One-time tax payment offers the advantage of settling your tax liability in a single transaction, reducing the risk of missed deadlines and penalties. Annual tax payments, however, allow for better cash flow management by spreading out the financial burden over the year. Choosing between these options depends on your financial situation and preference for payment flexibility.

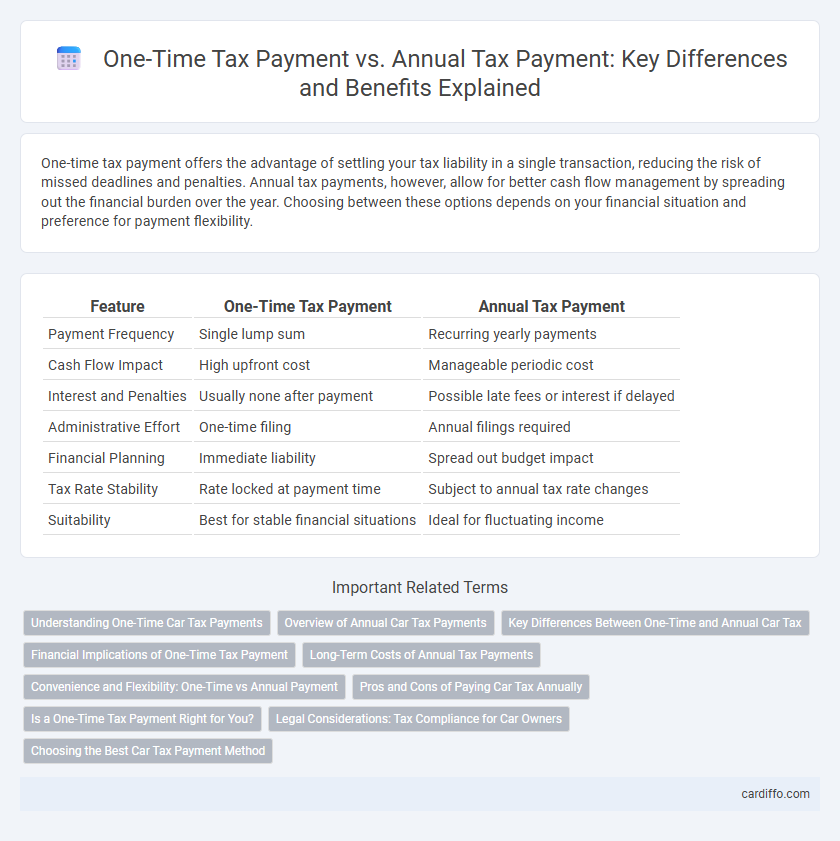

Table of Comparison

| Feature | One-Time Tax Payment | Annual Tax Payment |

|---|---|---|

| Payment Frequency | Single lump sum | Recurring yearly payments |

| Cash Flow Impact | High upfront cost | Manageable periodic cost |

| Interest and Penalties | Usually none after payment | Possible late fees or interest if delayed |

| Administrative Effort | One-time filing | Annual filings required |

| Financial Planning | Immediate liability | Spread out budget impact |

| Tax Rate Stability | Rate locked at payment time | Subject to annual tax rate changes |

| Suitability | Best for stable financial situations | Ideal for fluctuating income |

Understanding One-Time Car Tax Payments

One-time car tax payments offer a simplified alternative to annual tax obligations by requiring a single lump sum that covers the entire tax period, reducing administrative burden and potential late fees. This payment method often applies to specific circumstances such as new vehicle registration or final settlement upon sale, ensuring clear financial planning for the taxpayer. Understanding one-time car tax payments improves compliance and helps avoid penalties associated with missed or delayed annual tax dues.

Overview of Annual Car Tax Payments

Annual car tax payments require vehicle owners to remit taxes each year based on factors such as vehicle type, engine size, and emissions. This recurring tax system ensures consistent government revenue and supports road maintenance and infrastructure projects. Failure to pay annual car taxes can result in fines, penalties, or legal consequences, emphasizing the importance of timely compliance.

Key Differences Between One-Time and Annual Car Tax

One-time car tax payment requires a single lump sum paid upfront for vehicle registration, often covering a multi-year period, whereas annual car tax mandates yearly payments based on current tax rates and vehicle status. One-time payments offer convenience and long-term cost certainty but may involve higher initial costs compared to spreading the expense annually. Annual payments enable adjustments for tax changes, vehicle depreciation, or ownership transfers, ensuring compliance with updated regulations and potential eligibility for rebates or discounts.

Financial Implications of One-Time Tax Payment

One-time tax payments require paying the entire tax liability upfront, which can impact cash flow and liquidity, especially for individuals or businesses with limited immediate funds. Unlike annual tax payments spread over time, a lump-sum payment may result in opportunity costs, reducing available capital for investments or operational expenses. Careful financial planning is essential to avoid penalties or interest charges associated with delayed or insufficient payments in the one-time tax scenario.

Long-Term Costs of Annual Tax Payments

Annual tax payments often accumulate higher long-term costs due to recurring interest and penalties on unpaid amounts, increasing the total financial burden over time. Compounded interest on deferred tax liabilities can significantly raise the eventual payout compared to a one-time tax payment. Consistent annual payments may also incur additional administrative and compliance expenses, further inflating the long-term tax-related costs.

Convenience and Flexibility: One-Time vs Annual Payment

One-time tax payments offer convenience by allowing taxpayers to settle their obligations in a single transaction, reducing administrative hassle and simplifying financial planning. In contrast, annual tax payments provide greater flexibility, enabling individuals and businesses to manage cash flow more effectively by spreading costs throughout the year. Choosing between these options depends on prioritizing immediate settlement ease or long-term budget adaptability within tax compliance strategies.

Pros and Cons of Paying Car Tax Annually

Paying car tax annually offers the advantage of avoiding frequent renewals and potential penalties for missed payments, allowing for streamlined financial planning and better cash flow management in the long term. However, it requires a larger upfront payment compared to one-time or monthly options, which may strain budgets for some taxpayers. Annual tax payments also provide eligibility for discounts or reduced rates in certain jurisdictions, making it a cost-effective choice for consistent taxpayers.

Is a One-Time Tax Payment Right for You?

A one-time tax payment offers the advantage of settling your tax obligations upfront, potentially simplifying your financial planning and avoiding the risk of missed payments and penalties. It is particularly beneficial for individuals with stable cash flow or those who prefer to manage their finances in a lump sum rather than multiple installments. Evaluating your income stability, cash reserves, and long-term financial goals can help determine if a one-time tax payment aligns with your personal tax strategy.

Legal Considerations: Tax Compliance for Car Owners

Car owners must adhere to strict legal considerations regarding tax compliance, ensuring either timely one-time tax payments or consistent annual tax payments based on jurisdictional requirements. Failure to comply with mandated tax schedules can result in penalties, fines, and potential legal action from tax authorities. Understanding the legal framework governing car taxes helps owners maintain compliance and avoid costly disputes.

Choosing the Best Car Tax Payment Method

Choosing the best car tax payment method depends on factors such as cash flow flexibility, potential discounts, and administrative convenience. One-time tax payments often offer cost savings through early payment discounts and reduce administrative tasks by consolidating payments, while annual tax payments provide manageable monthly or quarterly installments that ease budgeting and cash flow management. Evaluating your financial situation and the specific terms of your local tax authority will help determine whether a lump sum or periodic payments maximize savings and convenience.

One-Time Tax Payment vs Annual Tax Payment Infographic

cardiffo.com

cardiffo.com