Tax regulations differ significantly between leased and owned cars, influencing deductible expenses and depreciation claims. Leased car tax deductions typically allow the lessee to deduct lease payments as a business expense, while owning a car permits the deduction of depreciation and actual operating costs. Understanding these distinctions helps optimize tax benefits depending on whether the vehicle is financed through leasing or ownership.

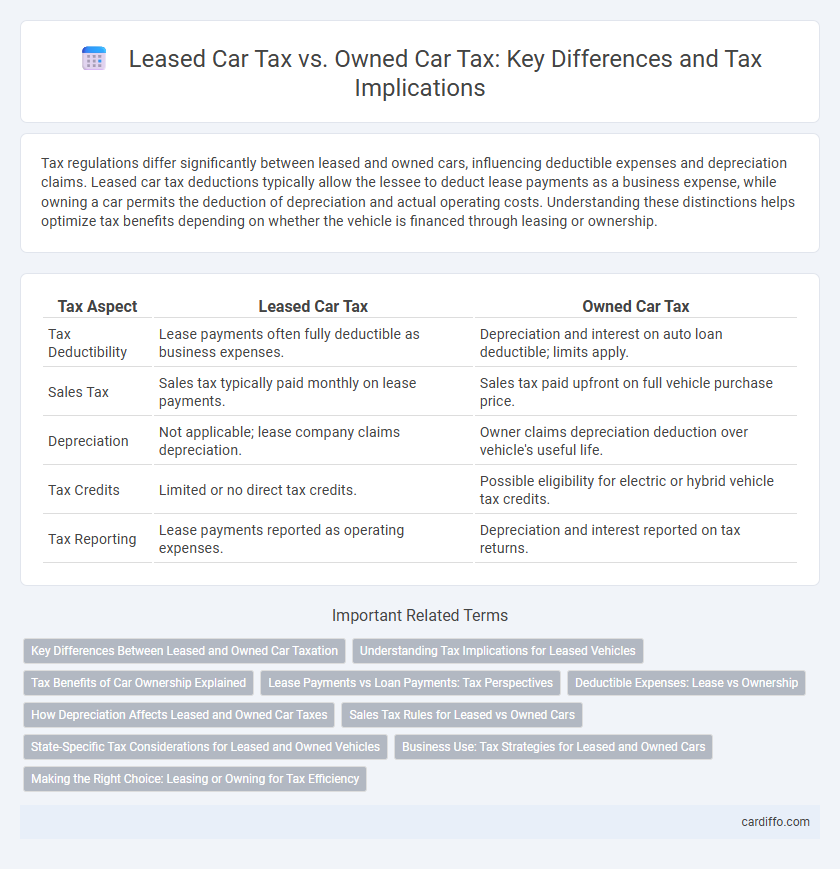

Table of Comparison

| Tax Aspect | Leased Car Tax | Owned Car Tax |

|---|---|---|

| Tax Deductibility | Lease payments often fully deductible as business expenses. | Depreciation and interest on auto loan deductible; limits apply. |

| Sales Tax | Sales tax typically paid monthly on lease payments. | Sales tax paid upfront on full vehicle purchase price. |

| Depreciation | Not applicable; lease company claims depreciation. | Owner claims depreciation deduction over vehicle's useful life. |

| Tax Credits | Limited or no direct tax credits. | Possible eligibility for electric or hybrid vehicle tax credits. |

| Tax Reporting | Lease payments reported as operating expenses. | Depreciation and interest reported on tax returns. |

Key Differences Between Leased and Owned Car Taxation

Leased car tax primarily involves monthly lease payments that may include sales tax, typically spread out over the lease term, whereas owned car tax requires paying sales tax upfront based on the vehicle's purchase price. Tax deductions for leased vehicles often limit depreciation claims to the lease term, while owned cars allow for full depreciation deductions over the vehicle's useful life. Ownership may also enable eligibility for tax credits related to electric or environmentally friendly vehicles, which leased car users might not fully capitalize on.

Understanding Tax Implications for Leased Vehicles

Leased car tax implications primarily involve paying sales tax on monthly lease payments rather than the full vehicle price, which can lower upfront tax liabilities compared to owned cars. Lease agreements often include fees and taxes that are deductible as business expenses if the vehicle is used for work, influencing overall tax benefits. Understanding local tax regulations and lease terms is crucial for accurately assessing the financial impact of leased vehicles versus owned cars in tax planning.

Tax Benefits of Car Ownership Explained

Owning a car offers significant tax benefits such as depreciation deductions and potential eligibility for business use expense write-offs, which are often limited or unavailable with leased vehicles. Lease payments may be deductible as a business expense, but ownership allows for claiming vehicle depreciation, interest on auto loans, and maintenance costs as tax advantages. Understanding the IRS rules on qualified business use of owned cars can maximize tax savings compared to leasing options.

Lease Payments vs Loan Payments: Tax Perspectives

Lease payments for a car are typically considered operating expenses and can often be fully deducted as a business expense, subject to IRS limits, whereas loan payments on an owned car include both principal and interest, but only the interest portion may be tax-deductible. Tax benefits from lease payments are generally straightforward, enabling businesses to reduce taxable income more predictably. Conversely, owned car tax advantages depend on depreciation schedules and interest deductions, making the overall tax impact more complex and potentially less immediate.

Deductible Expenses: Lease vs Ownership

Deductible expenses for leased cars typically include lease payments, maintenance, and fuel costs, which can be fully or partially written off depending on business use percentage. For owned vehicles, deductions often encompass depreciation, interest on auto loans, maintenance, insurance, and fuel, with depreciation schedules following IRS guidelines such as MACRS. Understanding the tax implications of lease payments versus depreciation and ownership costs is essential for maximizing deductible expenses under IRS Section 179 and business expense provisions.

How Depreciation Affects Leased and Owned Car Taxes

Depreciation directly impacts tax deductions for owned cars by allowing owners to deduct the vehicle's value loss over time, lowering taxable income. In leased cars, depreciation is factored into the lease payments, which can be deducted as a business expense, but the lessee cannot claim depreciation independently. Tax treatment of depreciation differs significantly, with owned vehicle owners gaining capital cost allowance benefits, while leased vehicle users leverage lease expense deductions.

Sales Tax Rules for Leased vs Owned Cars

Sales tax on leased cars is typically calculated based on the monthly lease payment rather than the vehicle's full purchase price, often resulting in lower upfront tax costs compared to owned cars. When purchasing a car outright, sales tax is usually applied to the total purchase price at the time of sale, which can lead to a higher initial tax burden. Lease agreements may also vary by state, with some states requiring sales tax on the entire lease amount upfront or on a per-payment basis, making it essential to understand local tax regulations.

State-Specific Tax Considerations for Leased and Owned Vehicles

State-specific tax considerations for leased and owned vehicles vary significantly, impacting overall tax liability. Lease payments are often subject to state sales tax either upfront or monthly, with some states taxing only the lease payment amount while others tax the total vehicle value. Owned vehicles typically face annual personal property taxes based on assessed value, which differ by state depending on local tax rates and vehicle depreciation schedules.

Business Use: Tax Strategies for Leased and Owned Cars

Business ownership of vehicles impacts tax strategies significantly, with leased cars allowing for consistent deduction of lease payments as a business expense, whereas owned cars require depreciation deductions over several years. Accurate mileage tracking for business use is crucial for both leased and owned cars to maximize deductible expenses and comply with IRS guidelines. Employing a strategic mix of lease versus ownership based on business usage intensity can optimize tax benefits and cash flow management effectively.

Making the Right Choice: Leasing or Owning for Tax Efficiency

Leased car tax benefits often include deductible lease payments that can lower taxable income, while owned car tax advantages primarily arise from depreciation deductions and interest on auto loans. Evaluating factors such as business use percentage, overall cost, and long-term tax impact ensures optimal tax efficiency in deciding between leasing or owning a vehicle. Precise record-keeping and consultation with a tax professional can maximize deductible expenses and align with current IRS guidelines.

Leased Car Tax vs Owned Car Tax Infographic

cardiffo.com

cardiffo.com