | Tax adjustment for assets used partially for private purposes | Assets used exclusively for business activities |

| Tax Deductibility | Only the business-use portion is deductible | 100% deductible as business expense |

| Example | Vehicle used 70% for business, 30% private | Office equipment used solely for business |

| Documentation Required | Detailed usage logs or mileage records | Proof of exclusive business use |

| Impact on Taxable Income | Adjusts deductions to reflect partial business use | Maximizes deductions, lowering taxable income |

| Compliance | Requires accurate apportionment and reporting | Simpler compliance due to exclusive use |

Understanding Car Tax: Private Use vs Full Business Use

Car tax rules differentiate significantly between private use adjustment and full business use, impacting deductible expenses and taxable benefits. When a vehicle is used partly for private purposes, a private use adjustment must be calculated to apportion business-related costs accurately, affecting VAT reclaim and taxable benefit-in-kind values. In contrast, full business use allows for 100% expense deduction without private use adjustments, simplifying tax reporting but requiring strict compliance to prove no personal use.

Defining Private Use Adjustment for Car Tax

Private Use Adjustment for car tax involves calculating the portion of vehicle expenses attributable to non-business use, ensuring only business-related costs are deducted for tax purposes. It requires detailed mileage tracking to separate private journeys from business travel, impacting allowable tax deductions and VAT reclaim. This adjustment prevents owners from claiming full business use benefits when the vehicle is partially used for personal purposes.

Key Differences Between Private and Business Car Use

Private use adjustment impacts tax deductions by reducing the allowable expenses based on the percentage of personal use, whereas full business use allows for claiming all vehicle-related costs as deductible expenses. Key differences include strict documentation requirements for full business use, such as maintaining detailed mileage logs, while private use adjustments require calculating the proportion of business versus private miles driven. Tax implications vary significantly, with private use adjustments potentially triggering additional taxable benefits, unlike vehicles designated for exclusive business purposes.

Tax Implications of Full Business Use

Full business use of assets allows for complete deductibility of expenses and accelerated depreciation under tax regulations, maximizing tax benefits and reducing taxable income significantly. Tax authorities require comprehensive documentation to substantiate exclusive business use, and any personal use could trigger adjustments or penalties. Properly managing full business use status can improve cash flow through enhanced tax savings and compliance with IRS or relevant tax body guidelines.

Calculating Private Use Adjustment: A Step-by-Step Guide

Calculating private use adjustment involves determining the percentage of an asset's use for personal purposes versus business purposes, often based on mileage logs or usage diaries. First, identify total usage and subtract the business use portion to find the private use percentage, then apply this ratio to expenses like depreciation, lease payments, or operating costs. Accurate record-keeping throughout the tax period is essential for substantiating the private use adjustment during tax reporting and audits.

Claiming Business Expenses: What Qualifies?

Claiming business expenses requires careful differentiation between private use adjustment and full business use to ensure accurate tax deductions. Only expenses directly related to business activities, such as vehicle mileage exclusively for client meetings or office supplies used solely for work, qualify under full business use. Expenses involving mixed use must be adjusted proportionally, with private use percentages disallowed to prevent inflating deductible amounts.

Record-Keeping Requirements for Each Use Type

Private use adjustment requires detailed logs tracking personal versus business use, including mileage records, dates, and purpose to substantiate the proportion of taxable private use. Full business use mandates comprehensive documentation proving the asset is exclusively for business, such as usage logs, maintenance records, and supporting financial statements. Accurate and consistent record-keeping ensures compliance with tax regulations and mitigates the risk of audit adjustments or penalties.

Impact on Depreciation and Car Deductions

Private use adjustment reduces the deductible business expenses for vehicle depreciation and operating costs, reflecting the portion of personal use, which lowers the overall tax benefit. In contrast, full business use allows for maximum depreciation claims and car-related expense deductions, optimizing tax savings. Accurate logbooks and mileage records are essential to substantiate business use percentages and avoid audits.

Common Mistakes When Choosing Use Category

Misclassifying asset use by inaccurately designating private use adjustment or full business use causes significant tax reporting errors, potentially triggering audits and penalties. Common mistakes include failing to maintain detailed usage logs and overestimating business use percentages without substantiating evidence. Accurate documentation and strict adherence to IRS guidelines are essential to correctly allocate expenses and avoid costly tax discrepancies.

Maximizing Tax Benefits: Best Practices for Businesses

Maximizing tax benefits requires accurately distinguishing between private use adjustment and full business use to ensure compliance and optimize deductions. Businesses should maintain detailed records and apply precise apportionment methods to allocate expenses correctly, reducing the risk of audit adjustments. Implementing robust tracking systems and regularly reviewing usage patterns can further enhance tax efficiency and safeguard against potential penalties.

Private Use Adjustment vs Full Business Use Infographic

cardiffo.com

cardiffo.com