Company car tax applies when an employer provides a vehicle for personal use, calculating taxable benefit based on the car's value and CO2 emissions. Mileage allowance allows employees to claim tax-free reimbursements for business miles driven in their own vehicle, typically at approved rates. Choosing between the two depends on company policy, vehicle usage, and tax efficiency for both employer and employee.

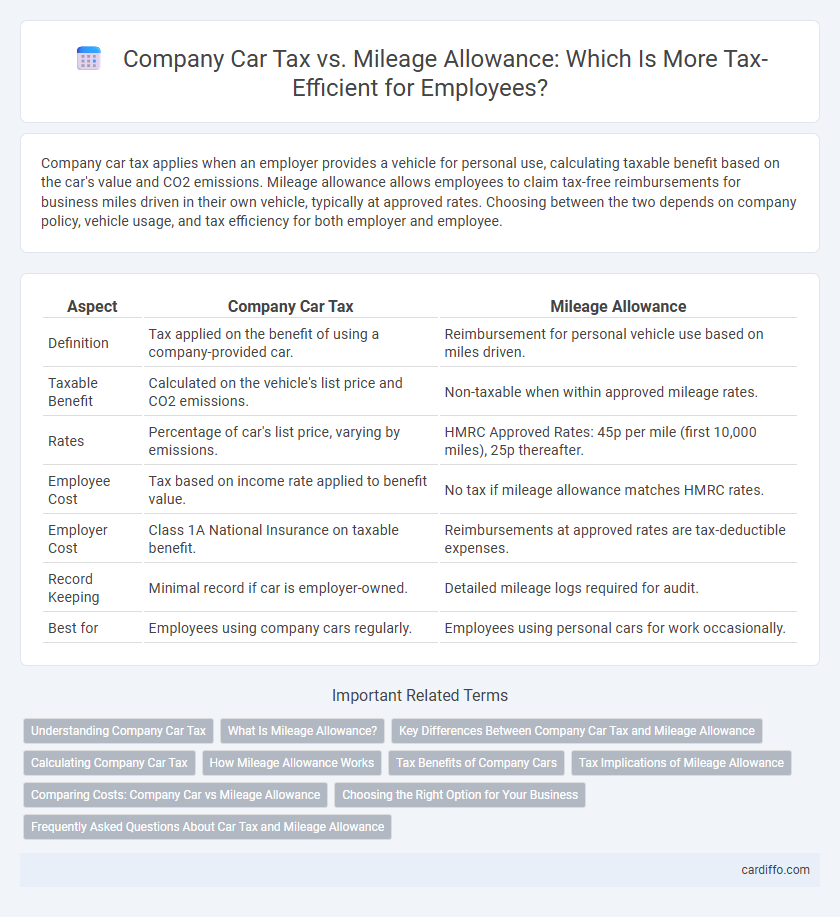

Table of Comparison

| Aspect | Company Car Tax | Mileage Allowance |

|---|---|---|

| Definition | Tax applied on the benefit of using a company-provided car. | Reimbursement for personal vehicle use based on miles driven. |

| Taxable Benefit | Calculated on the vehicle's list price and CO2 emissions. | Non-taxable when within approved mileage rates. |

| Rates | Percentage of car's list price, varying by emissions. | HMRC Approved Rates: 45p per mile (first 10,000 miles), 25p thereafter. |

| Employee Cost | Tax based on income rate applied to benefit value. | No tax if mileage allowance matches HMRC rates. |

| Employer Cost | Class 1A National Insurance on taxable benefit. | Reimbursements at approved rates are tax-deductible expenses. |

| Record Keeping | Minimal record if car is employer-owned. | Detailed mileage logs required for audit. |

| Best for | Employees using company cars regularly. | Employees using personal cars for work occasionally. |

Understanding Company Car Tax

Company Car Tax is a benefit-in-kind tax applied when an employee has a company-provided vehicle, based on the car's list price, CO2 emissions, and fuel type, impacting taxable income significantly. This tax differs from mileage allowance, which reimburses employees for business travel using their personal vehicles and is typically exempt from tax within approved rates. Understanding these distinctions helps businesses optimize tax liabilities and ensures compliance with HMRC regulations on vehicle-related expenses.

What Is Mileage Allowance?

Mileage allowance refers to the tax-free reimbursement a company provides employees for using their personal vehicles for business travel. HMRC sets approved mileage rates, typically 45p per mile for the first 10,000 miles and 25p thereafter, which employers can pay without attracting tax or National Insurance liabilities. This allowance helps employees avoid taxable benefits associated with company cars by covering fuel, wear, and maintenance costs.

Key Differences Between Company Car Tax and Mileage Allowance

Company car tax is calculated based on the vehicle's list price, CO2 emissions, and fuel type, leading to a fixed taxable benefit on the employee's income. Mileage allowance allows employees to claim a tax-free reimbursement for business miles driven in their personal vehicles, capped at approved rates set by HMRC. The key difference lies in taxable benefit calculation for company cars versus expense reimbursement for mileage, impacting employee tax liabilities and employer cost management.

Calculating Company Car Tax

Calculating company car tax involves determining the taxable benefit based on the vehicle's list price, CO2 emissions, and appropriate percentage rates set by HMRC. Employers must use the car's P11D value, including VAT and delivery charges, then apply a percentage corresponding to its emissions band to find the taxable amount. This figure is then added to the employee's income for tax purposes, affecting their overall tax liability.

How Mileage Allowance Works

Mileage allowance reimburses employees for business travel using personal vehicles, calculated at approved rates set by HMRC, typically 45p per mile for the first 10,000 miles and 25p thereafter. This allowance covers fuel, maintenance, insurance, and depreciation, ensuring employees do not incur out-of-pocket expenses. Employers can pay mileage allowances tax-free up to these rates, avoiding company car tax liabilities and simplifying expense reporting.

Tax Benefits of Company Cars

Company car tax offers significant benefits by allowing employees to use a vehicle without facing immediate purchase costs, with tax liability calculated based on the car's CO2 emissions and list price, often resulting in lower taxable amounts for low-emission vehicles. Employers can also reclaim VAT on company cars and related expenses, enhancing overall tax efficiency. Compared to mileage allowance, company cars provide more predictable tax outcomes and potential savings through capital allowances and fuel benefit charge reductions.

Tax Implications of Mileage Allowance

Mileage allowance payments made to employees for using their personal vehicles for business purposes are typically tax-free up to the approved HMRC rates, preventing additional taxable income for the employee. If the allowance exceeds HMRC's approved rates, the excess amount is subject to income tax and National Insurance contributions. Employers can claim these payments as allowable business expenses, reducing their corporation tax liability while ensuring compliance with HMRC regulations.

Comparing Costs: Company Car vs Mileage Allowance

Company car tax is calculated based on the vehicle's list price and CO2 emissions, often resulting in higher taxable benefits for luxury or high-emission vehicles, whereas mileage allowance allows employees to claim a fixed rate per mile for business travel, reducing tax liabilities. Choosing between a company car and mileage allowance depends on annual mileage, vehicle type, and personal tax bracket, with mileage allowance typically providing cost savings for low-mileage drivers. Employers benefit from mileage allowance schemes by minimizing National Insurance contributions and administrative costs compared to providing company cars.

Choosing the Right Option for Your Business

Selecting the right option between Company Car Tax and Mileage Allowance depends on your business's vehicle usage, budget, and tax efficiency. Company Car Tax offers predictable costs and benefits like maintenance coverage but incurs higher taxable benefits based on the car's emissions and value. Mileage Allowance reimburses employees for business travel using their personal vehicles, with tax-free rates up to HMRC's approved thresholds, often resulting in lower taxable expenses for businesses with moderate or variable travel needs.

Frequently Asked Questions About Car Tax and Mileage Allowance

Company car tax is calculated based on the vehicle's list price and CO2 emissions, while mileage allowance reimbursement depends on the distance traveled for business purposes. Employees receiving mileage allowance must keep accurate records to ensure tax-free reimbursement within HMRC-approved rates, typically 45p per mile for the first 10,000 miles. Common questions often address differences in taxable benefits, eligibility criteria, and how to claim mileage versus company car tax deductions on self-assessment tax returns.

Company Car Tax vs Mileage Allowance Infographic

cardiffo.com

cardiffo.com