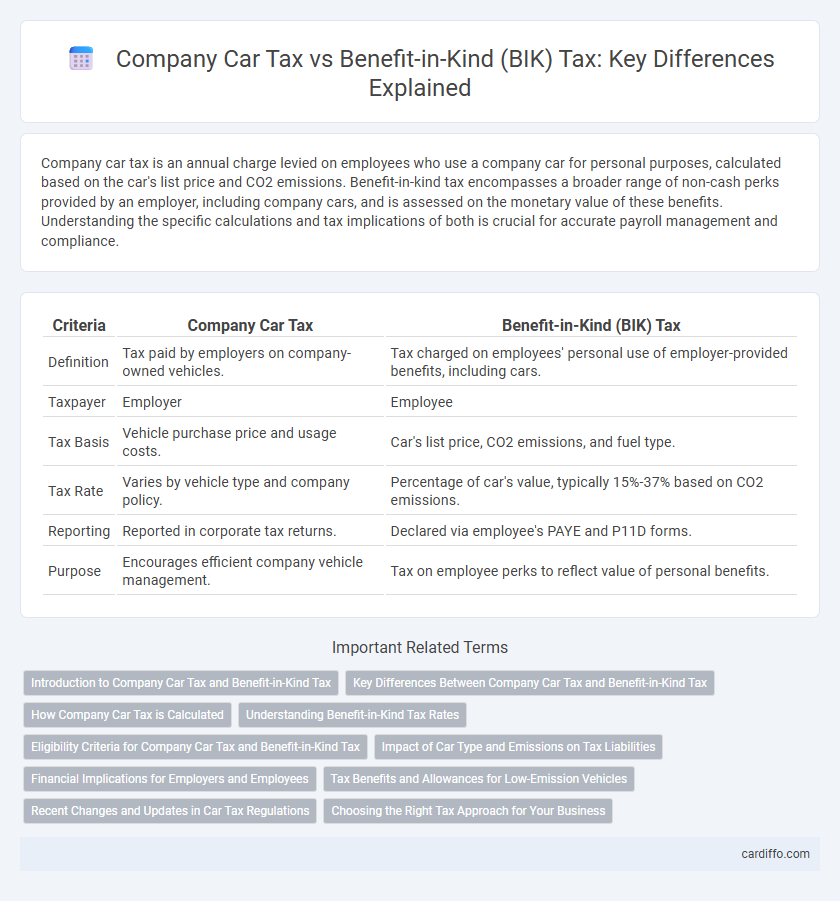

Company car tax is an annual charge levied on employees who use a company car for personal purposes, calculated based on the car's list price and CO2 emissions. Benefit-in-kind tax encompasses a broader range of non-cash perks provided by an employer, including company cars, and is assessed on the monetary value of these benefits. Understanding the specific calculations and tax implications of both is crucial for accurate payroll management and compliance.

Table of Comparison

| Criteria | Company Car Tax | Benefit-in-Kind (BIK) Tax |

|---|---|---|

| Definition | Tax paid by employers on company-owned vehicles. | Tax charged on employees' personal use of employer-provided benefits, including cars. |

| Taxpayer | Employer | Employee |

| Tax Basis | Vehicle purchase price and usage costs. | Car's list price, CO2 emissions, and fuel type. |

| Tax Rate | Varies by vehicle type and company policy. | Percentage of car's value, typically 15%-37% based on CO2 emissions. |

| Reporting | Reported in corporate tax returns. | Declared via employee's PAYE and P11D forms. |

| Purpose | Encourages efficient company vehicle management. | Tax on employee perks to reflect value of personal benefits. |

Introduction to Company Car Tax and Benefit-in-Kind Tax

Company car tax refers to the tax imposed on employees who receive a company vehicle for personal use, calculated based on the car's list price, CO2 emissions, and fuel type. Benefit-in-kind (BIK) tax encompasses the broader category of non-cash benefits provided by employers, with company car tax being a prominent example within this system. Understanding the valuation methods and reporting requirements for BIK is essential for accurate tax compliance and financial planning.

Key Differences Between Company Car Tax and Benefit-in-Kind Tax

Company car tax specifically applies to vehicles provided by an employer for private use, calculated based on the car's value, CO2 emissions, and fuel type. Benefit-in-kind tax is a broader category encompassing various non-cash employee benefits, including company cars, valued according to HMRC rules and added to taxable income. Key differences lie in company car tax's focus on vehicle-related valuations, while benefit-in-kind tax covers multiple types of perks with distinct valuation and reporting requirements.

How Company Car Tax is Calculated

Company car tax is calculated based on the vehicle's list price, CO2 emissions, and the employee's income tax bracket, determining the taxable benefit value. The benefit-in-kind (BIK) tax percentage increases with higher CO2 emissions, incentivizing low-emission vehicle use. Employers report this benefit on the employee's P11D form, and the tax is paid through the PAYE system.

Understanding Benefit-in-Kind Tax Rates

Benefit-in-Kind (BIK) tax rates on company cars are determined by the vehicle's CO2 emissions and its list price, significantly influencing the taxable benefit value for employees. Lower-emission vehicles attract reduced BIK rates, making them more tax-efficient, while zero-emission electric cars often benefit from minimal or zero BIK charges. Understanding these rates helps both employers and employees optimize tax liabilities related to company car usage.

Eligibility Criteria for Company Car Tax and Benefit-in-Kind Tax

Eligibility criteria for company car tax primarily focus on the vehicle being provided by the employer for personal use, with taxable value based on the car's list price and CO2 emissions. Benefit-in-kind (BIK) tax applies when an employee receives non-cash benefits like company cars, calculated according to HMRC guidelines that assess the car's taxable value and employee's income tax bracket. Both taxes require proper reporting to HMRC, ensuring that only company vehicles genuinely available for private use by employees are subject to company car tax and BIK tax rules.

Impact of Car Type and Emissions on Tax Liabilities

Company car tax and benefit-in-kind tax liabilities significantly depend on the type of vehicle and its carbon emissions, with electric and low-emission cars attracting lower tax rates compared to petrol or diesel models. Vehicle Excise Duty (VED) bands and CO2 emission levels directly influence the taxable benefit value, thus reducing the overall tax burden for greener cars. Tax authorities incentivize the use of eco-friendly vehicles through lower percentage rates applied to the car's list price, effectively lowering benefit-in-kind tax liabilities for employees and employers alike.

Financial Implications for Employers and Employees

Company car tax is a significant financial consideration for both employers and employees, as employers must account for the cost of providing vehicles and report taxable benefits accurately, which can impact payroll tax calculations and National Insurance contributions. Benefit-in-kind (BIK) tax directly affects employees by increasing their taxable income based on the car's CO2 emissions and list price, potentially leading to higher personal income tax liabilities. Employers face higher administration costs and compliance risks while employees must carefully evaluate the tax impact of choosing a company car versus using personal vehicles to optimize overall financial benefits.

Tax Benefits and Allowances for Low-Emission Vehicles

Low-emission vehicles significantly reduce company car tax liability through enhanced tax benefits and allowances, including lower benefit-in-kind (BIK) rates. Eligible electric and hybrid cars attract reduced taxable values, resulting in substantial savings on taxable income for employees and employers. Government incentives such as lower National Insurance contributions and capital allowances further increase the financial advantages for businesses adopting eco-friendly vehicles.

Recent Changes and Updates in Car Tax Regulations

Recent changes in UK car tax regulations emphasize stricter benefit-in-kind (BIK) valuations based on updated CO2 emissions and electric vehicle incentives. Company car tax rates now increasingly favor low-emission and electric vehicles, with revised thresholds impacting taxable benefits significantly. These updates aim to align tax liabilities more closely with environmental policies, enhancing fiscal responsibility for employers and employees alike.

Choosing the Right Tax Approach for Your Business

Choosing the right tax approach for your business involves understanding the distinctions between company car tax and benefit-in-kind (BIK) tax. Company car tax applies specifically to vehicles provided by an employer for personal use, calculated based on the car's value, CO2 emissions, and fuel type, while BIK tax encompasses a broader range of non-cash benefits including company cars, valuing the benefit on market rates. By evaluating the financial impact of each tax method, businesses can optimize tax liabilities, enhance employee benefits, and ensure compliance with HMRC regulations.

company car tax vs benefit-in-kind tax Infographic

cardiffo.com

cardiffo.com