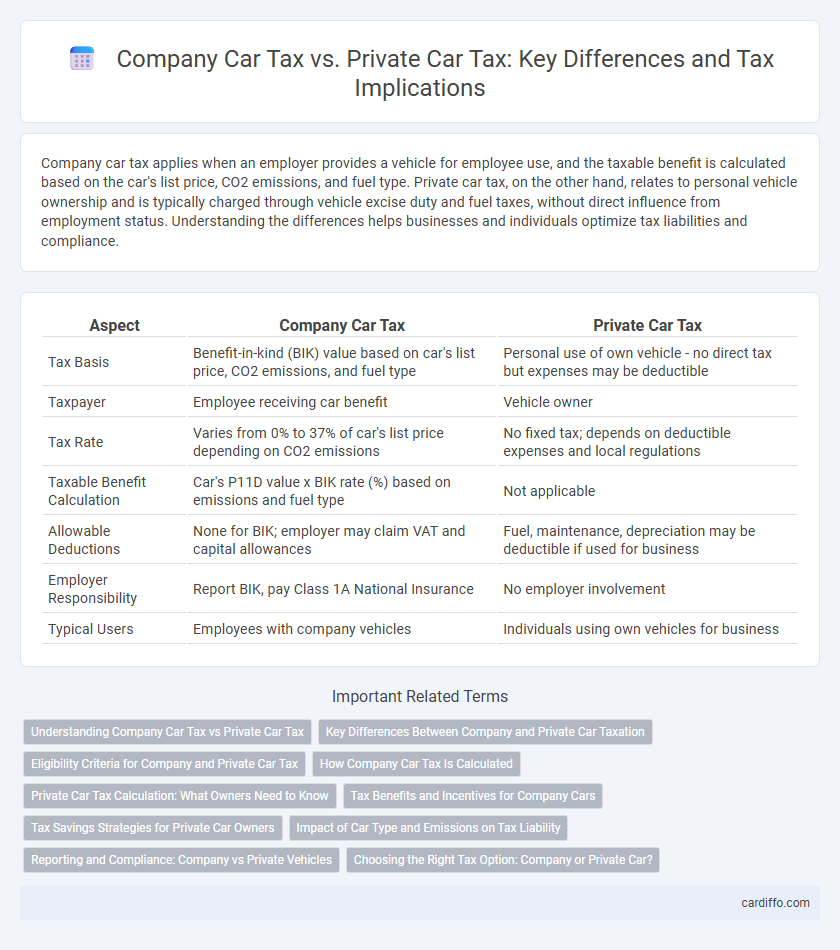

Company car tax applies when an employer provides a vehicle for employee use, and the taxable benefit is calculated based on the car's list price, CO2 emissions, and fuel type. Private car tax, on the other hand, relates to personal vehicle ownership and is typically charged through vehicle excise duty and fuel taxes, without direct influence from employment status. Understanding the differences helps businesses and individuals optimize tax liabilities and compliance.

Table of Comparison

| Aspect | Company Car Tax | Private Car Tax |

|---|---|---|

| Tax Basis | Benefit-in-kind (BIK) value based on car's list price, CO2 emissions, and fuel type | Personal use of own vehicle - no direct tax but expenses may be deductible |

| Taxpayer | Employee receiving car benefit | Vehicle owner |

| Tax Rate | Varies from 0% to 37% of car's list price depending on CO2 emissions | No fixed tax; depends on deductible expenses and local regulations |

| Taxable Benefit Calculation | Car's P11D value x BIK rate (%) based on emissions and fuel type | Not applicable |

| Allowable Deductions | None for BIK; employer may claim VAT and capital allowances | Fuel, maintenance, depreciation may be deductible if used for business |

| Employer Responsibility | Report BIK, pay Class 1A National Insurance | No employer involvement |

| Typical Users | Employees with company vehicles | Individuals using own vehicles for business |

Understanding Company Car Tax vs Private Car Tax

Company car tax is calculated based on the vehicle's list price, CO2 emissions, and fuel type, reflecting its benefit-in-kind value for employees using the car for personal purposes. Private car tax involves expenses like fuel, maintenance, and insurance, with no additional tax on the car itself, though income-related deductions may apply for business use. Understanding these differences is crucial for accurate tax planning and compliance under HMRC regulations.

Key Differences Between Company and Private Car Taxation

Company car tax is calculated based on the vehicle's list price and its CO2 emissions, reflecting the taxable benefit employees receive when using a company-provided car for personal use. Private car tax, in contrast, involves mileage allowances and deductions related to business use of a personally owned vehicle, typically allowing claimable expenses rather than direct taxation on the vehicle. The primary difference is that company car tax applies to benefits-in-kind, while private car tax focuses on reimbursing actual business mileage expenses.

Eligibility Criteria for Company and Private Car Tax

Company car tax eligibility depends on vehicle type, CO2 emissions, and the employee's taxable benefit value, with stricter rules for electric or low-emission vehicles to incentivize eco-friendly choices. Private car tax primarily concerns ownership status and personal use, with deductions or reliefs available based on usage purpose, mileage, and country-specific tax codes. Accurate assessment of eligibility criteria ensures compliance while optimizing tax liabilities for both company and private car owners.

How Company Car Tax Is Calculated

Company car tax is calculated based on the vehicle's list price, its CO2 emissions, and the employee's income tax bracket, with higher emissions resulting in greater taxable benefits. The taxable benefit is determined by applying a percentage rate, known as the Benefit-in-Kind (BIK) rate, to the car's P11D value, which includes the price of the car and options but excludes VAT and delivery charges. Unlike private car tax, which usually involves mileage deductions for business use, company car tax reflects the personal benefit value of the vehicle provided by an employer.

Private Car Tax Calculation: What Owners Need to Know

Private car tax calculation is primarily based on factors such as engine size, fuel type, CO2 emissions, and the vehicle's age, which directly influence the vehicle excise duty rates. Owners must accurately assess their car's taxable value using official government tables and ensure timely payment to avoid penalties. Understanding the specific tax bands and potential exemptions can result in significant savings for private car owners.

Tax Benefits and Incentives for Company Cars

Company car tax often provides significant tax benefits and incentives compared to private car tax, including reduced taxable benefits when opting for low-emission or electric vehicles. Employers may also offer scale rate benefits based on CO2 emissions, promoting environmentally friendly choices and reducing overall tax liabilities. These tax advantages encourage businesses to invest in company cars while supporting sustainability goals and operational cost savings.

Tax Savings Strategies for Private Car Owners

Private car owners can maximize tax savings by leveraging deductible expenses such as mileage, fuel, and maintenance costs related to business use, which are often not fully available to company car users. Claiming the correct proportion of business versus personal use on private vehicles enables owners to reduce taxable income through accurate expense reporting and adherence to local tax regulations. Utilizing mileage logs and tax-efficient reimbursement methods ensures optimal deduction claims, creating significant tax advantages over company car tax schemes.

Impact of Car Type and Emissions on Tax Liability

Company car tax liability is significantly influenced by the vehicle's CO2 emissions and fuel type, with electric and low-emission cars attracting lower Benefit-in-Kind (BIK) rates compared to traditional petrol or diesel cars. Private car tax is determined by vehicle emissions through the Vehicle Excise Duty (VED), where cars with higher emissions face increased annual charges while electric vehicles often qualify for exemptions or reduced rates. Selecting low-emission or electric vehicles reduces overall tax liability for both company and private car owners due to favorable tax band classifications and government incentives.

Reporting and Compliance: Company vs Private Vehicles

Company car tax requires detailed reporting of vehicle use, including business versus personal mileage, to ensure accurate compliance with HMRC regulations. Private car tax obligations are generally simpler, focusing on vehicle registration and road tax payments without the need for extensive usage records. Accurate record-keeping and proper documentation are essential for companies to avoid penalties and benefit from allowable deductions related to company vehicles.

Choosing the Right Tax Option: Company or Private Car?

Choosing the right tax option between a company car and a private car depends on factors such as vehicle usage, tax rates, and mileage patterns. Company car tax is typically based on the car's list price and CO2 emissions, making it more advantageous for low-emission vehicles and higher business mileage. Private car tax relies on mileage reimbursement rates, making it preferable for employees with low business mileage or when using cost-effective personal vehicles.

Company Car Tax vs Private Car Tax Infographic

cardiffo.com

cardiffo.com