Benefit-in-Kind (BIK) Tax applies to any non-cash perks provided by an employer, including company cars, whereas Company Car Tax specifically targets the taxable value of company-provided vehicles. BIK Tax calculations for company cars consider factors such as CO2 emissions, fuel type, and list price to determine the taxable benefit. Understanding the distinction between these taxes helps employees and employers manage taxable income and optimize vehicle-related expenses effectively.

Table of Comparison

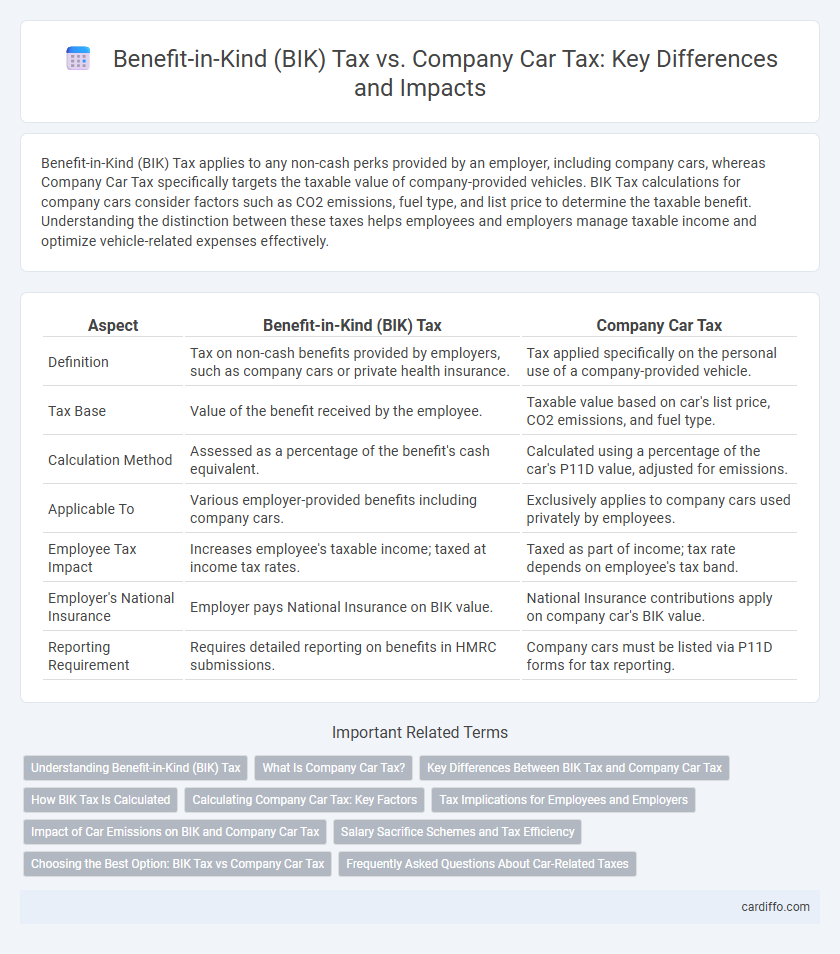

| Aspect | Benefit-in-Kind (BIK) Tax | Company Car Tax |

|---|---|---|

| Definition | Tax on non-cash benefits provided by employers, such as company cars or private health insurance. | Tax applied specifically on the personal use of a company-provided vehicle. |

| Tax Base | Value of the benefit received by the employee. | Taxable value based on car's list price, CO2 emissions, and fuel type. |

| Calculation Method | Assessed as a percentage of the benefit's cash equivalent. | Calculated using a percentage of the car's P11D value, adjusted for emissions. |

| Applicable To | Various employer-provided benefits including company cars. | Exclusively applies to company cars used privately by employees. |

| Employee Tax Impact | Increases employee's taxable income; taxed at income tax rates. | Taxed as part of income; tax rate depends on employee's tax band. |

| Employer's National Insurance | Employer pays National Insurance on BIK value. | National Insurance contributions apply on company car's BIK value. |

| Reporting Requirement | Requires detailed reporting on benefits in HMRC submissions. | Company cars must be listed via P11D forms for tax reporting. |

Understanding Benefit-in-Kind (BIK) Tax

Benefit-in-Kind (BIK) tax is a taxable non-cash benefit provided to employees, often including company cars, private medical insurance, or accommodation. The BIK tax value is calculated based on the market value of the benefit minus any employee contributions, with company cars being one of the most common BIK items, where emissions and fuel type significantly affect the taxable amount. Understanding BIK tax helps employees and employers accurately determine tax liabilities, optimize remuneration packages, and comply with HMRC regulations.

What Is Company Car Tax?

Company Car Tax is a form of Benefit-in-Kind (BIK) tax applied to employees who receive a company-provided vehicle for personal use. The tax is calculated based on the car's list price and its CO2 emissions, reflecting the vehicle's taxable value. This system incentivizes eco-friendly choices by reducing tax liability for low-emission or electric company cars.

Key Differences Between BIK Tax and Company Car Tax

Benefit-in-Kind (BIK) Tax applies to the taxable value of non-cash benefits provided by an employer, including company cars, whereas Company Car Tax specifically targets the taxable benefit derived from the personal use of a company vehicle. BIK Tax covers a broader range of perks beyond vehicles, such as private medical insurance or interest-free loans, while Company Car Tax is exclusively related to vehicles and calculated based on factors like the car's CO2 emissions and list price. Understanding these distinctions helps businesses and employees accurately assess their tax liabilities on employer-provided benefits.

How BIK Tax Is Calculated

Benefit-in-Kind (BIK) tax is calculated based on the taxable value of non-cash benefits provided to employees, such as company cars, which is determined by the car's list price and its CO2 emissions. The BIK rate applied varies according to the vehicle's fuel type and emissions, directly impacting the taxable amount an employee must declare. Accurate BIK tax calculations ensure compliance with HMRC regulations and reflect the true cost of using a company car as a personal perk.

Calculating Company Car Tax: Key Factors

Calculating Company Car Tax depends primarily on the vehicle's list price, its CO2 emissions, and the employee's income tax bracket. The P11D value, representing the car's retail price including optional extras, forms the basis for BIK tax calculations, influencing the amount payable. Fuel type and electric range also impact the BIK percentage, with ultra-low emission vehicles typically attracting lower tax rates.

Tax Implications for Employees and Employers

Benefit-in-Kind (BIK) tax applies to non-cash employee benefits such as company cars, where the taxable value depends on factors like CO2 emissions and list price, impacting employees' personal tax liabilities. Company Car Tax specifically refers to the BIK tax on company-provided vehicles, influencing employers through additional National Insurance contributions based on the car's BIK value. Employers must accurately assess BIK rates to comply with tax regulations, while employees face varying income tax rates depending on the car's environmental efficiency and market value.

Impact of Car Emissions on BIK and Company Car Tax

Car emissions significantly influence Benefit-in-Kind (BIK) tax rates and Company Car Tax calculations, with lower-emission vehicles attracting reduced tax liabilities due to government incentives promoting environmental sustainability. Electric cars and hybrids typically benefit from the lowest BIK rates, sometimes as low as 2% to 5%, compared to high-emission vehicles which can incur BIK rates exceeding 30%. The UK tax system uses CO2 emission bands to determine the precise tax rate, encouraging businesses and employees to opt for greener company cars and thus reduce overall tax expenses.

Salary Sacrifice Schemes and Tax Efficiency

Salary Sacrifice Schemes allow employees to exchange part of their salary for a company car, reducing taxable income and BIK Tax liabilities effectively. Company Car Tax is calculated based on the vehicle's CO2 emissions and list price, which can be optimized by selecting low-emission or electric vehicles within salary sacrifice arrangements. This combination enhances tax efficiency by lowering both income tax and National Insurance contributions for employees and employers.

Choosing the Best Option: BIK Tax vs Company Car Tax

Choosing the best option between Benefit-in-Kind (BIK) tax and Company Car Tax depends on factors like vehicle type, annual mileage, and personal tax rates. BIK tax applies to employees receiving company cars for personal use, calculated based on the car's list price and CO2 emissions, while Company Car Tax may refer to broader tax deductions available to businesses on vehicle expenses. Evaluating fuel costs, depreciation, and individual tax brackets helps determine whether personal BIK tax liabilities or company-owned vehicle expenses offer greater financial advantage.

Frequently Asked Questions About Car-Related Taxes

Benefit-in-Kind (BIK) tax applies to employees receiving company cars for personal use, calculated based on the vehicle's list price and CO2 emissions. Company Car Tax is essentially the income tax paid on this BIK value, impacting the employee's taxable income. Common FAQs address how fuel benefits are taxed, differences between electric and petrol cars, and how to calculate monthly tax liabilities for different car models.

Benefit-in-Kind (BIK) Tax vs Company Car Tax Infographic

cardiffo.com

cardiffo.com