Company car tax applies when an employer provides a vehicle for personal use, resulting in a taxable benefit based on the car's list price and CO2 emissions. Self-employed individuals can claim a car allowance or mileage expenses to reduce taxable profits, typically using the simplified mileage rate or actual vehicle costs. Choosing between company car tax liabilities and self-employed allowances depends on ownership, usage, and overall tax efficiency.

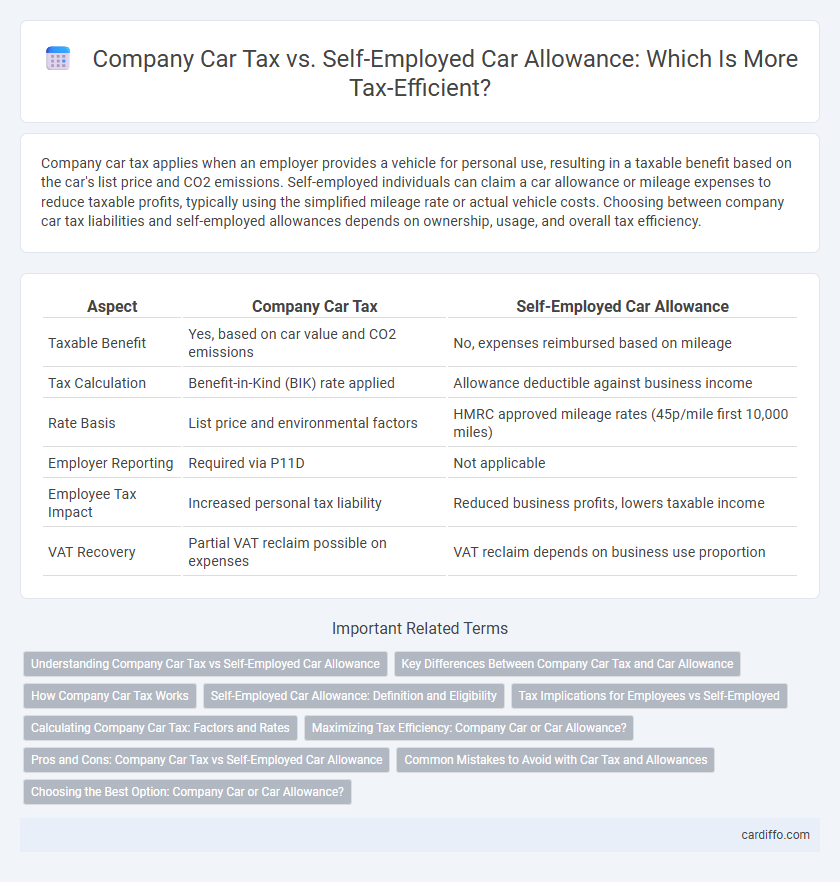

Table of Comparison

| Aspect | Company Car Tax | Self-Employed Car Allowance |

|---|---|---|

| Taxable Benefit | Yes, based on car value and CO2 emissions | No, expenses reimbursed based on mileage |

| Tax Calculation | Benefit-in-Kind (BIK) rate applied | Allowance deductible against business income |

| Rate Basis | List price and environmental factors | HMRC approved mileage rates (45p/mile first 10,000 miles) |

| Employer Reporting | Required via P11D | Not applicable |

| Employee Tax Impact | Increased personal tax liability | Reduced business profits, lowers taxable income |

| VAT Recovery | Partial VAT reclaim possible on expenses | VAT reclaim depends on business use proportion |

Understanding Company Car Tax vs Self-Employed Car Allowance

Company car tax is calculated based on the vehicle's CO2 emissions, list price, and the employee's income tax rate, making it essential to assess the taxable benefit value for accurate tax reporting. Self-employed individuals claim car allowance by deducting actual business mileage costs or using HMRC's approved mileage rates, allowing precise expense tracking for tax relief purposes. Understanding the differences enables optimized tax planning and compliance for both employees and self-employed drivers in the UK.

Key Differences Between Company Car Tax and Car Allowance

Company car tax applies when an employee has a vehicle provided by the employer, and the taxable benefit is calculated based on the car's list price and CO2 emissions. In contrast, a self-employed car allowance is a fixed sum paid to cover business mileage, allowing the individual to claim tax relief based on actual vehicle expenses or a flat mileage rate. Company car tax creates a benefit-in-kind liability, while car allowance provides more flexibility for deducting costs related to vehicle ownership and usage.

How Company Car Tax Works

Company car tax is calculated based on the vehicle's list price, CO2 emissions, and the employee's income tax bracket, making higher-emission vehicles subject to greater tax liability. The taxable benefit is reported on the employee's P11D form, influencing their personal tax bill through PAYE adjustments. Employers must accurately report company car use and ensure compliance with HMRC regulations to avoid penalties.

Self-Employed Car Allowance: Definition and Eligibility

Self-employed car allowance refers to the fixed sum a self-employed individual can claim to cover business-related vehicle expenses without detailed mileage records. Eligibility typically requires the vehicle to be used primarily for business purposes, and the allowance must align with HMRC guidelines to avoid tax discrepancies. Unlike company car tax, this allowance offers a simplified method for claiming road usage costs, reducing administrative burden for the self-employed.

Tax Implications for Employees vs Self-Employed

Company car tax for employees is calculated based on the vehicle's list price and CO2 emissions, leading to a taxable benefit that increases their income tax liability. Self-employed individuals can claim car allowance or actual business mileage costs as allowable expenses, reducing taxable profits and thus lowering income tax and National Insurance contributions. The tax treatment differences affect overall cost efficiency, with company car tax providing less flexibility compared to self-employed car expense deductions.

Calculating Company Car Tax: Factors and Rates

Calculating company car tax involves assessing the vehicle's list price, CO2 emissions, and the employee's income tax bracket to determine the taxable benefit value. The tax rate is set by the government and varies based on the car's emission levels, with lower rates for electric or low-emission vehicles. Company car tax is calculated annually through the PAYE system, directly affecting the employee's taxable income and overall tax liability.

Maximizing Tax Efficiency: Company Car or Car Allowance?

Maximizing tax efficiency depends on comparing the taxable benefits of a company car against the deductible expenses allowed under a self-employed car allowance. Company car tax liability is calculated based on the vehicle's list price and CO2 emissions, which can result in higher taxable income if the car is high-value or inefficient. In contrast, a self-employed car allowance permits claiming actual business mileage expenses using HMRC approved rates, potentially reducing taxable profit more effectively if mileage is high and a personal vehicle is used.

Pros and Cons: Company Car Tax vs Self-Employed Car Allowance

Company car tax offers convenience and reduced upfront costs but often comes with higher taxable benefits based on CO2 emissions and vehicle value. Self-employed car allowance provides greater flexibility and potential tax deductions for business mileage, though it requires meticulous record-keeping and may result in higher personal expenses. Evaluating mileage patterns, vehicle choice, and tax rates is crucial to determine which option maximizes financial efficiency for businesses or individuals.

Common Mistakes to Avoid with Car Tax and Allowances

Common mistakes to avoid with company car tax and self-employed car allowances include inaccurately reporting mileage, which can lead to overpaying tax or missing out on deductions. Many taxpayers fail to differentiate between personal and business use, resulting in incorrect tax liabilities or allowances. Keeping detailed, accurate records of car usage and understanding the specific tax rules for company cars versus self-employed allowances ensures compliance and maximizes tax benefits.

Choosing the Best Option: Company Car or Car Allowance?

Choosing between a company car and a self-employed car allowance depends on tax efficiency and personal usage patterns; company cars attract benefit-in-kind tax based on CO2 emissions and list price, while car allowances provide taxable income but offer greater flexibility in vehicle choice. Understanding HMRC's rules on mileage rates for allowances versus the taxable benefit rates for company cars is crucial to maximize savings. Evaluating annual mileage, fuel costs, and potential tax liabilities helps determine if a flat allowance or a lower benefit-in-kind charge yields better financial outcomes.

Company car tax vs self-employed car allowance Infographic

cardiffo.com

cardiffo.com