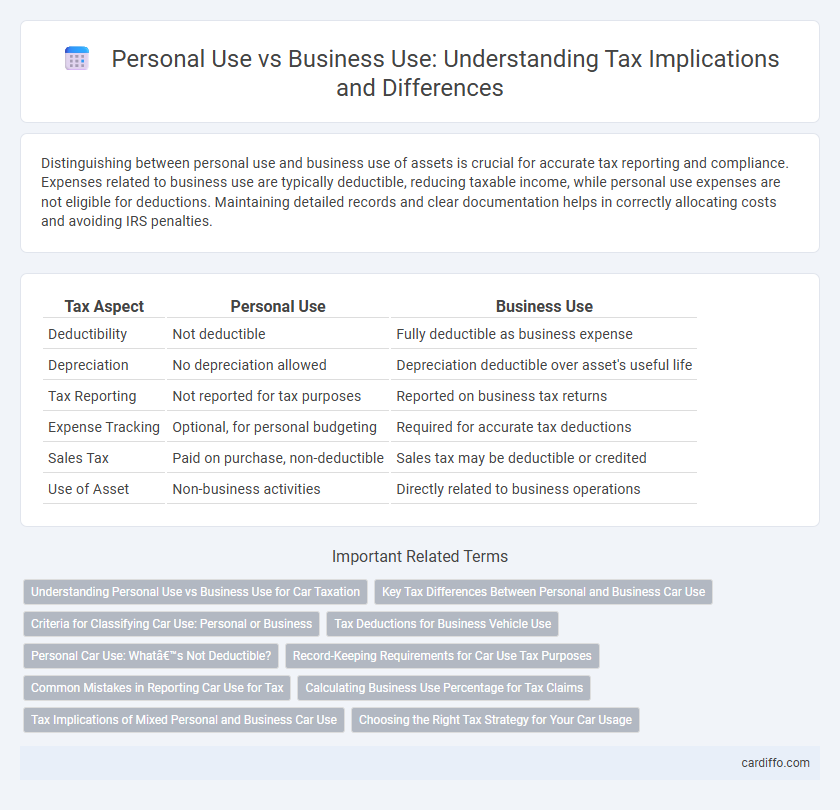

Distinguishing between personal use and business use of assets is crucial for accurate tax reporting and compliance. Expenses related to business use are typically deductible, reducing taxable income, while personal use expenses are not eligible for deductions. Maintaining detailed records and clear documentation helps in correctly allocating costs and avoiding IRS penalties.

Table of Comparison

| Tax Aspect | Personal Use | Business Use |

|---|---|---|

| Deductibility | Not deductible | Fully deductible as business expense |

| Depreciation | No depreciation allowed | Depreciation deductible over asset's useful life |

| Tax Reporting | Not reported for tax purposes | Reported on business tax returns |

| Expense Tracking | Optional, for personal budgeting | Required for accurate tax deductions |

| Sales Tax | Paid on purchase, non-deductible | Sales tax may be deductible or credited |

| Use of Asset | Non-business activities | Directly related to business operations |

Understanding Personal Use vs Business Use for Car Taxation

Differentiating personal use from business use in car taxation is crucial for accurate tax reporting and maximizing deductions. Personal use typically includes commuting and leisure driving, which are generally non-deductible expenses, whereas business use involves trips directly related to work activities, eligible for tax deductions. Proper documentation, such as mileage logs and expense records, supports tax compliance and ensures the correct allocation of car expenses between personal and business use.

Key Tax Differences Between Personal and Business Car Use

Personal car use deductions are limited to actual expenses or the standard mileage rate provided by the IRS, whereas business car use allows for more comprehensive write-offs including depreciation, gas, repairs, insurance, and lease payments. Accurate mileage logs separate business from personal use, directly impacting deductible amounts and audit risk. Tax regulations require maintaining detailed records to substantiate the percentage of business use for claiming vehicle expenses on returns.

Criteria for Classifying Car Use: Personal or Business

The criteria for classifying car use as personal or business depend on factors such as the primary purpose of the vehicle, mileage tracking, and the nature of trips made. Tax authorities typically require detailed logs documenting dates, destinations, and reasons for travel to substantiate business use claims. Proper classification influences deductible expenses, where business use permits deductions for operating costs while personal use expenses are non-deductible.

Tax Deductions for Business Vehicle Use

Tax deductions for business vehicle use allow taxpayers to reduce taxable income by claiming expenses related to operating a vehicle for business purposes, such as fuel, maintenance, insurance, and depreciation. Personal use of the vehicle generally cannot be deducted, so it is essential to keep accurate mileage logs separating business miles from personal miles to substantiate deductions. The IRS offers two methods for calculating deductions: the standard mileage rate and actual expense method, with strict documentation required to maximize tax benefits while ensuring compliance.

Personal Car Use: What’s Not Deductible?

Personal car use expenses such as commuting costs, daily travel between home and a regular workplace, and personal errands are not deductible for tax purposes. The IRS strictly disallows deductions for mileage or expenses that are not directly related to business activities. Maintaining detailed records to separate business use from personal use is essential to ensure compliance and avoid disallowed deductions.

Record-Keeping Requirements for Car Use Tax Purposes

Accurate record-keeping is essential for differentiating personal use from business use in car tax deductions, requiring detailed logs of mileage, dates, and purpose of each trip. The IRS mandates maintaining contemporaneous written or electronic records to substantiate claims, including odometer readings at the start and end of the tax year. Failure to provide adequate documentation can result in disallowed deductions and increased audit risk, underscoring the importance of meticulous record maintenance for tax compliance.

Common Mistakes in Reporting Car Use for Tax

Many taxpayers mistakenly claim full business use for vehicles actually used for personal purposes, leading to inaccurate deductions and potential audits. Failing to maintain detailed mileage logs differentiating personal versus business trips often results in disallowed expenses by the IRS. Overlooking proper allocation of mixed-use vehicles can trigger penalties and complicate depreciation calculations on tax returns.

Calculating Business Use Percentage for Tax Claims

Calculating the business use percentage for tax claims involves dividing the time or usage dedicated to business purposes by the total time or usage of the asset, such as a vehicle or home office. Accurate records, including mileage logs or usage diaries, are essential to substantiate the business use portion and ensure compliance with tax regulations. This percentage directly impacts the deductible expenses, allowing taxpayers to claim only the proportionate costs related to their business activities.

Tax Implications of Mixed Personal and Business Car Use

When a vehicle is used for both personal and business purposes, the IRS requires accurate record-keeping to differentiate deductible business expenses from non-deductible personal use. Deductible costs typically include fuel, maintenance, depreciation, and lease payments proportional to the business mileage, while personal mileage expenses are not deductible. Failure to separate personal and business use can result in disallowed deductions and potential tax penalties.

Choosing the Right Tax Strategy for Your Car Usage

Choosing the right tax strategy for your car usage depends on accurately distinguishing between personal use and business use, as only the business portion of expenses is tax-deductible. Keeping detailed mileage logs and receipts ensures you maximize allowable deductions while complying with IRS guidelines on vehicle expenses. Consulting a tax professional helps tailor the strategy to your specific situation, optimizing your tax savings based on the percentage of business-related car usage.

Personal use vs business use tax Infographic

cardiffo.com

cardiffo.com