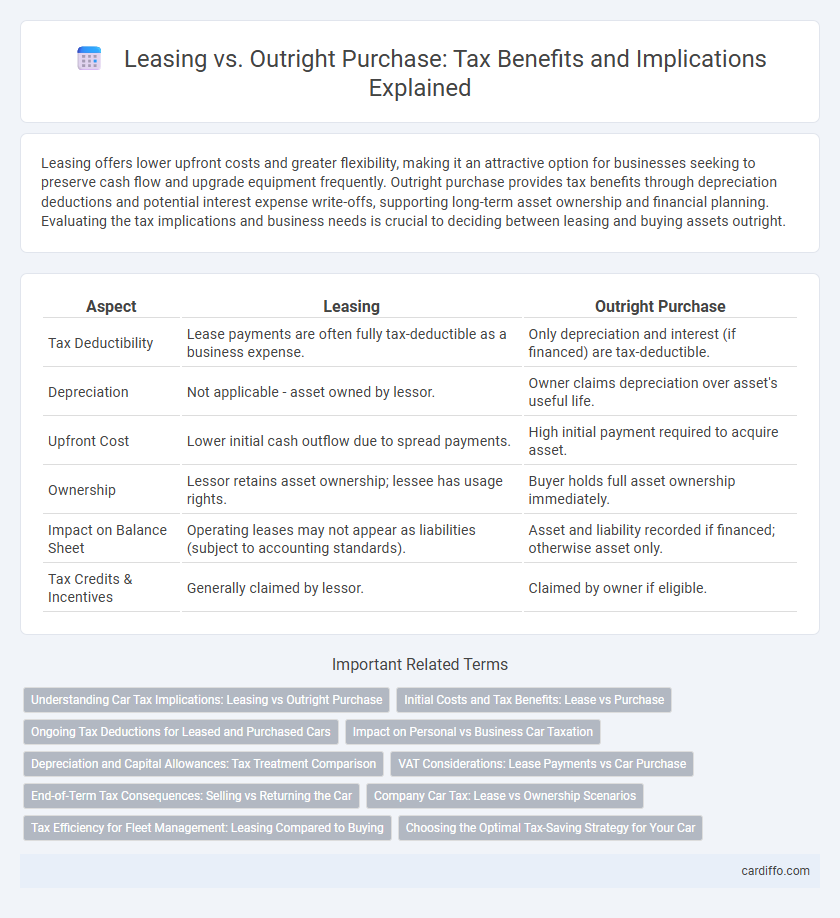

Leasing offers lower upfront costs and greater flexibility, making it an attractive option for businesses seeking to preserve cash flow and upgrade equipment frequently. Outright purchase provides tax benefits through depreciation deductions and potential interest expense write-offs, supporting long-term asset ownership and financial planning. Evaluating the tax implications and business needs is crucial to deciding between leasing and buying assets outright.

Table of Comparison

| Aspect | Leasing | Outright Purchase |

|---|---|---|

| Tax Deductibility | Lease payments are often fully tax-deductible as a business expense. | Only depreciation and interest (if financed) are tax-deductible. |

| Depreciation | Not applicable - asset owned by lessor. | Owner claims depreciation over asset's useful life. |

| Upfront Cost | Lower initial cash outflow due to spread payments. | High initial payment required to acquire asset. |

| Ownership | Lessor retains asset ownership; lessee has usage rights. | Buyer holds full asset ownership immediately. |

| Impact on Balance Sheet | Operating leases may not appear as liabilities (subject to accounting standards). | Asset and liability recorded if financed; otherwise asset only. |

| Tax Credits & Incentives | Generally claimed by lessor. | Claimed by owner if eligible. |

Understanding Car Tax Implications: Leasing vs Outright Purchase

Leasing a vehicle often results in lower monthly payments and allows businesses to deduct lease expenses as operational costs, potentially reducing taxable income. Outright purchase requires capital investment upfront but enables depreciation deductions over time, which can provide long-term tax benefits. Understanding the specific tax regulations, including limitations on luxury vehicle depreciation and lease deductibility, is essential to optimize tax savings in both options.

Initial Costs and Tax Benefits: Lease vs Purchase

Leasing a vehicle typically requires lower initial costs, including minimal down payments and reduced upfront fees compared to outright purchase, which demands full payment or significant financing upfront. Tax benefits differ as lease payments are often fully deductible as a business expense, providing immediate tax relief, while purchasing allows for depreciation deductions over several years, potentially lowering taxable income gradually. Understanding these distinctions can optimize cash flow management and maximize tax advantages based on a company's financial strategy.

Ongoing Tax Deductions for Leased and Purchased Cars

Leased vehicles typically allow full deduction of monthly lease payments as ongoing business expenses, providing consistent tax advantages over the lease term. Outright purchases require depreciation deductions spread over several years, limiting immediate tax benefits but potentially offering larger total deductions long-term. Understanding IRS guidelines on Section 179 and Bonus Depreciation is essential for maximizing tax savings on both leased and purchased vehicles.

Impact on Personal vs Business Car Taxation

Leasing a vehicle allows businesses to deduct lease payments as a business expense, often resulting in lower taxable income compared to outright purchase, where only depreciation and interest expenses can be claimed. For personal car use, lease payments are generally not deductible, while outright purchases provide limited tax benefits such as mileage deductions under specific conditions. Tax treatment differences significantly influence the decision between leasing or buying, especially when balancing personal versus business usage.

Depreciation and Capital Allowances: Tax Treatment Comparison

Leasing offers tax advantages by allowing full lease payments to be deducted as business expenses, reducing taxable income without requiring capital allowance claims. Outright purchases enable businesses to claim capital allowances on the asset's depreciation, spreading tax relief over several years according to prescribed rates. Tax treatment depends on cash flow preferences and asset usage; leases provide immediate expense deductions while outright purchases allow gradual depreciation claims under tax codes like the Annual Investment Allowance.

VAT Considerations: Lease Payments vs Car Purchase

Lease payments often allow businesses to recover VAT on monthly installments, providing cash flow benefits and easing upfront tax burdens. In contrast, outright car purchases require immediate VAT payment on the full purchase price, though the VAT can be reclaimed if the vehicle is used for business purposes. Careful analysis of VAT recovery rules and tax regulations is essential to determine the most financially advantageous option between leasing and buying a vehicle.

End-of-Term Tax Consequences: Selling vs Returning the Car

Leasing a vehicle often results in lower upfront tax liabilities, but at the end of the lease term, returning the car typically avoids capital gains tax, whereas outright purchase may trigger taxable gains upon selling the vehicle. Depreciation recapture rules can apply if the resale price of a purchased car exceeds its adjusted cost basis, increasing tax obligations. Leasing end-of-term options impact tax treatments significantly, as lessees must consider potential sales tax on buyout prices versus no immediate tax event when returning leased vehicles.

Company Car Tax: Lease vs Ownership Scenarios

Leasing a company car often provides tax benefits by allowing businesses to deduct lease payments as operating expenses, reducing taxable income. Outright purchase requires capital expenditure, offering depreciation and capital allowance claims that spread tax relief over several years. The choice impacts cash flow management and tax planning strategies, as leasing typically accelerates deductions while ownership builds asset equity.

Tax Efficiency for Fleet Management: Leasing Compared to Buying

Leasing a fleet offers significant tax advantages, as lease payments are typically fully deductible as a business expense, reducing taxable income more effectively than depreciation on purchased vehicles. Outright purchase requires capital investment and depreciation schedules that spread tax benefits over several years, limiting immediate cash flow benefits. Businesses can optimize tax efficiency by choosing leasing, which provides predictable expenses and potential VAT recovery on lease payments, enhancing overall fleet management cost control.

Choosing the Optimal Tax-Saving Strategy for Your Car

Leasing a car offers significant tax advantages by allowing you to deduct lease payments as a business expense, often resulting in lower taxable income compared to outright purchase. When buying a vehicle outright, you can capitalize on depreciation deductions such as Section 179 and bonus depreciation, which reduce your tax liability over time. Evaluating your cash flow, usage needs, and available tax credits ensures selecting the most beneficial option for maximizing tax savings in your specific financial situation.

Leasing vs Outright Purchase Infographic

cardiffo.com

cardiffo.com