Green car tax rates are significantly lower than petrol car taxes due to incentives promoting environmentally friendly vehicles. Petrol cars typically incur higher taxes based on fuel consumption and emissions, increasing the overall cost of ownership. This tax discrepancy encourages consumers to opt for greener alternatives, reducing carbon footprints and supporting sustainable transportation policies.

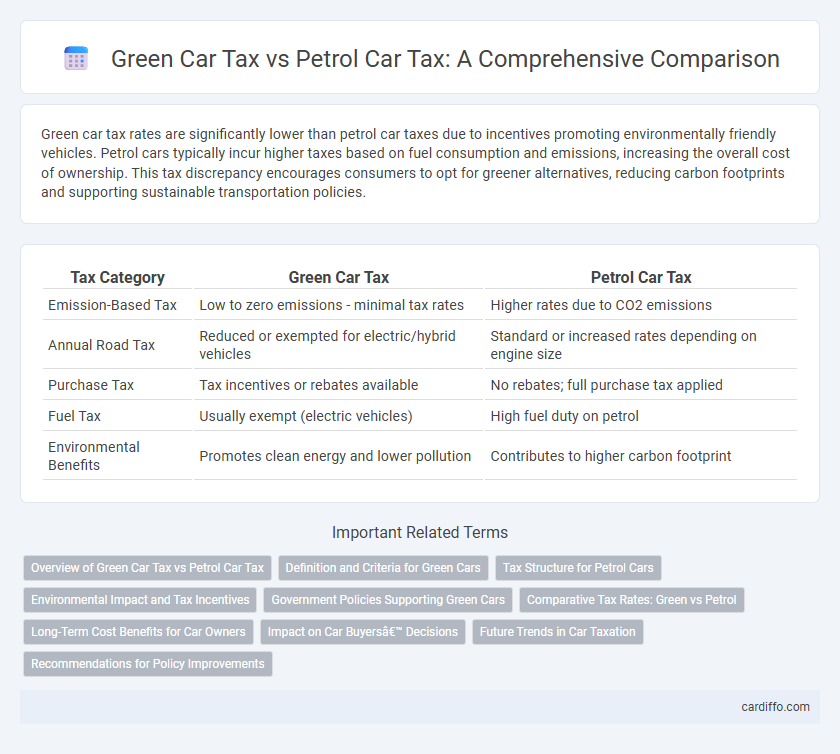

Table of Comparison

| Tax Category | Green Car Tax | Petrol Car Tax |

|---|---|---|

| Emission-Based Tax | Low to zero emissions - minimal tax rates | Higher rates due to CO2 emissions |

| Annual Road Tax | Reduced or exempted for electric/hybrid vehicles | Standard or increased rates depending on engine size |

| Purchase Tax | Tax incentives or rebates available | No rebates; full purchase tax applied |

| Fuel Tax | Usually exempt (electric vehicles) | High fuel duty on petrol |

| Environmental Benefits | Promotes clean energy and lower pollution | Contributes to higher carbon footprint |

Overview of Green Car Tax vs Petrol Car Tax

Green car tax incentives typically include reduced registration fees, tax credits, and exemptions aimed at encouraging electric and hybrid vehicle adoption. Petrol car tax generally involves higher fuel excise duties, road taxes based on emission levels, and limited rebates, reflecting environmental concerns. Governments use these differentiated tax structures to promote sustainability and reduce carbon emissions in the transportation sector.

Definition and Criteria for Green Cars

Green Car Tax applies to vehicles that meet specific environmental standards, such as low CO2 emissions and eligibility for incentives under government programs promoting sustainability. These criteria often include electric, hybrid, or hydrogen fuel cell technologies, distinguishing them from petrol cars, which rely solely on internal combustion engines with higher emission rates. By targeting tangible factors like fuel efficiency and emission thresholds, Green Car Tax aims to encourage environmentally friendly vehicle choices and reduce overall carbon footprints.

Tax Structure for Petrol Cars

Petrol car tax is primarily based on engine size, CO2 emissions, and fuel consumption, resulting in higher rates for less efficient vehicles. The tax structure often includes Vehicle Excise Duty (VED), which increases with emissions bands, promoting lower-polluting cars. Compared to green car tax benefits, petrol car owners face steeper annual charges and limited incentives for environmental performance.

Environmental Impact and Tax Incentives

Green cars benefit from significantly lower tax rates due to government incentives aimed at reducing carbon emissions and promoting sustainable transportation, resulting in decreased environmental impact compared to petrol cars. Petrol car tax often incorporates higher levies based on CO2 emissions, reflecting their contribution to air pollution and climate change. Tax policies favoring green vehicles accelerate the transition to eco-friendly alternatives by making electric and hybrid models more financially attractive to consumers.

Government Policies Supporting Green Cars

Government policies promoting green car adoption include reduced registration fees, tax credits, and subsidies that significantly lower the total cost of ownership compared to petrol cars. Emission regulations and carbon pricing further incentivize consumers to choose electric and hybrid vehicles by increasing the tax burden on petrol cars. These policies not only stimulate demand for environmentally friendly vehicles but also align with national goals to reduce carbon emissions and combat climate change.

Comparative Tax Rates: Green vs Petrol

Comparative tax rates reveal that green cars typically benefit from lower vehicle excise duties and reduced road tax compared to petrol cars, reflecting government incentives to promote eco-friendly transportation. Petrol car tax rates are often higher due to increased CO2 emissions, with charges escalating alongside engine size and fuel consumption. These contrasting tax structures significantly impact the total cost of ownership, favoring electric and hybrid vehicles through fiscal advantages designed to reduce environmental impact.

Long-Term Cost Benefits for Car Owners

Green car tax incentives significantly reduce the long-term ownership costs compared to petrol car tax liabilities, as lower registration fees and exemption from congestion charges yield substantial savings. Electric and hybrid vehicles benefit from government rebates and reduced annual road taxes, enhancing their financial appeal over time. Reduced fuel and maintenance costs further contribute to the overall economic advantage of green cars versus conventional petrol vehicles.

Impact on Car Buyers’ Decisions

Green car tax incentives significantly lower the overall cost of ownership, making electric and hybrid vehicles more attractive compared to petrol cars. Reduced or zero emissions tax rates and government rebates encourage buyers to prioritize environmentally friendly options. These financial benefits influence consumer preferences by making green vehicles more economically viable in both short and long-term ownership.

Future Trends in Car Taxation

Future trends in car taxation increasingly favor green vehicles, with governments implementing higher tax rates on petrol cars to encourage eco-friendly transportation. Incentives such as reduced registration fees, tax credits, and exemptions from congestion charges are expected to expand for electric and hybrid cars. Regulatory frameworks are projected to tighten emissions standards, driving a shift toward sustainable mobility and reshaping automotive tax policies worldwide.

Recommendations for Policy Improvements

Implementing higher tax incentives for green cars compared to petrol cars encourages environmentally sustainable transportation choices and reduces carbon emissions. Policies should focus on increasing subsidies for electric vehicles, expanding charging infrastructure, and introducing stricter emissions-based taxation on petrol cars. Enhancing public awareness campaigns about the long-term economic and environmental benefits of green cars can further accelerate the transition to cleaner transportation.

Green Car Tax vs Petrol Car Tax Infographic

cardiffo.com

cardiffo.com