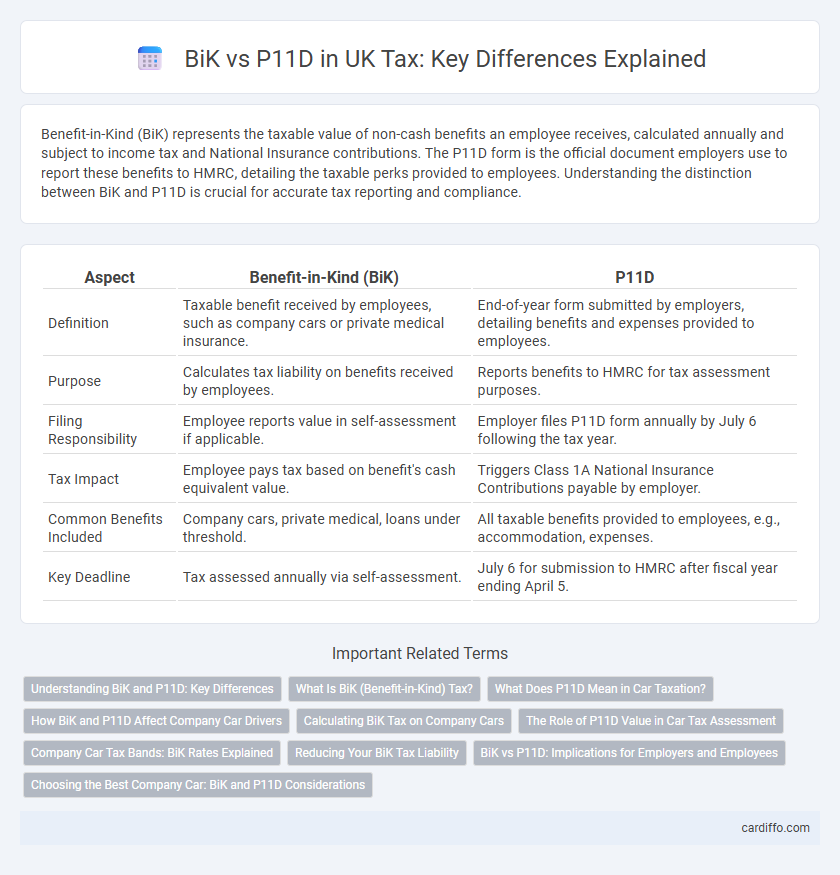

Benefit-in-Kind (BiK) represents the taxable value of non-cash benefits an employee receives, calculated annually and subject to income tax and National Insurance contributions. The P11D form is the official document employers use to report these benefits to HMRC, detailing the taxable perks provided to employees. Understanding the distinction between BiK and P11D is crucial for accurate tax reporting and compliance.

Table of Comparison

| Aspect | Benefit-in-Kind (BiK) | P11D |

|---|---|---|

| Definition | Taxable benefit received by employees, such as company cars or private medical insurance. | End-of-year form submitted by employers, detailing benefits and expenses provided to employees. |

| Purpose | Calculates tax liability on benefits received by employees. | Reports benefits to HMRC for tax assessment purposes. |

| Filing Responsibility | Employee reports value in self-assessment if applicable. | Employer files P11D form annually by July 6 following the tax year. |

| Tax Impact | Employee pays tax based on benefit's cash equivalent value. | Triggers Class 1A National Insurance Contributions payable by employer. |

| Common Benefits Included | Company cars, private medical, loans under threshold. | All taxable benefits provided to employees, e.g., accommodation, expenses. |

| Key Deadline | Tax assessed annually via self-assessment. | July 6 for submission to HMRC after fiscal year ending April 5. |

Understanding BiK and P11D: Key Differences

Benefit-in-Kind (BiK) represents non-cash employee perks subject to Income Tax and National Insurance contributions, while P11D is the form employers use to report these benefits to HMRC. BiK valuation affects an employee's taxable income by applying specific rules and rates to the benefit's cash equivalent, whereas P11D ensures compliance by detailing all reportable benefits and expenses for accurate tax assessment. Understanding the interplay between BiK assessments and P11D submissions is crucial for both employers and employees to manage tax liabilities efficiently.

What Is BiK (Benefit-in-Kind) Tax?

Benefit-in-Kind (BiK) tax applies to non-cash benefits provided by employers to employees, such as company cars, private medical insurance, or interest-free loans. The BiK value is determined based on the benefit's taxable value, which employers must report on the employee's P11D form to HMRC. Paying BiK tax ensures that employees are taxed fairly on perks that have monetary value beyond their salary.

What Does P11D Mean in Car Taxation?

P11D is a UK tax form used to report the value of benefits in kind (BiK) provided to employees, including company cars, to HMRC. It calculates the taxable benefit based on factors like the car's list price, CO2 emissions, and fuel type, which determines the employee's car tax liability. Employers must submit P11D annually, ensuring accurate reporting of car-related benefits for proper taxation.

How BiK and P11D Affect Company Car Drivers

Benefit-in-Kind (BiK) tax directly influences company car drivers by increasing their taxable income based on the car's value and emissions, leading to higher personal tax liabilities. The P11D form reports the details of company car benefits to HMRC, ensuring accurate calculation of employee tax obligations. Understanding both BiK rates and P11D submissions is crucial for drivers to manage their tax planning and avoid unexpected charges.

Calculating BiK Tax on Company Cars

Calculating BiK tax on company cars involves determining the car's list price, applying the appropriate CO2 emission-based percentage, and multiplying by the employee's income tax rate to find the taxable benefit value. The P11D form reports the benefit details, but BiK tax liability calculations require precise CO2 emission data, car fuel type, and current tax year rates to accurately assess the employee's tax burden. Employers must ensure accurate valuation of all company cars provided to comply with HMRC regulations and avoid penalties.

The Role of P11D Value in Car Tax Assessment

P11D value plays a crucial role in car tax assessment by determining the taxable benefit-in-kind (BiK) amount reported to HMRC for company cars. The P11D figure includes the list price of the vehicle, adding options and VAT, and subtracts any employee contributions, which directly influences the BiK tax rate applied. Accurate reporting of the P11D value ensures correct calculation of income tax liability for employees using company cars.

Company Car Tax Bands: BiK Rates Explained

Company Car Tax bands are determined by the Benefit-in-Kind (BiK) rates, which are calculated based on the vehicle's CO2 emissions and list price. BiK rates dictate the taxable value of company cars, significantly affecting employees' tax liabilities reported via the P11D form. Understanding the BiK percentage is crucial for accurate company car tax planning and compliance within the UK tax system.

Reducing Your BiK Tax Liability

Reducing your Benefit-in-Kind (BiK) tax liability involves strategic use of salary sacrifice schemes and opting for low-emission or electric company cars to minimize taxable benefits reported through P11D forms. Employers can provide tax-efficient benefits by carefully selecting assets and allowances that qualify for lower or no BiK rates, which directly reduces the amount declared on P11D submissions. Regularly reviewing and updating your company car policy in line with HMRC guidelines ensures optimal tax savings and compliance.

BiK vs P11D: Implications for Employers and Employees

Benefit-in-Kind (BiK) tax represents the taxable value of non-cash employee benefits provided by employers, whereas P11D forms are official HMRC documents used to report these benefits annually. Employers must accurately calculate BiK values to ensure correct tax deductions, while P11D submissions are essential for compliance and employee tax records. Mismanagement of BiK and P11D can result in penalties, increased tax liabilities, and administrative challenges for both employers and employees.

Choosing the Best Company Car: BiK and P11D Considerations

Choosing the best company car involves understanding the differences between BiK (Benefit-in-Kind) tax rates and P11D reporting requirements, as these factors directly impact both employee tax liabilities and employer National Insurance contributions. BiK rates vary based on the car's CO2 emissions, fuel type, and list price, making low-emission vehicles more tax-efficient under current HMRC rules. Employers must also accurately complete P11D forms to report the value of company cars and calculate the correct taxable benefit, ensuring compliance and optimal tax planning.

BiK vs P11D Infographic

cardiffo.com

cardiffo.com