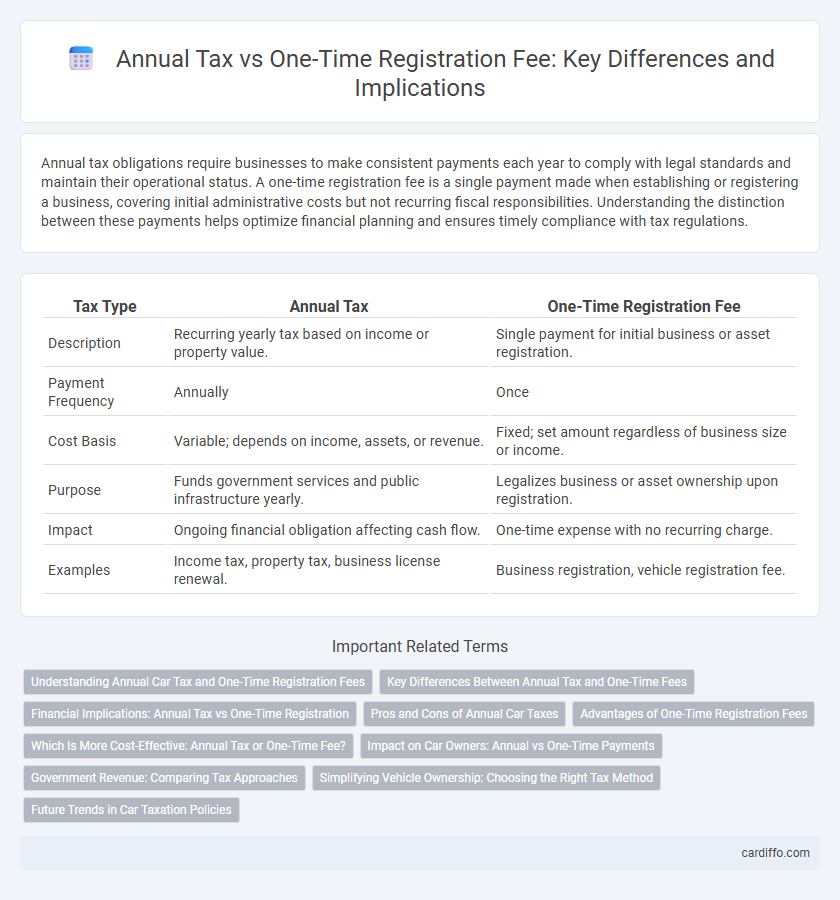

Annual tax obligations require businesses to make consistent payments each year to comply with legal standards and maintain their operational status. A one-time registration fee is a single payment made when establishing or registering a business, covering initial administrative costs but not recurring fiscal responsibilities. Understanding the distinction between these payments helps optimize financial planning and ensures timely compliance with tax regulations.

Table of Comparison

| Tax Type | Annual Tax | One-Time Registration Fee |

|---|---|---|

| Description | Recurring yearly tax based on income or property value. | Single payment for initial business or asset registration. |

| Payment Frequency | Annually | Once |

| Cost Basis | Variable; depends on income, assets, or revenue. | Fixed; set amount regardless of business size or income. |

| Purpose | Funds government services and public infrastructure yearly. | Legalizes business or asset ownership upon registration. |

| Impact | Ongoing financial obligation affecting cash flow. | One-time expense with no recurring charge. |

| Examples | Income tax, property tax, business license renewal. | Business registration, vehicle registration fee. |

Understanding Annual Car Tax and One-Time Registration Fees

Annual car tax is a recurring fee imposed by governments to fund road maintenance and environmental initiatives, typically based on vehicle type, emissions, and engine size. One-time registration fees are upfront charges required to legally register a vehicle, covering administrative costs and initial vehicle identification. Understanding the distinction helps vehicle owners budget for ongoing expenses versus initial purchase requirements.

Key Differences Between Annual Tax and One-Time Fees

Annual tax requires recurring payments based on income or property value, ensuring continuous compliance and government revenue. One-time registration fees are paid only once at the time of business setup or asset registration, covering initial processing costs without recurring charges. The main difference lies in frequency and purpose: annual taxes support ongoing public services while one-time fees fund initial administrative expenses.

Financial Implications: Annual Tax vs One-Time Registration

Annual taxes require recurring financial commitments affecting cash flow and long-term budgeting, whereas a one-time registration fee represents a single upfront cost with no ongoing tax obligations specific to registration. Businesses may favor one-time fees for initial setup but must plan for ongoing annual taxes that impact profitability and financial forecasting. Understanding the distinction aids in evaluating total financial liability and optimizing fiscal strategies in tax planning.

Pros and Cons of Annual Car Taxes

Annual car taxes offer consistent government revenue, supporting infrastructure and public services, but impose a recurring financial burden on vehicle owners. While they encourage responsible vehicle ownership and can be adjusted based on emissions or vehicle value, they require ongoing compliance and administrative processing. In contrast, a one-time registration fee eliminates repeated payments but may not generate sufficient funds for long-term government projects or maintenance.

Advantages of One-Time Registration Fees

One-time registration fees offer the advantage of simplicity by eliminating the need for annual payments, reducing administrative burden and ensuring long-term fiscal predictability for businesses. These fees provide cost savings over time, especially for small enterprises and startups that benefit from a fixed initial investment without recurring tax obligations. Furthermore, one-time fees facilitate easier budgeting and cash flow management, supporting financial stability and operational focus.

Which Is More Cost-Effective: Annual Tax or One-Time Fee?

Choosing between annual tax payments and a one-time registration fee depends on the duration and profitability of the business. Annual taxes can accumulate substantially over time, potentially exceeding a single registration fee, especially for high-revenue enterprises. Businesses with long-term operations often find a one-time registration fee more cost-effective, while short-term or fluctuating incomes may benefit from annual tax structures.

Impact on Car Owners: Annual vs One-Time Payments

Annual tax payments create a recurring financial obligation for car owners, influencing long-term budgeting and vehicle ownership costs. One-time registration fees offer upfront payment convenience but may result in higher initial expenses and limited flexibility in tax planning. Understanding the impact of these payment structures helps car owners make informed decisions about managing their automotive expenses effectively.

Government Revenue: Comparing Tax Approaches

Annual tax generates consistent government revenue streams by ensuring regular inflows throughout the fiscal year, supporting sustained public services and infrastructure projects. One-time registration fees provide a significant but singular influx of funds typically designated for initial administrative costs or specific government programs. Comparing these approaches, annual taxes offer greater predictability and financial stability for government budgets, while one-time fees yield immediate capital but lack ongoing revenue potential.

Simplifying Vehicle Ownership: Choosing the Right Tax Method

Annual tax payments for vehicle ownership provide predictable budgeting and ongoing government revenue, while a one-time registration fee offers simplicity by eliminating recurring charges. Selecting the right tax method depends on factors such as vehicle usage frequency, budget preferences, and regulatory environment. Evaluating these elements helps owners balance cost efficiency with compliance and ease of ownership.

Future Trends in Car Taxation Policies

Annual tax for vehicles ensures a continuous revenue stream for governments, reflecting current vehicle usage and environmental impact, while one-time registration fees offer a simpler upfront cost but may fail to adapt to changes in vehicle ownership or emissions over time. Emerging trends in car taxation policies prioritize dynamic pricing models that incorporate real-time data on emissions, mileage, and vehicle type to promote eco-friendly transportation. Future regulations are likely to merge annual and one-time fees into flexible frameworks incentivizing low-emission vehicles and penalizing high-polluters to align with global sustainability goals.

Annual tax vs one-time registration fee Infographic

cardiffo.com

cardiffo.com