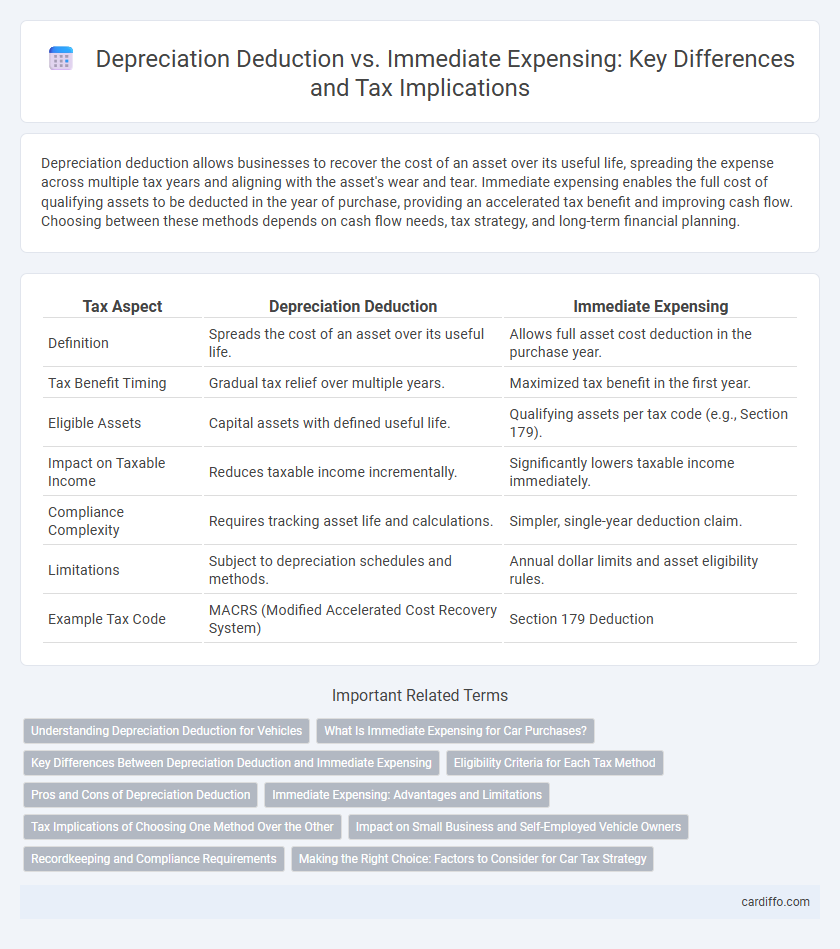

Depreciation deduction allows businesses to recover the cost of an asset over its useful life, spreading the expense across multiple tax years and aligning with the asset's wear and tear. Immediate expensing enables the full cost of qualifying assets to be deducted in the year of purchase, providing an accelerated tax benefit and improving cash flow. Choosing between these methods depends on cash flow needs, tax strategy, and long-term financial planning.

Table of Comparison

| Tax Aspect | Depreciation Deduction | Immediate Expensing |

|---|---|---|

| Definition | Spreads the cost of an asset over its useful life. | Allows full asset cost deduction in the purchase year. |

| Tax Benefit Timing | Gradual tax relief over multiple years. | Maximized tax benefit in the first year. |

| Eligible Assets | Capital assets with defined useful life. | Qualifying assets per tax code (e.g., Section 179). |

| Impact on Taxable Income | Reduces taxable income incrementally. | Significantly lowers taxable income immediately. |

| Compliance Complexity | Requires tracking asset life and calculations. | Simpler, single-year deduction claim. |

| Limitations | Subject to depreciation schedules and methods. | Annual dollar limits and asset eligibility rules. |

| Example Tax Code | MACRS (Modified Accelerated Cost Recovery System) | Section 179 Deduction |

Understanding Depreciation Deduction for Vehicles

Depreciation deduction allows businesses to recover the cost of vehicles over their useful life, spreading the expense across multiple tax years according to IRS guidelines. This method contrasts with immediate expensing, which permits full deduction of the vehicle's cost in the purchase year under Section 179 or bonus depreciation provisions, subject to specific limits and eligibility. Understanding depreciation schedules and applicable limits ensures accurate tax reporting and maximizes potential deductions on vehicle expenses.

What Is Immediate Expensing for Car Purchases?

Immediate expensing for car purchases allows businesses to deduct the full cost of a vehicle in the year it is placed in service, rather than spreading the deduction over several years through depreciation. This tax benefit, often available under Section 179 or bonus depreciation rules, accelerates cash flow by reducing taxable income more quickly. Immediate expensing is particularly advantageous for companies investing in business vehicles, providing a significant upfront tax deduction compared to gradual depreciation schedules.

Key Differences Between Depreciation Deduction and Immediate Expensing

Depreciation deduction allocates the cost of an asset over its useful life, spreading tax benefits across multiple years, whereas immediate expensing allows full cost deduction in the year of purchase, accelerating tax relief. Depreciation requires asset categorization and adherence to IRS schedules, such as MACRS, while immediate expensing often applies to qualifying assets under Section 179 or bonus depreciation rules. The choice impacts cash flow and taxable income timing, with immediate expensing providing faster deductions but depreciation offering long-term tax planning advantages.

Eligibility Criteria for Each Tax Method

Depreciation deduction requires assets to be capital in nature and used in a trade or business, with a useful life exceeding one year, making tangible property eligible for gradual cost recovery over time. Immediate expensing applies primarily to qualified business property, often under sections like Section 179 or bonus depreciation, allowing full deduction in the acquisition year subject to specific thresholds and asset types. Eligibility differences hinge on asset classification, business use percentage, and regulatory limits set by the IRS for each tax treatment method.

Pros and Cons of Depreciation Deduction

Depreciation deduction allows businesses to recover the cost of tangible assets over their useful life, providing a steady tax benefit that aligns with the asset's wear and tear. This method improves profit accuracy by matching expenses with revenue generation but delays full tax relief compared to immediate expensing. However, tracking depreciation schedules can increase administrative complexity and reduce cash flow flexibility in the short term.

Immediate Expensing: Advantages and Limitations

Immediate expensing allows businesses to fully deduct the cost of qualifying assets in the year of purchase, providing significant tax relief and improved cash flow compared to depreciation deduction methods. This approach accelerates tax benefits by reducing taxable income immediately, but it often comes with limits on asset types and maximum deduction amounts, which can restrict long-term tax planning flexibility. While immediate expensing simplifies accounting and encourages investment, it may lead to larger taxable income in future years when no further deductions on the depreciated asset are available.

Tax Implications of Choosing One Method Over the Other

Choosing depreciation deduction spreads the expense of an asset over its useful life, reducing taxable income gradually, while immediate expensing allows full deduction in the year of purchase, resulting in accelerated tax benefits. Depreciation maximizes long-term tax planning and smoother income reporting, whereas immediate expensing provides immediate cash flow relief through upfront tax savings. Taxpayers must evaluate the timing of taxable income and potential changes in tax rates to optimize overall tax liability between these methods.

Impact on Small Business and Self-Employed Vehicle Owners

Depreciation deduction allows small business and self-employed vehicle owners to spread the cost of their vehicles over several years, reducing taxable income gradually while immediate expensing offers the advantage of deducting the entire vehicle cost in the purchase year, providing significant upfront tax relief. The choice between these methods impacts cash flow management and tax liability timing, with immediate expensing enhancing short-term financial flexibility but limiting future deductions. IRS Section 179 and bonus depreciation rules are key factors influencing eligibility and deduction limits for vehicle expenses in both strategies.

Recordkeeping and Compliance Requirements

Depreciation deduction requires detailed recordkeeping to track asset cost, useful life, and accumulated depreciation over several years, ensuring accurate compliance with IRS guidelines. Immediate expensing simplifies compliance by allowing full expense recognition in the purchase year, reducing ongoing documentation and audit complexities. Both methods demand adherence to specific tax codes, but immediate expensing offers streamlined reporting while depreciation involves periodic updates and stricter documentation.

Making the Right Choice: Factors to Consider for Car Tax Strategy

Depreciation deduction allows for gradual tax relief over the useful life of a vehicle, spreading the expense and reducing taxable income incrementally. Immediate expensing accelerates the full deduction in the year of purchase, offering substantial upfront tax benefits beneficial for businesses with high current profits. Key factors influencing the choice include the company's cash flow needs, projected profitability, and long-term asset management strategy to maximize tax efficiency.

Depreciation deduction vs immediate expensing Infographic

cardiffo.com

cardiffo.com