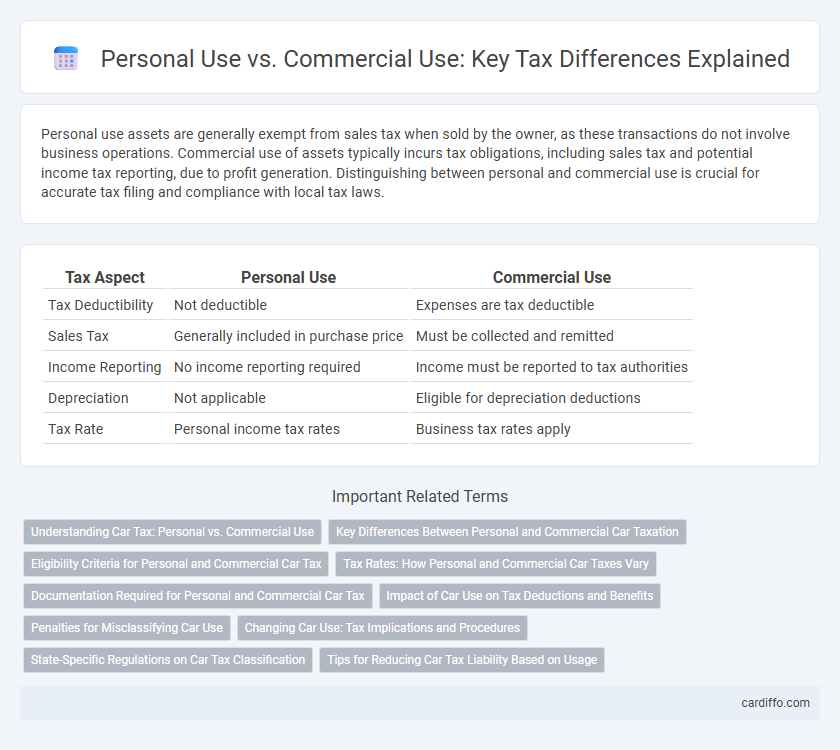

Personal use assets are generally exempt from sales tax when sold by the owner, as these transactions do not involve business operations. Commercial use of assets typically incurs tax obligations, including sales tax and potential income tax reporting, due to profit generation. Distinguishing between personal and commercial use is crucial for accurate tax filing and compliance with local tax laws.

Table of Comparison

| Tax Aspect | Personal Use | Commercial Use |

|---|---|---|

| Tax Deductibility | Not deductible | Expenses are tax deductible |

| Sales Tax | Generally included in purchase price | Must be collected and remitted |

| Income Reporting | No income reporting required | Income must be reported to tax authorities |

| Depreciation | Not applicable | Eligible for depreciation deductions |

| Tax Rate | Personal income tax rates | Business tax rates apply |

Understanding Car Tax: Personal vs. Commercial Use

Car tax rates vary significantly based on whether the vehicle is registered for personal or commercial use, with commercial vehicles often subject to higher taxes due to increased mileage and wear. Understanding the specific tax obligations for personal use vehicles--typically lower fixed rates versus commercial use models--helps ensure compliance and avoid penalties. Accurate classification affects deductions, depreciation claims, and eligibility for tax exemptions or credits under local tax laws.

Key Differences Between Personal and Commercial Car Taxation

Personal car tax typically involves lower rates and simpler registration processes tailored for individual use, while commercial car tax includes higher fees and stricter regulations due to business-related operations. Commercial vehicles often incur additional taxes such as weight-based fees, fuel surcharges, and income tax deductions eligibility that personal vehicles do not. Understanding distinctions like tax credits limitations, depreciation rules, and usage reporting requirements is essential for accurate tax compliance between personal and commercial car uses.

Eligibility Criteria for Personal and Commercial Car Tax

Eligibility criteria for personal car tax typically require the vehicle to be used primarily for private, non-commercial purposes such as commuting and leisure. Commercial car tax applies when the vehicle is utilized for business activities, including transporting goods, passengers for hire, or any income-generating services. Verification often involves documentation like business registration, usage logs, and proof of income related to the vehicle's commercial operations.

Tax Rates: How Personal and Commercial Car Taxes Vary

Personal car taxes generally have lower rates compared to commercial vehicles due to differing usage purposes and associated tax policies. Commercial vehicles often incur higher tax rates to account for increased wear, business-related depreciation, and regulatory compliance costs. Understanding local tax codes is essential, as rates vary significantly by jurisdiction and impact overall vehicle ownership expenses.

Documentation Required for Personal and Commercial Car Tax

Documentation required for personal car tax typically includes proof of ownership, valid identification, and vehicle registration papers, while commercial car tax demands additional documents such as business licenses, commercial vehicle permits, and detailed usage logs. Commercial vehicles often require evidence of operational scope like freight contracts or service invoices to validate tax classification. Proper and thorough documentation ensures compliance with tax regulations and accurate tax calculation for both personal and commercial use vehicles.

Impact of Car Use on Tax Deductions and Benefits

Personal use of a car typically limits tax deductions to standard mileage rates or actual expenses strictly related to commuting and personal trips, whereas commercial use allows for broader deductions including business mileage, depreciation, fuel, and maintenance costs. The IRS requires detailed records such as mileage logs and purpose of trips to differentiate between personal and commercial use, directly impacting the amount deductible. Maximizing tax benefits hinges on accurately categorizing car use, as improper classification may trigger audits or disallowance of expenses.

Penalties for Misclassifying Car Use

Misclassifying a vehicle's use between personal and commercial can lead to significant tax penalties, including fines and increased audit risk from the IRS. Commercial use vehicles require accurate record-keeping and proper expense reporting, as deductions and credits differ substantially compared to personal use. Failure to correctly classify car usage may result in disallowed deductions, triggering back taxes, interest charges, and penalties that impact overall tax liability.

Changing Car Use: Tax Implications and Procedures

Changing a vehicle's use from personal to commercial affects tax deductions and requires updating records with tax authorities to reflect the new usage. Business-related expenses, including depreciation and maintenance, become deductible, but strict documentation must be maintained to justify these claims. Failure to accurately report changes can lead to audits, penalties, and disallowed deductions.

State-Specific Regulations on Car Tax Classification

State-specific regulations on car tax classification distinguish personal use vehicles from commercial use based on factors such as mileage, vehicle weight, and intended use. For instance, California imposes higher registration fees and excise taxes on commercial vehicles, while Texas differentiates tax rates depending on whether the vehicle is primarily used for business activities. Understanding these state regulations is essential for accurate tax reporting and compliance.

Tips for Reducing Car Tax Liability Based on Usage

Car tax liability varies significantly between personal use and commercial use, with commercial vehicles often subject to higher rates and additional reporting requirements. Keeping detailed mileage logs distinguishing between personal and business trips can maximize allowable deductions and minimize taxable income. Leveraging tax credits and deductions specific to business-related vehicle expenses, such as depreciation and fuel costs, effectively reduces overall tax burdens.

Personal use vs commercial use tax Infographic

cardiffo.com

cardiffo.com