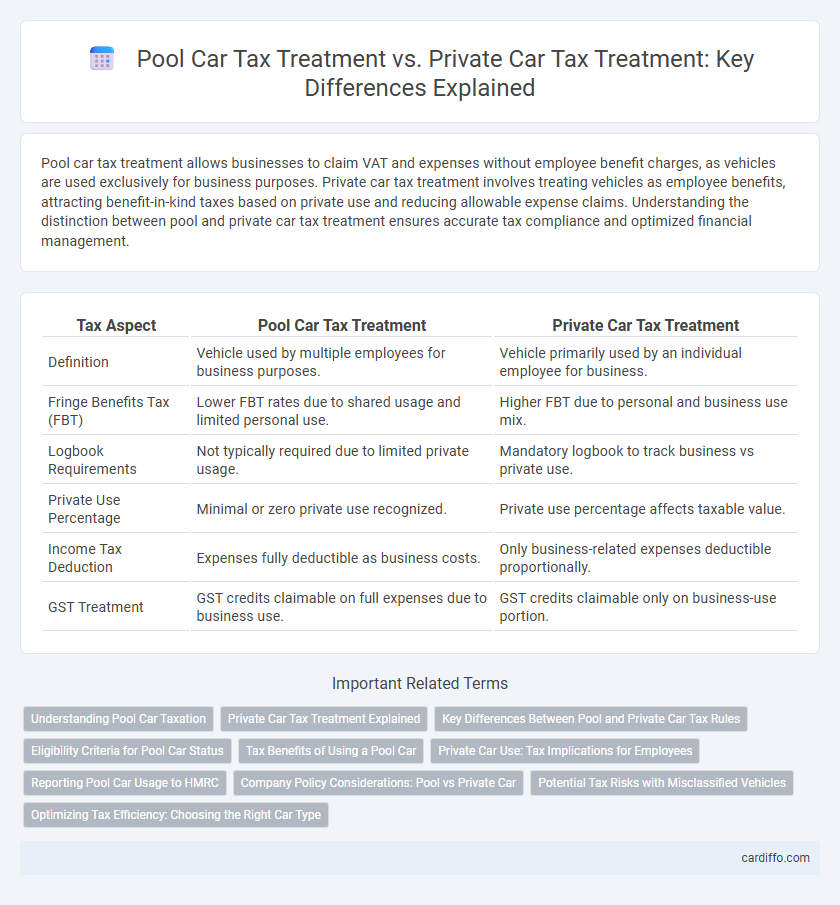

Pool car tax treatment allows businesses to claim VAT and expenses without employee benefit charges, as vehicles are used exclusively for business purposes. Private car tax treatment involves treating vehicles as employee benefits, attracting benefit-in-kind taxes based on private use and reducing allowable expense claims. Understanding the distinction between pool and private car tax treatment ensures accurate tax compliance and optimized financial management.

Table of Comparison

| Tax Aspect | Pool Car Tax Treatment | Private Car Tax Treatment |

|---|---|---|

| Definition | Vehicle used by multiple employees for business purposes. | Vehicle primarily used by an individual employee for business. |

| Fringe Benefits Tax (FBT) | Lower FBT rates due to shared usage and limited personal use. | Higher FBT due to personal and business use mix. |

| Logbook Requirements | Not typically required due to limited private usage. | Mandatory logbook to track business vs private use. |

| Private Use Percentage | Minimal or zero private use recognized. | Private use percentage affects taxable value. |

| Income Tax Deduction | Expenses fully deductible as business costs. | Only business-related expenses deductible proportionally. |

| GST Treatment | GST credits claimable on full expenses due to business use. | GST credits claimable only on business-use portion. |

Understanding Pool Car Taxation

Pool car taxation differs significantly from private car tax treatment due to the business use requirement and shared employee access. The Australian Taxation Office (ATO) defines pool cars as vehicles used for work-related travel by multiple employees, eliminating fringe benefits tax (FBT) if strict usage and accessibility criteria are met. Understanding pool car taxation requires accurate logbook records and adherence to ATO guidelines to avoid FBT liabilities typically applied to private vehicles used for work purposes.

Private Car Tax Treatment Explained

Private car tax treatment typically requires employees to report personal use of company cars as a taxable benefit, calculated based on the vehicle's list price, CO2 emissions, and fuel type. Tax authorities may impose benefit-in-kind (BIK) charges on private mileage, leading to higher taxable income and corresponding PAYE or self-assessment liabilities. Employers must accurately track private versus business usage and report fringe benefits on employee tax returns to ensure compliance with local tax regulations.

Key Differences Between Pool and Private Car Tax Rules

Pool car tax treatment involves vehicles used by multiple employees primarily for business purposes, where fringe benefits tax (FBT) exemptions apply due to the car's availability to all staff and limited private use. Private car tax treatment applies to vehicles used predominantly by an individual employee, requiring detailed logbooks or statutory formula methods to calculate FBT on private usage. Key differences include FBT exemption eligibility, usage tracking requirements, and the scope of private vs business use allowances.

Eligibility Criteria for Pool Car Status

Pool car tax treatment applies only to vehicles that are available for use by multiple employees for official business purposes and cannot be regularly assigned to any single employee. Eligibility criteria for pool car status require the vehicle to be parked at the business premises when not in use, to have no fixed parking space allocated to an individual, and to have logbooks or records demonstrating shared usage. Private cars used for work typically fail to meet these conditions, making them ineligible for pool car tax benefits and subject to different taxation rules.

Tax Benefits of Using a Pool Car

Using a pool car for business purposes provides significant tax benefits, including the ability to claim full business-related fuel and maintenance expenses as tax deductions without the need for complex logbook records. Unlike private cars used for business, pool cars are exempt from Fringe Benefits Tax (FBT) when availability to multiple employees is maintained, maximizing cost efficiency for employers. This tax treatment reduces administrative burden and enhances overall tax savings in fleet management.

Private Car Use: Tax Implications for Employees

Private car use for business purposes generally requires employees to report taxable benefits based on the vehicle's personal usage, often calculated using mileage logs or a flat rate per kilometer. Employers must include the value of private car use in the employee's taxable income, impacting income tax and social security contributions. Accurate record-keeping ensures compliance with tax regulations and prevents underreporting of benefits-in-kind for private vehicle use.

Reporting Pool Car Usage to HMRC

Pool car usage must be accurately recorded and reported to HMRC to ensure compliance with tax regulations, distinguishing it clearly from private car use which is subject to different tax treatments. Unlike private cars, pool cars do not attract benefit-in-kind charges if they are genuinely available for business use by multiple employees and properly logged. Maintaining detailed mileage records and usage logs is essential for accurate tax reporting and avoiding penalties.

Company Policy Considerations: Pool vs Private Car

Company policy on pool car versus private car tax treatment should clearly define vehicle usage, eligibility criteria, and record-keeping requirements to ensure compliance with tax regulations. Pool cars, shared among multiple employees for business purposes, typically have simplified reporting and lower Fringe Benefit Tax (FBT) liabilities due to limited private use. Private cars, assigned to individual employees, require detailed logbooks and strict adherence to personal versus business use rules, impacting the calculation of taxable benefits and company tax deductions.

Potential Tax Risks with Misclassified Vehicles

Misclassifying pool cars as private cars can lead to significant tax risks, including inaccurate fringe benefit tax (FBT) calculations and non-compliance penalties from tax authorities. Pool cars, available for business use by multiple employees and meeting specific usage criteria, are generally exempt from FBT, while private cars attract FBT based on personal use. Failure to correctly categorize vehicles may result in unexpected tax liabilities, audit scrutiny, and increased administrative costs.

Optimizing Tax Efficiency: Choosing the Right Car Type

Selecting a pool car over a private car can significantly enhance tax efficiency by allowing businesses to claim VAT recovery on fuel and maintenance expenses, as pool cars are classified for business use only. Private cars used for both personal and business purposes limit VAT claims to business mileage, increasing the taxable benefit for employees and complicating tax reporting. Analyzing vehicle usage patterns and tax regulations helps optimize deductions, reduce taxable benefits, and improve overall corporate tax strategy.

Pool Car Tax Treatment vs Private Car Tax Treatment Infographic

cardiffo.com

cardiffo.com