Lease rental restriction limits the deductible lease payments a business can claim against taxable profits, often capping the amount based on the asset's value or usage. Contract hire tax treats the entire lease payment as an allowable expense, simplifying tax calculations but potentially resulting in higher taxable income if lease terms are unfavorable. Understanding the distinction helps companies optimize tax benefits by choosing the most advantageous lease arrangement under corporate tax rules.

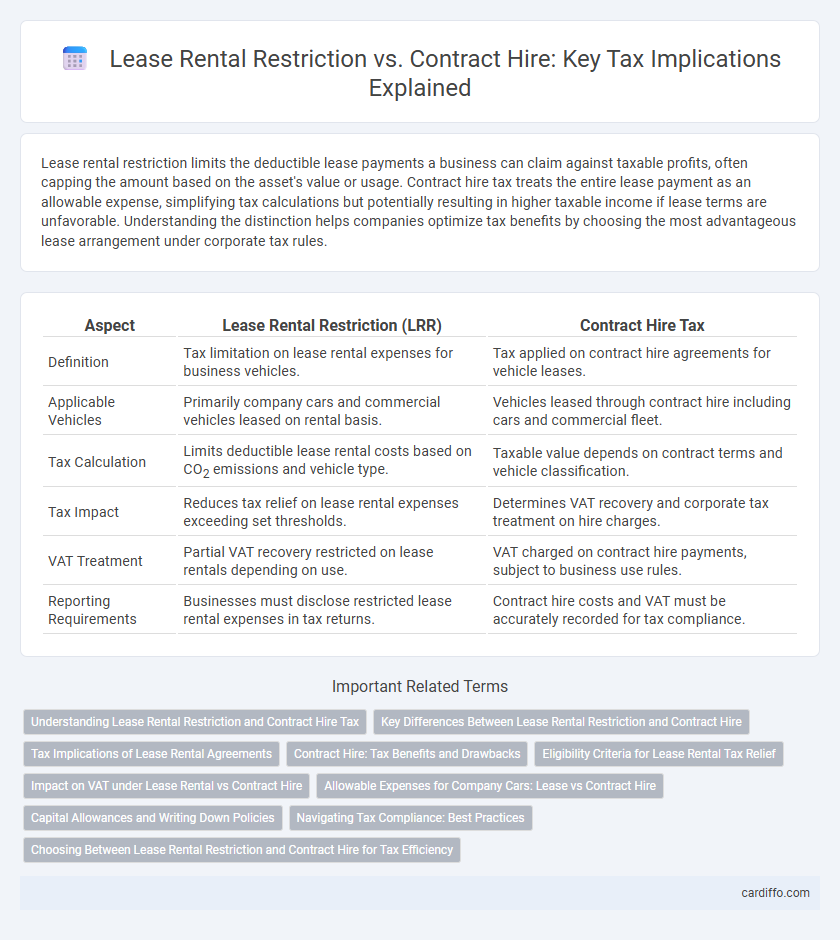

Table of Comparison

| Aspect | Lease Rental Restriction (LRR) | Contract Hire Tax |

|---|---|---|

| Definition | Tax limitation on lease rental expenses for business vehicles. | Tax applied on contract hire agreements for vehicle leases. |

| Applicable Vehicles | Primarily company cars and commercial vehicles leased on rental basis. | Vehicles leased through contract hire including cars and commercial fleet. |

| Tax Calculation | Limits deductible lease rental costs based on CO2 emissions and vehicle type. | Taxable value depends on contract terms and vehicle classification. |

| Tax Impact | Reduces tax relief on lease rental expenses exceeding set thresholds. | Determines VAT recovery and corporate tax treatment on hire charges. |

| VAT Treatment | Partial VAT recovery restricted on lease rentals depending on use. | VAT charged on contract hire payments, subject to business use rules. |

| Reporting Requirements | Businesses must disclose restricted lease rental expenses in tax returns. | Contract hire costs and VAT must be accurately recorded for tax compliance. |

Understanding Lease Rental Restriction and Contract Hire Tax

Lease rental restriction limits the tax deductions on lease payments for vehicles based on CO2 emissions, aimed at curbing environmental impacts and promoting lower-emission vehicles. Contract hire tax involves VAT treatment on contract hire agreements, where businesses can reclaim VAT on lease rentals subject to usage conditions. Understanding both concepts ensures compliance with HMRC rules while optimizing tax efficiency in fleet management.

Key Differences Between Lease Rental Restriction and Contract Hire

Lease rental restriction limits tax deductions by capping allowable expenses related to leasing vehicles, primarily affecting business expense claims, while contract hire tax involves VAT implications and stricter rules on reclaiming input tax. Lease rental restrictions often apply to high-emission vehicles, reducing deductible amounts based on CO2 emissions, whereas contract hire agreements typically include full service and maintenance, influencing the tax treatment of both the lease payments and associated costs. Understanding these key differences is crucial for businesses to optimize tax efficiency when choosing between lease rental and contract hire options.

Tax Implications of Lease Rental Agreements

Lease rental agreements often allow businesses to deduct lease payments as operating expenses, reducing taxable income and improving cash flow. Contract hire tax treatment distinguishes these payments as VAT-exempt or VAT-recoverable, depending on the contract structure, significantly impacting the net tax payable. Understanding the differences can optimize tax planning, leveraging allowable deductions and minimizing liability under corporate tax regulations.

Contract Hire: Tax Benefits and Drawbacks

Contract hire offers tax benefits such as predictable monthly payments that can be fully deductible as a business expense, reducing taxable income. It often includes maintenance and insurance, simplifying budgeting and potentially enhancing cash flow management. However, contract hire may have restrictions on mileage and penalties for damage, which could lead to additional costs and impact overall tax efficiency.

Eligibility Criteria for Lease Rental Tax Relief

Eligibility criteria for Lease Rental Tax Relief require that the lease agreement be registered and used exclusively for business purposes, with the lessee holding the primary right to use the leased asset. The leased asset must not be subleased or used for personal purposes to qualify for relief under the lease rental tax provisions. Contract hire tax rules differ as they typically apply to rental agreements where the lessee does not own the asset and tax treatment depends on specific vehicle or equipment usage conditions outlined by tax authorities.

Impact on VAT under Lease Rental vs Contract Hire

Lease rental payments are subject to VAT based on the invoiced amount, allowing businesses to reclaim input VAT if the vehicle is used for taxable activities. Contract hire agreements typically include VAT on the monthly payments, with VAT reclaim eligibility depending on the contract terms and business usage. The key impact on VAT lies in the recoverability of input tax and how VAT treatment aligns with the intended commercial use under both lease rental and contract hire arrangements.

Allowable Expenses for Company Cars: Lease vs Contract Hire

Lease rental payments for company cars qualify as allowable expenses, enabling businesses to deduct these costs from taxable profits, provided the vehicle meets company car tax regulations. Contract hire agreements also allow for the deduction of monthly rental payments as allowable expenses, although companies must consider potential VAT recovery differences compared to lease arrangements. Accurate documentation and compliance with HMRC rules ensure that both lease and contract hire expenses are optimized for tax efficiency in company car usage.

Capital Allowances and Writing Down Policies

Lease rental restriction limits the amount of lease payments that can be deducted for tax purposes, excluding capital allowances on leased assets. Contract hire agreements allow businesses to claim capital allowances on the asset, applying writing down allowances to reduce taxable profits over time. Understanding the differences in capital allowance eligibility and writing down policies is crucial for optimizing tax liabilities under each financing option.

Navigating Tax Compliance: Best Practices

Lease rental restriction limits the deductible lease rental expenses for businesses, impacting taxable profits and necessitating precise record-keeping to ensure compliance. Contract hire tax regulations require clear documentation of payments and contract terms to avoid misclassification and potential penalties. Maintaining detailed contracts, accurate payment records, and up-to-date knowledge of tax laws are essential best practices for navigating tax compliance effectively.

Choosing Between Lease Rental Restriction and Contract Hire for Tax Efficiency

Choosing between Lease Rental Restriction and Contract Hire for tax efficiency depends on the business's VAT recovery status and overall tax strategy. Lease Rental Restriction limits VAT reclaim on contracts involving cars with restricted business use, impacting cash flow, while Contract Hire enables fixed monthly payments fully reclaimable by VAT-registered businesses with eligible vehicles. Analyzing VAT recovery rates, contract terms, and expected vehicle usage ensures optimal tax benefits and compliance with HMRC guidelines.

Lease Rental Restriction vs Contract Hire Tax Infographic

cardiffo.com

cardiffo.com