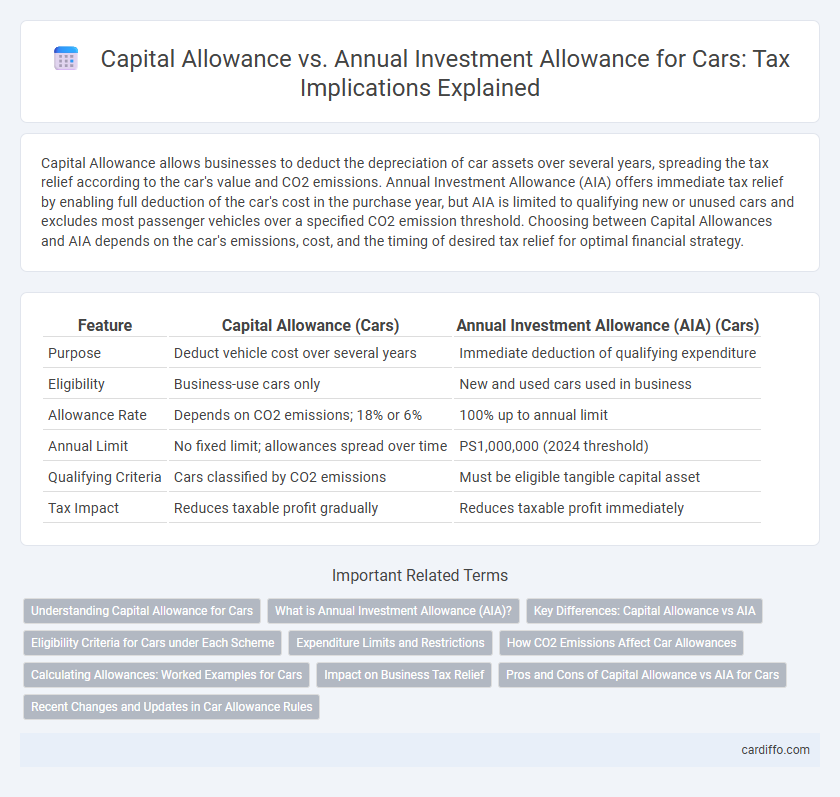

Capital Allowance allows businesses to deduct the depreciation of car assets over several years, spreading the tax relief according to the car's value and CO2 emissions. Annual Investment Allowance (AIA) offers immediate tax relief by enabling full deduction of the car's cost in the purchase year, but AIA is limited to qualifying new or unused cars and excludes most passenger vehicles over a specified CO2 emission threshold. Choosing between Capital Allowances and AIA depends on the car's emissions, cost, and the timing of desired tax relief for optimal financial strategy.

Table of Comparison

| Feature | Capital Allowance (Cars) | Annual Investment Allowance (AIA) (Cars) |

|---|---|---|

| Purpose | Deduct vehicle cost over several years | Immediate deduction of qualifying expenditure |

| Eligibility | Business-use cars only | New and used cars used in business |

| Allowance Rate | Depends on CO2 emissions; 18% or 6% | 100% up to annual limit |

| Annual Limit | No fixed limit; allowances spread over time | PS1,000,000 (2024 threshold) |

| Qualifying Criteria | Cars classified by CO2 emissions | Must be eligible tangible capital asset |

| Tax Impact | Reduces taxable profit gradually | Reduces taxable profit immediately |

Understanding Capital Allowance for Cars

Capital Allowance for cars enables businesses to deduct a portion of the vehicle's cost from taxable profits, with rates varying depending on the car's CO2 emissions. Low-emission cars typically qualify for a 100% write-off under the Annual Investment Allowance (AIA), while higher emission vehicles attract writing down allowances at a reduced rate. Understanding these differing treatment options ensures optimized tax relief and compliance with HMRC regulations.

What is Annual Investment Allowance (AIA)?

Annual Investment Allowance (AIA) provides businesses with 100% tax relief on qualifying capital expenditure, including most cars with low CO2 emissions, up to a set annual limit. This allowance enables immediate deduction of the full purchase cost against taxable profits, accelerating tax relief compared to standard capital allowances spread over several years. AIA's threshold, currently set at PS1 million, incentivizes investment in energy-efficient vehicles by reducing the taxable profit in the year of purchase.

Key Differences: Capital Allowance vs AIA

Capital Allowance and Annual Investment Allowance (AIA) differ primarily in scope and limit for car expenses. Capital Allowance allows tax relief on the depreciation of business assets over time, with cars categorized by CO2 emissions affecting the rate, while AIA provides 100% upfront relief on qualifying expenditure up to a specified limit, currently PS1 million per year. Cars with high emissions often fall outside the full AIA, making Capital Allowance rates critical for accurate tax planning in vehicle investments.

Eligibility Criteria for Cars under Each Scheme

Capital Allowance eligibility for cars depends on the vehicle's CO2 emissions, with low-emission cars qualifying for a 100% first-year allowance, while higher-emission vehicles fall under writing-down allowances at varying rates. Annual Investment Allowance (AIA) applies to cars with CO2 emissions at or below 50g/km, offering full cost deduction up to the AIA limit in the purchase year. Vehicles exceeding these emission thresholds do not qualify for AIA but may still attract capital allowances under different rates, making emission levels the key criterion in determining eligibility for each scheme.

Expenditure Limits and Restrictions

Capital Allowance for cars allows businesses to deduct the cost of vehicles from taxable profits, with specific rates depending on CO2 emissions, typically 18% or 6% per year under the Writing Down Allowance. Annual Investment Allowance (AIA) provides 100% upfront relief on qualifying capital expenditure, but excludes cars, meaning AIA cannot be claimed on vehicle purchases. Expenditure limits for Capital Allowance on cars are influenced by CO2 emission bands, while AIA excludes cars entirely, enforcing distinct restrictions on tax relief for automotive capital expenditure.

How CO2 Emissions Affect Car Allowances

Capital Allowance for cars depends heavily on CO2 emissions, with lower emission vehicles qualifying for higher writing-down allowances, while cars with emissions above 50g/km are subject to reduced rates or restricted relief. Annual Investment Allowance (AIA) offers 100% tax relief on qualifying capital expenditure but excludes cars, making CO2 emissions irrelevant for AIA car claims. Understanding CO2 thresholds is crucial for businesses to optimize tax benefits by selecting environmentally efficient vehicles that maximize capital allowance claims.

Calculating Allowances: Worked Examples for Cars

Calculating Capital Allowance for cars involves applying the writing-down allowance rate to the car's taxable value, typically 18% per annum for cars with CO2 emissions up to 110g/km. Annual Investment Allowance (AIA) allows full deduction of the car's purchase cost from taxable profits in the year of acquisition, but only applies to certain low-emission vehicles under current HMRC rules. Working examples show that for a PS20,000 car with 100g/km emissions, claiming AIA results in an immediate PS20,000 deduction, whereas Capital Allowance spreads deductions over several years using the reducing balance method.

Impact on Business Tax Relief

Capital Allowance and Annual Investment Allowance (AIA) significantly influence business tax relief on company cars by enabling accelerated depreciation claims against taxable profits, thereby reducing overall tax liabilities. While Capital Allowance allows businesses to claim allowances based on the car's CO2 emissions and its writing down allowance rate, AIA provides a 100% upfront deduction for qualifying capital expenditure up to a set annual limit, enhancing immediate cash flow benefits. Understanding the differential impact of these allowances helps businesses optimize tax relief strategies, particularly in managing the tax cost of investing in low-emission vehicles versus standard company cars.

Pros and Cons of Capital Allowance vs AIA for Cars

Capital Allowance offers the benefit of spreading the cost of a car over several years, aligning tax relief with asset depreciation, but the writing down allowance rates for cars with higher CO2 emissions can reduce immediate tax savings. Annual Investment Allowance (AIA) provides full tax relief in the year of purchase, maximizing cash flow for businesses investing in low-emission vehicles, but it is limited by an annual threshold (PS1 million as of 2024), which can restrict benefits for higher-value investments. Choosing between Capital Allowance and AIA depends on factors like vehicle cost, CO2 emissions, and the business's need for immediate versus spread-out tax relief.

Recent Changes and Updates in Car Allowance Rules

Recent changes in car allowance rules include updated Capital Allowance rates reflecting stricter CO2 emission thresholds, with cars emitting less than 50g/km benefiting from 100% first-year allowances. The Annual Investment Allowance (AIA) continues to exclude cars, limiting its application to other assets and necessitating businesses to claim Capital Allowances under the new emissions-based bands for vehicles. These updates emphasize the government's focus on environmental criteria in tax relief, impacting how businesses plan their vehicle purchases for tax efficiency.

Capital Allowance vs Annual Investment Allowance (for cars) Infographic

cardiffo.com

cardiffo.com