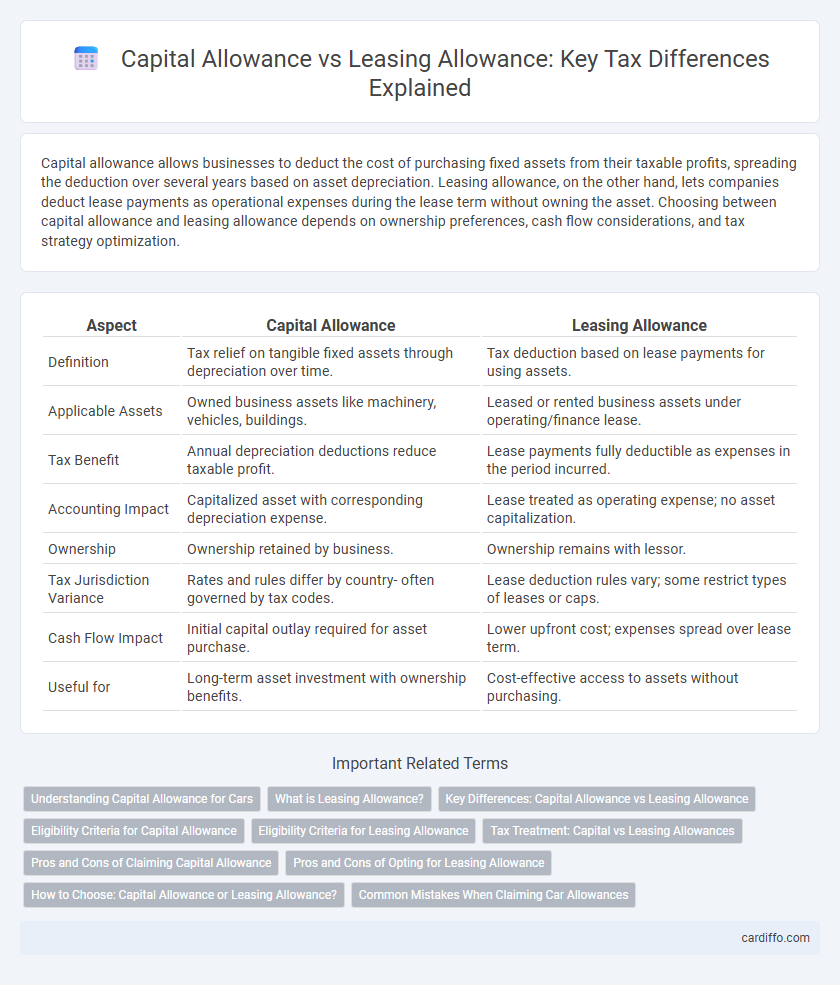

Capital allowance allows businesses to deduct the cost of purchasing fixed assets from their taxable profits, spreading the deduction over several years based on asset depreciation. Leasing allowance, on the other hand, lets companies deduct lease payments as operational expenses during the lease term without owning the asset. Choosing between capital allowance and leasing allowance depends on ownership preferences, cash flow considerations, and tax strategy optimization.

Table of Comparison

| Aspect | Capital Allowance | Leasing Allowance |

|---|---|---|

| Definition | Tax relief on tangible fixed assets through depreciation over time. | Tax deduction based on lease payments for using assets. |

| Applicable Assets | Owned business assets like machinery, vehicles, buildings. | Leased or rented business assets under operating/finance lease. |

| Tax Benefit | Annual depreciation deductions reduce taxable profit. | Lease payments fully deductible as expenses in the period incurred. |

| Accounting Impact | Capitalized asset with corresponding depreciation expense. | Lease treated as operating expense; no asset capitalization. |

| Ownership | Ownership retained by business. | Ownership remains with lessor. |

| Tax Jurisdiction Variance | Rates and rules differ by country- often governed by tax codes. | Lease deduction rules vary; some restrict types of leases or caps. |

| Cash Flow Impact | Initial capital outlay required for asset purchase. | Lower upfront cost; expenses spread over lease term. |

| Useful for | Long-term asset investment with ownership benefits. | Cost-effective access to assets without purchasing. |

Understanding Capital Allowance for Cars

Capital allowance for cars enables businesses to deduct the cost of purchasing vehicles from their taxable profits over several years, based on the car's CO2 emissions and value. The tax relief is structured through writing down allowances, which vary depending on whether the car is new, used, or qualifies for the first-year allowance. Understanding these rules helps optimize tax liabilities by aligning capital expenditure with appropriate depreciation schedules rather than incurring immediate lease expenses.

What is Leasing Allowance?

Leasing allowance refers to the tax deduction available for businesses that lease assets rather than purchase them outright, allowing expenses related to lease payments to be deducted from taxable income. Unlike capital allowances, which apply to ownership and depreciation of purchased assets, leasing allowances focus on the cost of using leased equipment or property over the lease term. This distinction impacts cash flow management and tax planning strategies for companies utilizing leased assets.

Key Differences: Capital Allowance vs Leasing Allowance

Capital Allowance enables businesses to deduct the depreciable cost of fixed assets such as machinery or equipment from taxable profits, promoting long-term investment by spreading the tax relief over the asset's useful life. Leasing Allowance, in contrast, pertains to the tax deductions available on lease payments made for business use assets, offering immediate relief aligned with the lease term rather than asset ownership. The primary difference lies in ownership and timing: Capital Allowance applies to owned assets depreciated over time, while Leasing Allowance applies to rented assets with deductions matched to lease expenses.

Eligibility Criteria for Capital Allowance

Capital allowance eligibility requires ownership of qualifying capital assets used in a trade, including machinery, equipment, and industrial buildings, ensuring the asset is integral to business operations. The asset must not be acquired solely for leasing purposes, distinguishing it from leasing allowances which apply when assets are rented or leased to others. Businesses must maintain detailed records of asset acquisition costs, usage, and depreciation schedules to claim capital allowances accurately under tax regulations.

Eligibility Criteria for Leasing Allowance

Leasing allowance eligibility requires that the leased asset be used exclusively for business purposes and the lease agreement must comply with local tax regulations. Only companies or self-employed individuals with verifiable lease contracts can claim the allowance, ensuring the asset is not owned but rented for operational use. The leased asset should contribute directly to generating taxable income to qualify for the leasing allowance under tax law.

Tax Treatment: Capital vs Leasing Allowances

Capital allowances provide tax relief by allowing businesses to deduct the cost of qualifying fixed assets from their taxable profits over time, reflecting asset depreciation. Leasing allowances, on the other hand, enable businesses to deduct lease payments as expenses in the income statement, reducing taxable income in the lease period. The key tax treatment difference lies in capital allowances being spread across asset useful life, whereas leasing allowances offer immediate expense recognition aligned with lease terms.

Pros and Cons of Claiming Capital Allowance

Claiming capital allowances allows businesses to deduct the cost of qualifying assets from taxable profits, reducing overall tax liability and improving cash flow. However, capital allowances require ownership of the asset, often resulting in significant upfront expenditure and potential limitations on claim timing. Unlike leasing allowances, capital allowances can provide long-term tax benefits but may restrict flexibility due to asset depreciation rules and disposal implications.

Pros and Cons of Opting for Leasing Allowance

Leasing allowance offers flexibility by avoiding large upfront capital expenditure and enabling access to updated equipment, improving cash flow management. However, it often results in higher overall costs due to interest and fees compared to capital allowance, which provides tax relief through asset depreciation. Businesses must weigh immediate liquidity benefits against long-term tax savings when choosing leasing allowance over capital allowance.

How to Choose: Capital Allowance or Leasing Allowance?

Choosing between capital allowance and leasing allowance depends on ownership and tax benefits associated with asset usage. Capital allowance applies when assets are purchased, allowing deductions based on depreciation rates set by tax authorities, while leasing allowance offers deductions on lease payments without ownership. Analyzing cash flow, asset control, and long-term tax efficiency helps determine the optimal choice for maximizing tax relief in business investments.

Common Mistakes When Claiming Car Allowances

Common mistakes when claiming car allowances include misclassifying capital allowances and leasing allowances, leading to inaccurate tax deductions. Taxpayers often overlook the distinction that capital allowances apply to owned vehicles with allowable depreciation, while leasing allowances relate to rented or leased cars with lease payments deductible as business expenses. Incorrectly combining or mixing these claims can result in overpaid taxes or penalties from tax authorities.

Capital Allowance vs Leasing Allowance Infographic

cardiffo.com

cardiffo.com