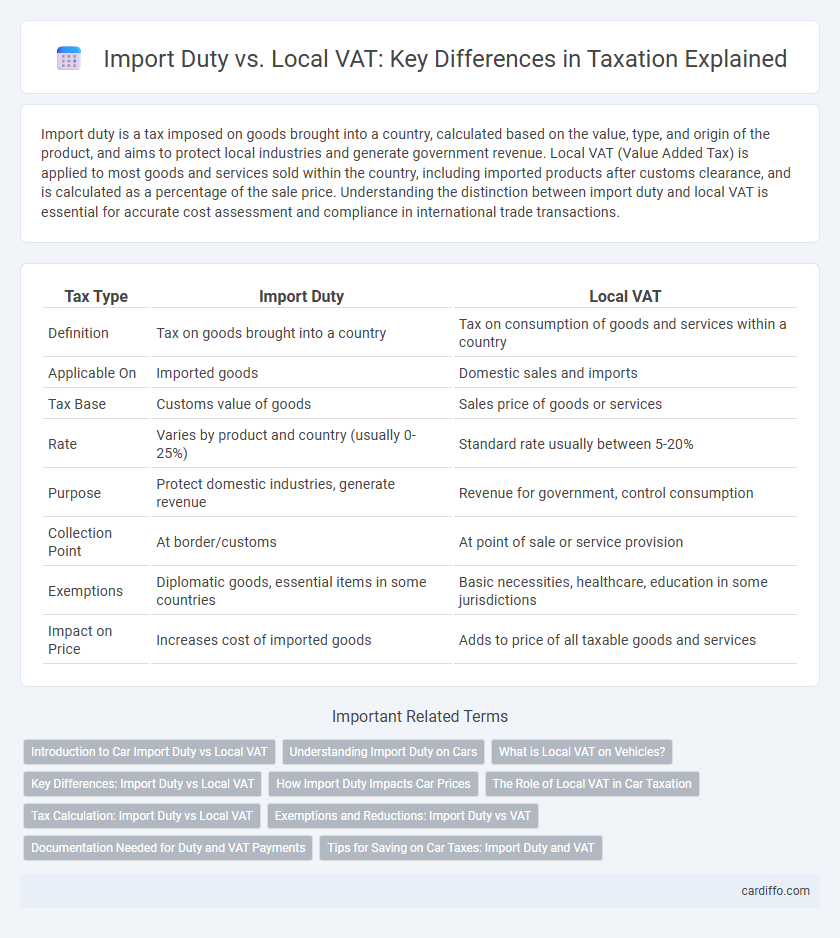

Import duty is a tax imposed on goods brought into a country, calculated based on the value, type, and origin of the product, and aims to protect local industries and generate government revenue. Local VAT (Value Added Tax) is applied to most goods and services sold within the country, including imported products after customs clearance, and is calculated as a percentage of the sale price. Understanding the distinction between import duty and local VAT is essential for accurate cost assessment and compliance in international trade transactions.

Table of Comparison

| Tax Type | Import Duty | Local VAT |

|---|---|---|

| Definition | Tax on goods brought into a country | Tax on consumption of goods and services within a country |

| Applicable On | Imported goods | Domestic sales and imports |

| Tax Base | Customs value of goods | Sales price of goods or services |

| Rate | Varies by product and country (usually 0-25%) | Standard rate usually between 5-20% |

| Purpose | Protect domestic industries, generate revenue | Revenue for government, control consumption |

| Collection Point | At border/customs | At point of sale or service provision |

| Exemptions | Diplomatic goods, essential items in some countries | Basic necessities, healthcare, education in some jurisdictions |

| Impact on Price | Increases cost of imported goods | Adds to price of all taxable goods and services |

Introduction to Car Import Duty vs Local VAT

Car import duty is a tax levied on vehicles brought into a country, calculated based on the vehicle's customs value, engine size, and country of origin. Local Value Added Tax (VAT) applies to the sale price of the vehicle within the country and is charged at a fixed percentage rate set by local tax authorities. Understanding the differences in calculation methods and applicable rates for import duty and VAT is crucial for accurate tax compliance when importing cars.

Understanding Import Duty on Cars

Import duty on cars is a tariff imposed by customs authorities based on the vehicle's declared value, origin, and type, directly impacting the overall cost of imported vehicles. Unlike local VAT, which applies a standardized percentage on goods and services within the country, import duty specifically targets imported vehicles to protect domestic industries and regulate trade balances. Understanding import duty rates, exemptions, and calculation methods is crucial for accurate cost assessment when purchasing cars from abroad.

What is Local VAT on Vehicles?

Local VAT on vehicles is a consumption tax applied to the sale of new and used vehicles within a country, calculated as a percentage of the vehicle's purchase price or taxable value. Unlike import duty, which is charged on vehicles entering a country, local VAT is levied at the point of sale on vehicles registered locally and contributes to government revenue for public services. This tax ensures that both imported and domestically sold vehicles are subject to a standardized tax rate, promoting fairness in the automotive market.

Key Differences: Import Duty vs Local VAT

Import duty is a government-imposed tax on goods brought into a country, calculated based on the item's value, type, and origin, aiming to protect domestic industries and generate revenue. Local VAT (Value-Added Tax) is a consumption tax applied at each stage of the supply chain on the added value of goods and services within the country, typically expressed as a percentage of the sales price. While import duty applies only once at the border during importation, local VAT is charged repeatedly at multiple points in the distribution process.

How Import Duty Impacts Car Prices

Import duty significantly increases car prices by adding a percentage-based tax on the vehicle's declared value at the border, often ranging from 10% to 50% depending on the country and car type. This additional cost is applied before local VAT, which itself is calculated on the sum of the car's invoice price plus import duty, compounding the final price paid by consumers. Import duty serves as a protective measure for local industries but directly raises the entry price of imported cars, thus affecting affordability and market competitiveness.

The Role of Local VAT in Car Taxation

Local VAT plays a crucial role in car taxation by ensuring that tax revenue is collected consistently on all vehicle transactions within a country, regardless of the vehicle's origin. Unlike import duty, which is a one-time tax on bringing a car into a country, local VAT applies to both new and used cars, providing ongoing tax revenue with each sale or transfer. This continuous application helps governments maintain steady fiscal resources while encouraging transparency and compliance in the automotive market.

Tax Calculation: Import Duty vs Local VAT

Import Duty is calculated based on the customs value of goods, including cost, insurance, and freight (CIF), and rates vary depending on the product classification under the Harmonized System (HS) code. Local VAT is applied to the total taxable base, which includes the cost of goods, import duty, and any other applicable charges, usually at a fixed percentage set by the local tax authority. Correct tax calculation requires integrating both Import Duty and Local VAT to determine the final tax liability on imported goods.

Exemptions and Reductions: Import Duty vs VAT

Import duty exemptions often apply to raw materials, diplomatic goods, and humanitarian aid, reducing the cost burden on specific sectors. Local VAT exemptions typically include essential goods like basic foodstuffs, healthcare products, and educational materials, aiming to alleviate the tax impact on consumers. Reductions in import duties may target machinery used in manufacturing to encourage industry growth, while VAT reductions focus on promoting affordability of services and locally produced goods.

Documentation Needed for Duty and VAT Payments

Accurate import duty and local VAT payments require comprehensive documentation, including a commercial invoice, bill of lading, packing list, and customs declaration form. Import duty assessment depends on the tariff classification and valuation of goods, necessitating precise product descriptions and origin certificates. Local VAT payments mandate valid tax invoices and proof of import duty payment to ensure compliance with tax authorities.

Tips for Saving on Car Taxes: Import Duty and VAT

Minimizing import duty on cars can be achieved by accurately declaring the vehicle's value and exploring applicable trade agreements that reduce tariffs. Understanding local VAT regulations, including possible exemptions or reduced rates for eco-friendly or low-emission vehicles, helps lower overall tax burdens. Consulting with customs brokers or tax professionals ensures compliance while maximizing savings on both import duty and VAT during vehicle acquisition.

Import Duty vs Local VAT Infographic

cardiffo.com

cardiffo.com