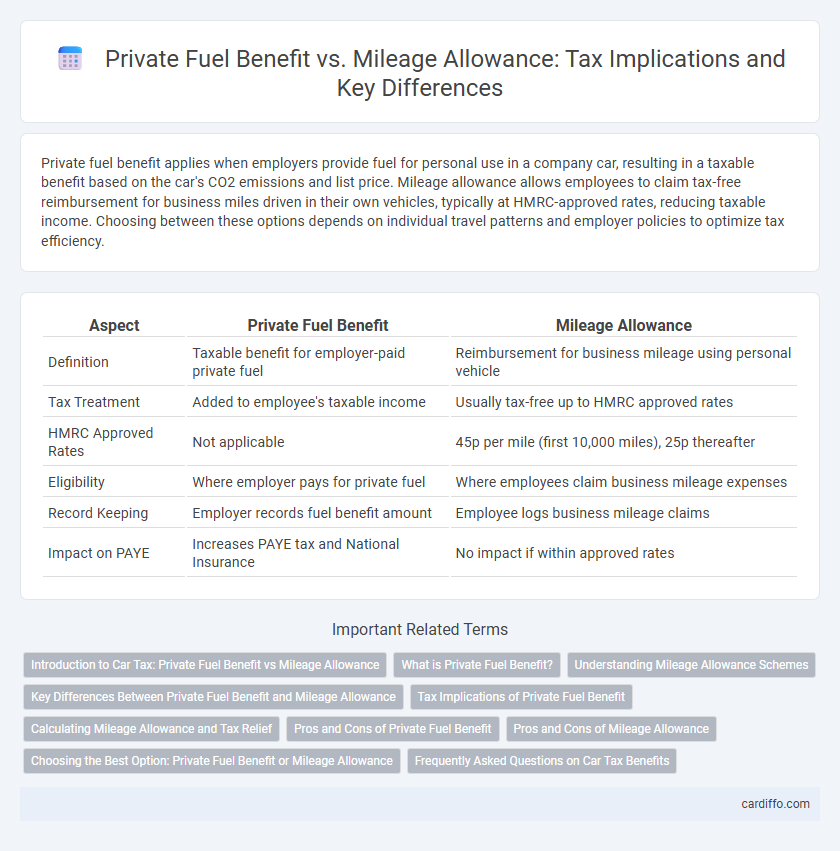

Private fuel benefit applies when employers provide fuel for personal use in a company car, resulting in a taxable benefit based on the car's CO2 emissions and list price. Mileage allowance allows employees to claim tax-free reimbursement for business miles driven in their own vehicles, typically at HMRC-approved rates, reducing taxable income. Choosing between these options depends on individual travel patterns and employer policies to optimize tax efficiency.

Table of Comparison

| Aspect | Private Fuel Benefit | Mileage Allowance |

|---|---|---|

| Definition | Taxable benefit for employer-paid private fuel | Reimbursement for business mileage using personal vehicle |

| Tax Treatment | Added to employee's taxable income | Usually tax-free up to HMRC approved rates |

| HMRC Approved Rates | Not applicable | 45p per mile (first 10,000 miles), 25p thereafter |

| Eligibility | Where employer pays for private fuel | Where employees claim business mileage expenses |

| Record Keeping | Employer records fuel benefit amount | Employee logs business mileage claims |

| Impact on PAYE | Increases PAYE tax and National Insurance | No impact if within approved rates |

Introduction to Car Tax: Private Fuel Benefit vs Mileage Allowance

Private fuel benefit arises when an employer provides fuel for private use in a company car, creating a taxable benefit subject to income tax and National Insurance contributions. Mileage allowance allows employees to claim tax-free reimbursement for business miles driven in their personal vehicle, typically set at HMRC's approved rates of 45p per mile for the first 10,000 miles and 25p thereafter. Understanding the distinction between these two helps optimize tax efficiency and ensures compliance with HMRC regulations on company car use and mileage claims.

What is Private Fuel Benefit?

Private Fuel Benefit is a taxable perk provided by employers when they pay for or reimburse employees' private use of company vehicles, covering fuel costs for non-business travel. HMRC calculates the taxable benefit based on a set monetary value linked to the car's CO2 emissions and fuel type, added to the employee's income for tax purposes. Unlike Mileage Allowance, which reimburses business-related travel expenses with tax-free limits, Private Fuel Benefit specifically addresses private fuel expenses, subject to income tax and National Insurance contributions.

Understanding Mileage Allowance Schemes

Mileage Allowance Schemes (MAS) provide a tax-efficient way for employees to claim reimbursement for business travel using personal vehicles, with fixed rates typically set by HMRC, such as 45p per mile for the first 10,000 miles. Private Fuel Benefit arises when an employer pays for fuel for private use, which is treated as a taxable benefit and attracts Class 1A National Insurance contributions. Understanding the distinction between MAS and Private Fuel Benefit is crucial for accurate tax reporting and minimizing taxable income related to vehicle expenses.

Key Differences Between Private Fuel Benefit and Mileage Allowance

Private Fuel Benefit applies when an employer provides fuel for private use in a company car, creating a taxable benefit based on the car's list price and CO2 emissions. Mileage Allowance reimburses employees for business miles driven in a personal vehicle, typically paid at HMRC's Approved Mileage Allowance Payments (AMAP) rates, which are tax-free up to set limits. Key differences include the taxable nature of Private Fuel Benefit versus the tax-free status of Mileage Allowance within specified thresholds, and the fact that Private Fuel Benefit covers fuel for private use while Mileage Allowance compensates for business travel in personal cars.

Tax Implications of Private Fuel Benefit

Private Fuel Benefit is a taxable benefit-in-kind that arises when an employer provides fuel for private use in a company car, leading to additional income tax and National Insurance contributions for the employee. The tax value of the fuel benefit is calculated based on the car's CO2 emissions and the appropriate percentage of the car's list price, which increases the employee's taxable income. Mileage Allowance payments, by contrast, are typically non-taxable up to HMRC-approved rates, providing employees with a tax-efficient method to cover business travel expenses without triggering a taxable benefit.

Calculating Mileage Allowance and Tax Relief

Calculating mileage allowance involves multiplying the number of business miles driven by the approved HMRC rates, currently 45p per mile for the first 10,000 miles and 25p thereafter, ensuring accurate reimbursement without incurring taxable benefits. Private fuel benefit arises when an employer provides fuel for private travel, which generates a taxable benefit assessed using a specific fuel benefit charge rate alongside the car's list price. Claiming tax relief on mileage allowance requires maintaining detailed mileage records and submitting appropriate expenses claims to reduce taxable income effectively.

Pros and Cons of Private Fuel Benefit

Private Fuel Benefit allows employees to use company-provided fuel for private journeys, reducing out-of-pocket expenses but incurs a taxable benefit calculated based on the car's CO2 emissions and fuel type, potentially leading to higher tax liabilities. It eliminates the need for detailed mileage records, simplifying expense reporting but may provide less flexibility compared to mileage allowance, which reimburses actual travel costs and can be more tax-efficient for low business mileage. Employers must carefully evaluate the cost implications and administrative burden, as Private Fuel Benefit often results in higher National Insurance contributions compared to mileage allowance schemes.

Pros and Cons of Mileage Allowance

Mileage allowance offers a tax-efficient way for employees to receive compensation for business travel using their own vehicles, as payments within approved rates are typically tax-free. However, mileage allowance may require detailed record-keeping of business miles, and exceeding the approved rates can result in taxable benefits. Compared to private fuel benefits, mileage allowance provides more flexibility and potential tax savings but demands careful compliance with HMRC rules to avoid unexpected tax liabilities.

Choosing the Best Option: Private Fuel Benefit or Mileage Allowance

Choosing between Private Fuel Benefit and Mileage Allowance depends on factors such as annual mileage, fuel costs, and tax implications. Private Fuel Benefit incurs a taxable benefit based on the car's list price and CO2 emissions, potentially increasing your tax liability. Mileage Allowance reimburses actual business miles driven at HMRC-approved rates, often resulting in a more tax-efficient option for employees who cover significant business travel.

Frequently Asked Questions on Car Tax Benefits

Private fuel benefit applies when an employer provides fuel for personal use in a company car, leading to a taxable benefit based on the car's CO2 emissions and list price. Mileage allowance allows employees to claim tax-free reimbursement for business miles driven in their own vehicle, typically up to 45p per mile for the first 10,000 miles and 25p thereafter. Understanding eligibility criteria and accurate record-keeping is essential to maximize tax advantages and comply with HMRC regulations.

Private Fuel Benefit vs Mileage Allowance Infographic

cardiffo.com

cardiffo.com