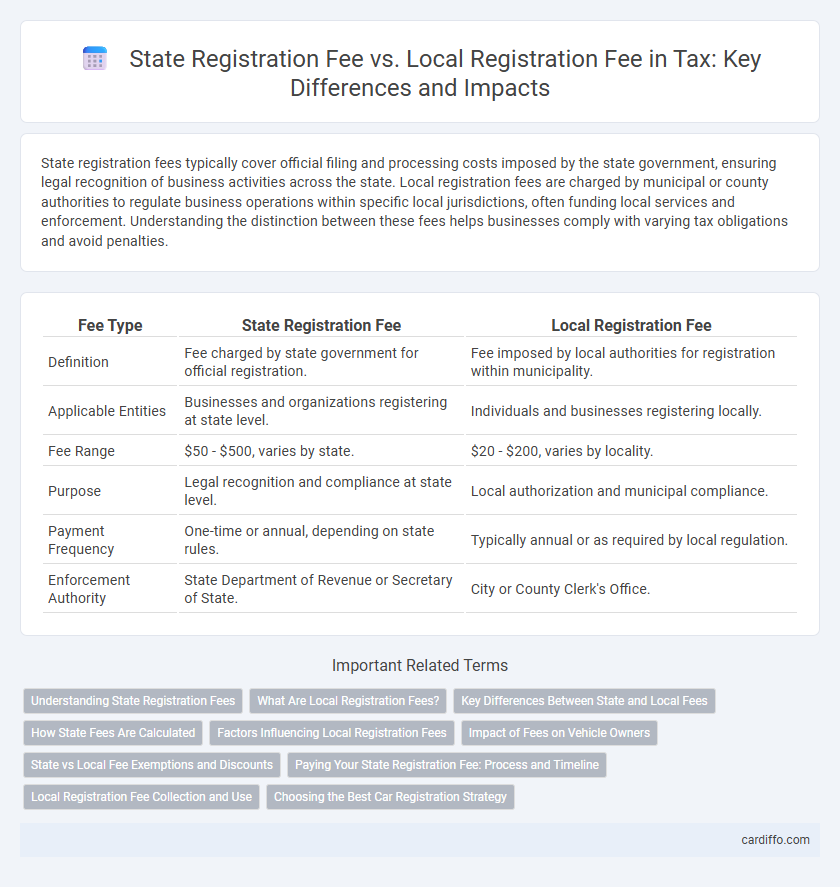

State registration fees typically cover official filing and processing costs imposed by the state government, ensuring legal recognition of business activities across the state. Local registration fees are charged by municipal or county authorities to regulate business operations within specific local jurisdictions, often funding local services and enforcement. Understanding the distinction between these fees helps businesses comply with varying tax obligations and avoid penalties.

Table of Comparison

| Fee Type | State Registration Fee | Local Registration Fee |

|---|---|---|

| Definition | Fee charged by state government for official registration. | Fee imposed by local authorities for registration within municipality. |

| Applicable Entities | Businesses and organizations registering at state level. | Individuals and businesses registering locally. |

| Fee Range | $50 - $500, varies by state. | $20 - $200, varies by locality. |

| Purpose | Legal recognition and compliance at state level. | Local authorization and municipal compliance. |

| Payment Frequency | One-time or annual, depending on state rules. | Typically annual or as required by local regulation. |

| Enforcement Authority | State Department of Revenue or Secretary of State. | City or County Clerk's Office. |

Understanding State Registration Fees

State registration fees are mandatory charges imposed by the state government during the registration of businesses, property, or vehicles, varying significantly by state and type of transaction. These fees fund state-level administrative services and legal documentation processes, ensuring compliance with state laws. Understanding state registration fees is crucial for accurate financial planning and avoiding penalties related to underpayment or late registration.

What Are Local Registration Fees?

Local registration fees are charges imposed by municipal or county governments for the registration of property, vehicles, or business activities within their jurisdiction. These fees fund local services such as infrastructure maintenance, public safety, and administrative operations. Unlike state registration fees, which are mandated by state authorities and apply uniformly across a state, local registration fees vary significantly based on location and specific local regulations.

Key Differences Between State and Local Fees

State registration fees are typically standardized charges imposed by state governments for official document filings or business registrations, reflecting uniform regulatory requirements across the state. Local registration fees vary by municipality or county and are generally lower but can differ significantly based on local government policies and services provided. Key differences include the scope of authority, fee amounts, and specific documentation required, with state fees often covering broader regulatory compliance and local fees addressing community-specific administrative costs.

How State Fees Are Calculated

State registration fees are typically calculated based on the type of business entity, the authorized capital, or the number of shares issued during incorporation. Each state sets its own fee structure, which may include fixed charges or tiered rates that increase with the amount of capital or business size. These fees differ significantly from local registration fees, which often cover municipal services and licensing and are usually calculated as a percentage of local business activity or property value.

Factors Influencing Local Registration Fees

Local registration fees vary significantly based on property location, size, and zoning regulations, directly affecting the total cost of property transactions. Municipal governments often set local fees to fund regional infrastructure, public services, and administrative expenses, which can differ widely between urban and rural areas. Economic factors such as local real estate market conditions and budgetary needs also play a critical role in determining these fees, making them more variable than state registration fees.

Impact of Fees on Vehicle Owners

State registration fees typically cover broader administrative costs for vehicle titling and statewide law enforcement, often resulting in higher expense compared to local registration fees that fund community-specific services like road maintenance and local safety programs. The variation in these fees affects vehicle owners' total annual costs, influencing decisions on vehicle ownership, registration timing, and compliance. Understanding the distinction between state and local fees helps owners anticipate financial obligations and optimize budget planning for vehicle-related expenses.

State vs Local Fee Exemptions and Discounts

State registration fees often have standardized exemptions and discounts based on business type, nonprofit status, or economic development incentives, which are governed by statewide tax codes. Local registration fees vary significantly by municipality, with discounts frequently provided for small businesses or sustainable practices, depending on city or county regulations. Understanding the specific exemption criteria at both levels is crucial for optimizing tax liabilities and ensuring compliance.

Paying Your State Registration Fee: Process and Timeline

Paying your state registration fee involves submitting an application through the state's official department of revenue or business services portal, often requiring specific documentation and payment methods such as credit card or electronic check. The timeline typically ranges from a few business days to several weeks, depending on the state's processing efficiency and the accuracy of your application. Failure to pay promptly can result in penalties, so it is crucial to verify deadlines and maintain proof of payment for compliance and future reference.

Local Registration Fee Collection and Use

Local registration fees are imposed by municipal or county authorities to fund community-specific services such as public safety, infrastructure maintenance, and local administrative expenses. These fees are collected directly at the local level, ensuring that revenues remain within the jurisdiction to support localized needs and development projects. Effective collection and allocation of local registration fees enhance transparency and enable tailored public service improvements benefiting residents.

Choosing the Best Car Registration Strategy

State registration fees typically cover broader administrative costs and vary by vehicle type and weight, while local registration fees often fund community-specific infrastructure and services, influencing total registration costs. Evaluating the combined impact of both fees on your annual expenses is crucial for selecting the most cost-effective car registration strategy. Prioritizing regions with lower cumulative state and local fees can optimize long-term savings on vehicle ownership.

State Registration Fee vs Local Registration Fee Infographic

cardiffo.com

cardiffo.com