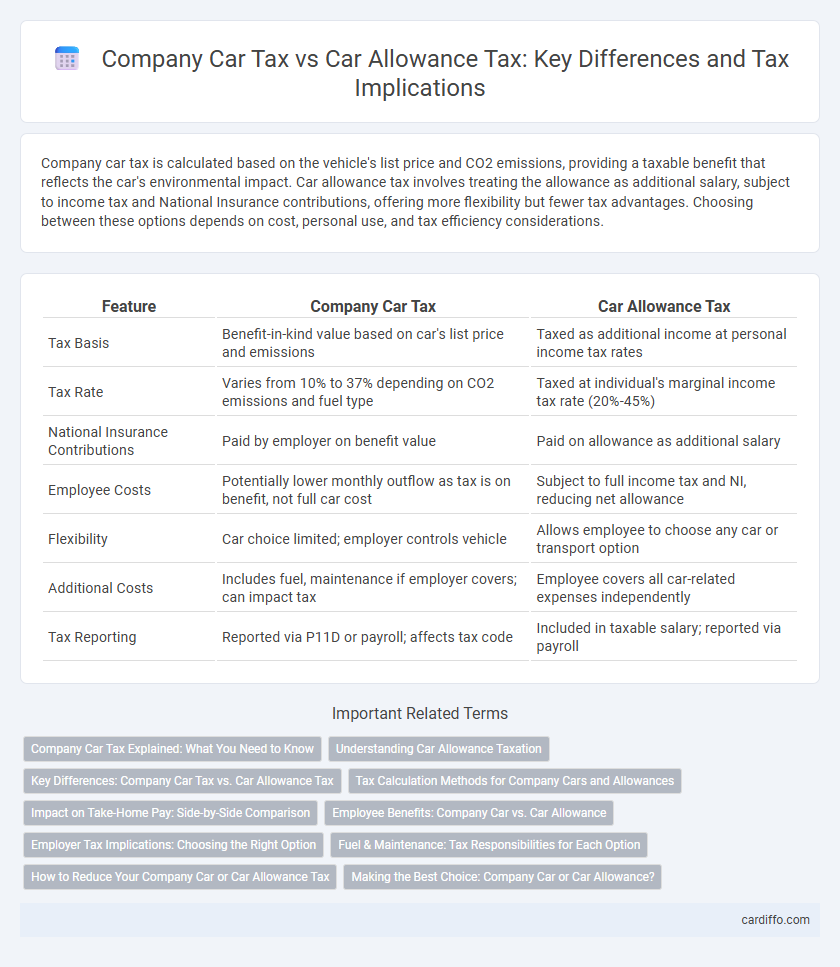

Company car tax is calculated based on the vehicle's list price and CO2 emissions, providing a taxable benefit that reflects the car's environmental impact. Car allowance tax involves treating the allowance as additional salary, subject to income tax and National Insurance contributions, offering more flexibility but fewer tax advantages. Choosing between these options depends on cost, personal use, and tax efficiency considerations.

Table of Comparison

| Feature | Company Car Tax | Car Allowance Tax |

|---|---|---|

| Tax Basis | Benefit-in-kind value based on car's list price and emissions | Taxed as additional income at personal income tax rates |

| Tax Rate | Varies from 10% to 37% depending on CO2 emissions and fuel type | Taxed at individual's marginal income tax rate (20%-45%) |

| National Insurance Contributions | Paid by employer on benefit value | Paid on allowance as additional salary |

| Employee Costs | Potentially lower monthly outflow as tax is on benefit, not full car cost | Subject to full income tax and NI, reducing net allowance |

| Flexibility | Car choice limited; employer controls vehicle | Allows employee to choose any car or transport option |

| Additional Costs | Includes fuel, maintenance if employer covers; can impact tax | Employee covers all car-related expenses independently |

| Tax Reporting | Reported via P11D or payroll; affects tax code | Included in taxable salary; reported via payroll |

Company Car Tax Explained: What You Need to Know

Company car tax is a taxable benefit applied when an employer provides a vehicle for personal use, calculated based on the car's list price and its CO2 emissions. This tax impacts the employee's taxable income and varies depending on fuel type, vehicle price, and emission levels, making it essential to evaluate the environmental and financial factors. Understanding company car tax helps businesses and employees optimize their tax liabilities and make informed decisions about vehicle benefits.

Understanding Car Allowance Taxation

Car allowance taxation is typically treated as additional income and subject to income tax and National Insurance contributions, unlike company car tax which is based on the car's CO2 emissions and list price. Employees receiving a car allowance must budget for the resulting higher tax liability while retaining full control over vehicle choice and associated costs. Understanding the tax implications helps optimize compensation packages and ensures compliance with HMRC regulations.

Key Differences: Company Car Tax vs. Car Allowance Tax

Company Car Tax is based on the vehicle's list price, CO2 emissions, and fuel type, resulting in a taxable benefit that affects the employee's income tax liability. Car Allowance Tax is applied to cash allowances given to employees for using their own cars, taxed as regular income subject to income tax and National Insurance contributions. Key differences include the method of valuation--benefit in kind for company cars versus direct cash income for allowances--and the impact on overall tax efficiency for both employers and employees.

Tax Calculation Methods for Company Cars and Allowances

Company car tax is calculated based on the vehicle's list price, CO2 emissions, and fuel type, applying a percentage that increases with higher emissions, while car allowance tax treats allowances as additional salary subject to income tax and National Insurance contributions. Company car tax uses the Benefit-in-Kind (BIK) rate set annually by HMRC to determine taxable amounts, whereas car allowances are gross payments fully taxable at the employee's marginal tax rate. Employees receiving a car allowance must budget for higher personal tax liability, as the allowance increases their taxable income without the offset of reduced personal vehicle expenses.

Impact on Take-Home Pay: Side-by-Side Comparison

Company car tax reduces take-home pay by taxing the benefit's cash equivalent, based on CO2 emissions and vehicle value, whereas car allowance tax treats the payment as salary subject to income tax and National Insurance contributions. With company car tax, employees avoid upfront car costs but face a taxable benefit that can increase their tax liability, while car allowances increase gross income, potentially pushing earners into higher tax brackets. Choosing between the two requires evaluating individual tax rates, vehicle choices, and how each option influences net salary and total compensation packages.

Employee Benefits: Company Car vs. Car Allowance

Employee benefits involving company cars and car allowances differ significantly in tax treatment and financial impact. Company cars are considered a taxable benefit with a benefit-in-kind (BIK) value based on factors such as vehicle list price and CO2 emissions, increasing the employee's taxable income. Car allowances are paid as additional salary subject to income tax and national insurance contributions but offer greater flexibility for employees to choose their own vehicle or transportation methods.

Employer Tax Implications: Choosing the Right Option

Employers must evaluate National Insurance Contributions (NICs) and administrative responsibilities when deciding between company car tax and car allowance tax. Opting for a company car typically incurs Class 1A NICs on the vehicle's taxable benefit value, while car allowances increase employees' taxable income, affecting PAYE deductions and NICs liabilities. Strategic selection influences overall employer tax costs, compliance complexity, and workforce satisfaction with tax-efficient benefits.

Fuel & Maintenance: Tax Responsibilities for Each Option

Company car tax includes the benefit-in-kind (BIK) tax on fuel if the employer provides fuel for private use, while car allowance recipients are responsible for all fuel expenses without tax relief. Maintenance costs for company cars are covered by the employer and do not affect the employee's taxable income, whereas employees with car allowances must pay maintenance expenses from their net allowance, with no additional tax deductions. Understanding these distinctions ensures accurate tax reporting and maximizes financial efficiency for employees choosing between company car tax and car allowance tax schemes.

How to Reduce Your Company Car or Car Allowance Tax

Maximizing tax efficiency on company car or car allowance requires selecting low-emission vehicles to lower taxable benefit rates and opting for electric or hybrid models eligible for government incentives. Keeping detailed mileage records enables claiming actual business expenses rather than flat allowances, significantly reducing taxable income. Reviewing and adjusting your car usage policies annually ensures alignment with current tax laws, optimizing deductions and minimizing overall tax liability.

Making the Best Choice: Company Car or Car Allowance?

Choosing between a company car and a car allowance depends on your tax situation and personal preferences. Company car tax rates are influenced by the vehicle's CO2 emissions and list price, often providing lower taxable benefits for low-emission vehicles, whereas car allowances are treated as taxable income, increasing your overall income tax liability. Evaluating factors such as your annual mileage, car usage, and potential tax savings helps determine whether a company car or car allowance offers the most financial advantage.

Company Car Tax vs Car Allowance Tax Infographic

cardiffo.com

cardiffo.com