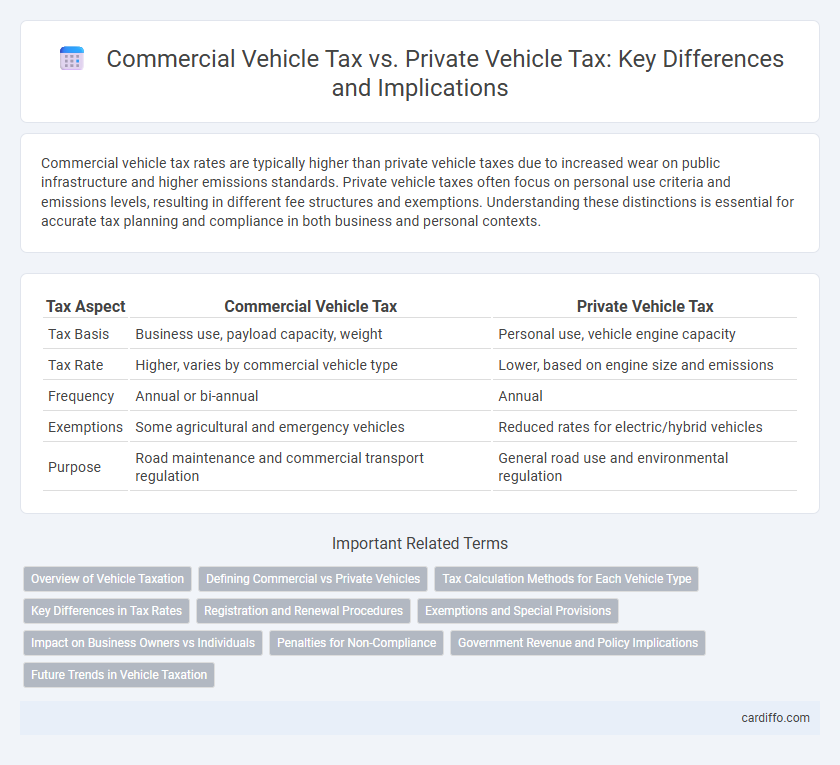

Commercial vehicle tax rates are typically higher than private vehicle taxes due to increased wear on public infrastructure and higher emissions standards. Private vehicle taxes often focus on personal use criteria and emissions levels, resulting in different fee structures and exemptions. Understanding these distinctions is essential for accurate tax planning and compliance in both business and personal contexts.

Table of Comparison

| Tax Aspect | Commercial Vehicle Tax | Private Vehicle Tax |

|---|---|---|

| Tax Basis | Business use, payload capacity, weight | Personal use, vehicle engine capacity |

| Tax Rate | Higher, varies by commercial vehicle type | Lower, based on engine size and emissions |

| Frequency | Annual or bi-annual | Annual |

| Exemptions | Some agricultural and emergency vehicles | Reduced rates for electric/hybrid vehicles |

| Purpose | Road maintenance and commercial transport regulation | General road use and environmental regulation |

Overview of Vehicle Taxation

Vehicle taxation varies significantly between commercial and private vehicles, with commercial vehicle tax often calculated based on weight, usage, and emissions to reflect higher road wear and business use. Private vehicle tax typically relies on engine size, fuel type, and CO2 emissions, aiming to encourage environmentally friendly choices. Governments implement these differentiated tax structures to balance infrastructure funding and environmental impact while promoting efficient vehicle use.

Defining Commercial vs Private Vehicles

Commercial vehicles are defined as vehicles used primarily for transporting goods or passengers for business purposes, including trucks, buses, and taxis, which are subject to higher tax rates due to their economic usage and wear on infrastructure. Private vehicles are designed for personal use, such as sedans, SUVs, and motorcycles, typically taxed at lower rates reflecting their limited commercial impact. Tax authorities differentiate these categories based on vehicle registration, usage documentation, and intended function to ensure appropriate tax application.

Tax Calculation Methods for Each Vehicle Type

Commercial vehicle tax is typically calculated based on factors such as vehicle weight, load capacity, and distance traveled, reflecting the higher wear and tear caused by heavy usage. Private vehicle tax calculations tend to focus on engine size, vehicle age, and emissions, aligning with environmental policies and personal usage patterns. The differing tax bases ensure that heavier, regularly used commercial vehicles contribute more to infrastructure maintenance, while private vehicles are taxed according to their potential environmental impact.

Key Differences in Tax Rates

Commercial vehicle tax rates are typically higher than private vehicle taxes due to increased road wear and higher regulatory scrutiny. Private vehicle taxes often rely on factors such as engine size, vehicle age, and fuel type, while commercial vehicle taxation considers payload capacity and vehicle usage intensity. These distinctions result in commercial vehicles facing significantly greater tax burdens to offset their economic impact and maintenance costs on public infrastructure.

Registration and Renewal Procedures

Commercial vehicle tax registration requires submission of detailed business documentation, including proof of commercial use and fleet details, while private vehicle registration primarily demands owner identification and personal vehicle information. Renewal procedures for commercial vehicles often involve more frequent inspections and higher fees to ensure compliance with commercial regulations, contrasting with the simpler annual renewal process for private vehicles. Proper adherence to these distinct processes ensures legal operation and avoids penalties specific to commercial and private vehicle classifications.

Exemptions and Special Provisions

Commercial vehicle tax exemptions often include vehicles used for agricultural purposes, emergency services, and certain public transportation categories, reflecting government incentives to support essential services and economic activities. Private vehicle tax exemptions typically cover vehicles owned by disabled individuals, electric vehicles promoting environmental sustainability, and historic or classic cars under specific age criteria, aligning with social and ecological policies. Special provisions for commercial vehicles may also involve mileage-based tax reductions or regional tax waivers, whereas private vehicles benefit from income-based tax relief schemes or eligibility for local government rebates.

Impact on Business Owners vs Individuals

Commercial vehicle tax applies higher rates and stricter regulations compared to private vehicle tax, significantly affecting business owners' operating costs and profitability. Business owners face additional charges based on vehicle weight, usage frequency, and commercial routes, while individuals pay lower, flat rates primarily based on vehicle type and emissions. This tax disparity influences purchasing decisions, with businesses often opting for more fuel-efficient or alternative-fuel vehicles to mitigate tax liabilities.

Penalties for Non-Compliance

Penalties for non-compliance with commercial vehicle tax typically include hefty fines, vehicle impoundment, and possible suspension of operating licenses, reflecting the strict regulations designed to ensure road safety and proper tax contributions. In contrast, private vehicle tax violations generally incur lower fines and fewer enforcement actions, though repeated offenses can lead to increased penalties and legal repercussions. Authorities prioritize timely tax payment and accurate record-keeping to avoid these punitive measures and maintain regulatory compliance.

Government Revenue and Policy Implications

Commercial vehicle tax generates significantly higher government revenue due to heavier usage and higher taxation rates compared to private vehicle tax. Policy implications favor increased tax rates on commercial vehicles to fund infrastructure maintenance and reduce road wear caused by frequent heavy loads. Balancing tax structures ensures equitable contributions from private vehicle owners while optimizing public resources through commercial vehicle taxation.

Future Trends in Vehicle Taxation

Future trends in vehicle taxation indicate a shift towards differentiated tax structures favoring electric and low-emission commercial vehicles over traditional private vehicles. Governments are increasingly implementing usage-based taxes and emission-focused levies to incentivize greener commercial fleets while phasing out subsidies on private vehicle ownership. Advances in telematics and data analytics will enable more precise taxation based on vehicle type, mileage, and environmental impact, transforming commercial and private vehicle tax policies.

Commercial Vehicle Tax vs Private Vehicle Tax Infographic

cardiffo.com

cardiffo.com