The Flat Rate Scheme simplifies VAT accounting by allowing businesses to pay a fixed percentage of their turnover as VAT, reducing administrative burden but limiting claimable input VAT. In contrast, the Standard Rate Scheme requires businesses to account for VAT on sales and reclaim VAT on purchases, providing greater accuracy and potential savings for businesses with higher VAT on expenses. Choosing between schemes depends on the business's turnover, expense structure, and administrative capacity.

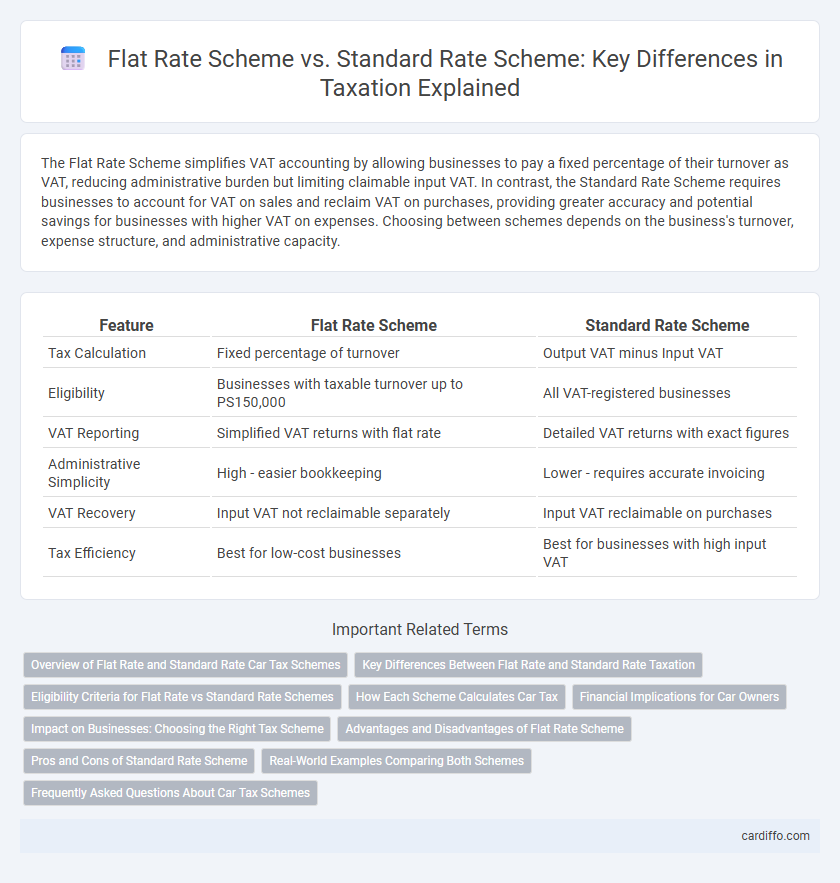

Table of Comparison

| Feature | Flat Rate Scheme | Standard Rate Scheme |

|---|---|---|

| Tax Calculation | Fixed percentage of turnover | Output VAT minus Input VAT |

| Eligibility | Businesses with taxable turnover up to PS150,000 | All VAT-registered businesses |

| VAT Reporting | Simplified VAT returns with flat rate | Detailed VAT returns with exact figures |

| Administrative Simplicity | High - easier bookkeeping | Lower - requires accurate invoicing |

| VAT Recovery | Input VAT not reclaimable separately | Input VAT reclaimable on purchases |

| Tax Efficiency | Best for low-cost businesses | Best for businesses with high input VAT |

Overview of Flat Rate and Standard Rate Car Tax Schemes

The Flat Rate Scheme simplifies VAT reporting by applying a fixed percentage to total sales, reducing administrative burden for small businesses below the VAT threshold. The Standard Rate Scheme requires detailed tracking of VAT on all sales and purchases, allowing precise reclaiming of input VAT but demanding comprehensive record-keeping. Choosing between these schemes depends on business size, transaction complexity, and cash flow considerations, with the Flat Rate Scheme often favored for its ease of use.

Key Differences Between Flat Rate and Standard Rate Taxation

The Flat Rate Scheme simplifies VAT reporting by applying a fixed percentage to total turnover, reducing administrative effort and record-keeping requirements, whereas the Standard Rate Scheme requires detailed tracking of input and output VAT on each transaction. Flat Rate percentages vary by industry sector, often resulting in lower VAT payments for small businesses but limiting the ability to reclaim input VAT fully. In contrast, the Standard Rate Scheme offers precise VAT recovery on business expenses but involves more complex calculations and regular VAT returns.

Eligibility Criteria for Flat Rate vs Standard Rate Schemes

The Flat Rate Scheme targets small businesses with an annual taxable turnover of up to PS150,000, excluding VAT, allowing simplified VAT accounting by applying a fixed percentage rate to gross turnover. In contrast, the Standard Rate Scheme has no turnover eligibility limit, requiring detailed VAT record-keeping and reporting based on actual sales and purchases VAT rates. Eligibility for the Flat Rate Scheme depends on business type and turnover limits, offering reduced administrative burden compared to the comprehensive accounting required under the Standard Rate Scheme.

How Each Scheme Calculates Car Tax

The Flat Rate Scheme calculates car tax by applying a fixed percentage rate to the total turnover, simplifying VAT accounting without itemizing input VAT on vehicle expenses. In contrast, the Standard Rate Scheme requires businesses to separately account for VAT on car purchases and running costs, allowing input VAT recovery but involving detailed record-keeping. Choosing between schemes impacts the accuracy of VAT reclaim on vehicles, with the Flat Rate Scheme offering simplicity and the Standard Rate Scheme providing precise VAT deductions.

Financial Implications for Car Owners

The Flat Rate Scheme simplifies VAT accounting by allowing car owners to pay a fixed percentage of turnover as VAT, reducing administrative burdens but potentially increasing costs if car expenses are high. Under the Standard Rate Scheme, car owners reclaim VAT on eligible car-related expenses, maximizing potential refunds but requiring meticulous record-keeping and complex calculations. Evaluating car usage patterns and VAT reclaim opportunities is crucial to determine which scheme offers better financial advantages.

Impact on Businesses: Choosing the Right Tax Scheme

Selecting the appropriate tax scheme significantly impacts business cash flow and administrative efficiency, with the Flat Rate Scheme simplifying VAT calculations by applying a fixed percentage to turnover instead of tracking VAT on each sale and purchase. Businesses with low VAT-deductible expenses benefit more from the Flat Rate Scheme, while those with high input VAT costs usually save under the Standard Rate Scheme by reclaiming actual VAT paid. Understanding turnover thresholds, industry-specific flat rates, and VAT recovery eligibility helps businesses optimize tax liability and compliance.

Advantages and Disadvantages of Flat Rate Scheme

The Flat Rate Scheme simplifies VAT accounting by allowing businesses to pay a fixed percentage of their turnover as VAT, reducing administrative burdens and improving cash flow management. However, this scheme may result in higher VAT payments for businesses with lower input tax, limiting recovery of VAT on purchases and potentially increasing costs. Its straightforward approach suits small businesses with limited expenses but can be disadvantageous for companies with significant taxable input costs compared to the Standard Rate Scheme.

Pros and Cons of Standard Rate Scheme

The Standard Rate Scheme requires businesses to charge VAT on sales and reclaim VAT on purchases, allowing for precise input tax recovery but increasing administrative complexity and record-keeping demands. This scheme suits companies with significant VATable expenditures, maximizing cash flow benefits by accurately offsetting VAT paid on inputs. However, the necessity to maintain detailed VAT records can lead to higher compliance costs and potential cash flow delays due to periodic VAT payments.

Real-World Examples Comparing Both Schemes

Small businesses using the Flat Rate Scheme often benefit from simplified VAT accounting and predictable payments, as demonstrated by a local bakery saving administrative time and reducing errors compared to the Standard Rate Scheme. In contrast, a consulting firm operating under the Standard Rate Scheme can reclaim input VAT on expenses, resulting in higher net savings when purchasing expensive equipment. Real-world comparisons show that businesses with low overheads tend to favor the Flat Rate Scheme, while those with significant VAT-reclaimable costs usually benefit more from the Standard Rate Scheme.

Frequently Asked Questions About Car Tax Schemes

Flat Rate Scheme simplifies VAT reporting by allowing businesses to pay a fixed percentage of their turnover as VAT, reducing administrative burden compared to the Standard Rate Scheme which requires detailed tracking of VAT on each sale and purchase. Under the Flat Rate Scheme, car-related expenses are generally included in the flat rate calculation rather than reclaimed separately, whereas the Standard Scheme permits reclaiming VAT on eligible vehicle expenses based on business use. Common questions revolve around eligibility, impact on cash flow, and how each scheme affects VAT reclaim on fuel and vehicle maintenance costs.

Flat Rate Scheme vs Standard Rate Scheme Infographic

cardiffo.com

cardiffo.com