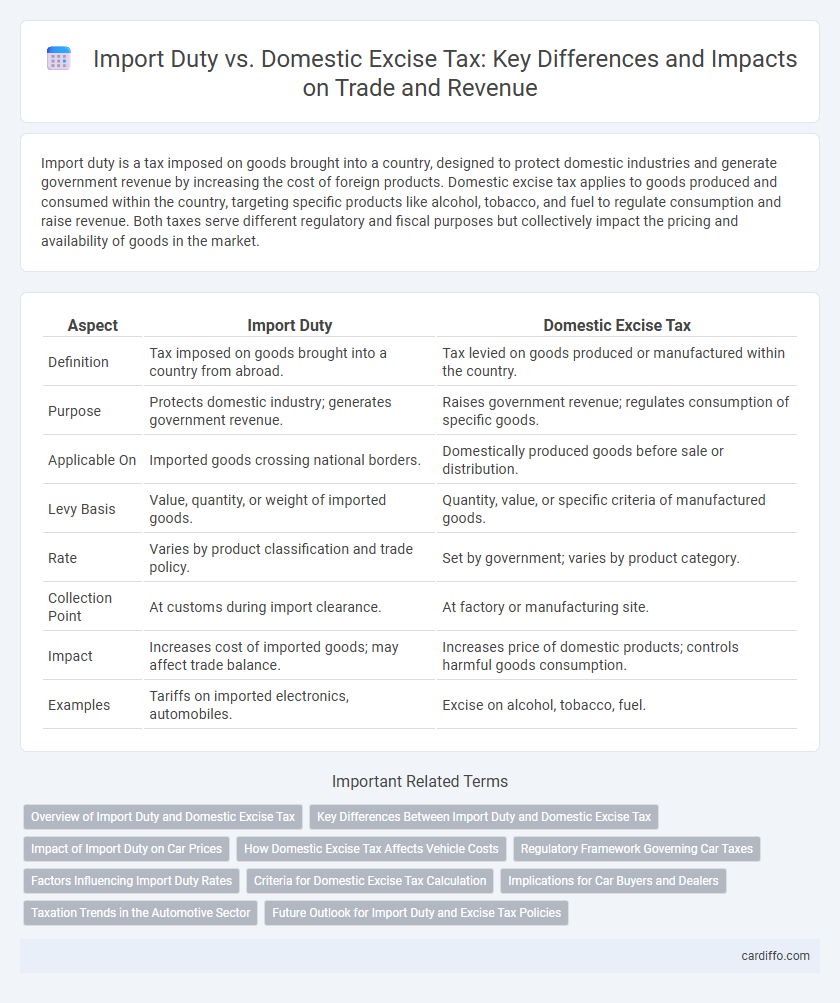

Import duty is a tax imposed on goods brought into a country, designed to protect domestic industries and generate government revenue by increasing the cost of foreign products. Domestic excise tax applies to goods produced and consumed within the country, targeting specific products like alcohol, tobacco, and fuel to regulate consumption and raise revenue. Both taxes serve different regulatory and fiscal purposes but collectively impact the pricing and availability of goods in the market.

Table of Comparison

| Aspect | Import Duty | Domestic Excise Tax |

|---|---|---|

| Definition | Tax imposed on goods brought into a country from abroad. | Tax levied on goods produced or manufactured within the country. |

| Purpose | Protects domestic industry; generates government revenue. | Raises government revenue; regulates consumption of specific goods. |

| Applicable On | Imported goods crossing national borders. | Domestically produced goods before sale or distribution. |

| Levy Basis | Value, quantity, or weight of imported goods. | Quantity, value, or specific criteria of manufactured goods. |

| Rate | Varies by product classification and trade policy. | Set by government; varies by product category. |

| Collection Point | At customs during import clearance. | At factory or manufacturing site. |

| Impact | Increases cost of imported goods; may affect trade balance. | Increases price of domestic products; controls harmful goods consumption. |

| Examples | Tariffs on imported electronics, automobiles. | Excise on alcohol, tobacco, fuel. |

Overview of Import Duty and Domestic Excise Tax

Import duty is a government-imposed tax on goods brought into a country, calculated based on the product's value, quantity, or weight to protect domestic industries and generate revenue. Domestic excise tax targets the manufacture, sale, or consumption of specific goods within a country, often imposed on items like alcohol, tobacco, and fuel to regulate usage and raise fiscal funds. Both taxes serve distinct economic roles: import duty controls foreign trade, while excise tax controls internal market consumption.

Key Differences Between Import Duty and Domestic Excise Tax

Import duty is a tax levied on goods brought into a country, primarily aimed at regulating international trade and protecting local industries. Domestic excise tax applies to specific goods produced and consumed within a country, such as alcohol, tobacco, and fuel, to generate revenue and discourage consumption. Unlike import duty, excise tax is imposed on the manufacturing or sale of goods domestically rather than on cross-border transactions.

Impact of Import Duty on Car Prices

Import duty significantly increases the final cost of imported vehicles, often adding 20-50% to the base price depending on the country's tariff rates. This tax inflates consumer prices, reducing affordability and potentially dampening demand for foreign cars in the domestic market. Unlike domestic excise tax, import duty specifically targets cross-border trade and plays a crucial role in protecting local automotive industries by making imported models less price competitive.

How Domestic Excise Tax Affects Vehicle Costs

Domestic excise tax significantly increases the overall cost of vehicles by imposing additional taxes on manufacturers or importers based on the type, engine capacity, or fuel efficiency of the vehicle. Unlike import duty, which is charged once upon vehicle entry, domestic excise tax is applied throughout the supply chain, affecting retail prices and consumer affordability. Higher excise rates on luxury or high-emission vehicles promote environmental goals but result in considerably higher purchase prices for end buyers.

Regulatory Framework Governing Car Taxes

Import duty on cars is governed by customs regulations, imposing tariffs on vehicles brought into a country to protect local industries and generate government revenue. Domestic excise tax applies to vehicles manufactured or sold within the country, regulated under national tax laws targeting luxury or high-emission cars to influence consumer behavior. Both taxes operate under distinct frameworks, with import duties administered by customs authorities and excise taxes enforced by tax agencies, ensuring compliance through specific assessment and collection procedures.

Factors Influencing Import Duty Rates

Import duty rates are influenced by factors such as the country of origin, tariff classifications under the Harmonized System, and trade agreements that may offer preferential rates or exemptions. The value of the imported goods, including insurance and freight costs, also plays a critical role in determining the import duty amount. Domestic policies, protection of local industries, and international trade regulations further impact the final import duty rates applied.

Criteria for Domestic Excise Tax Calculation

Domestic excise tax calculation is primarily based on the nature, quantity, and value of domestically manufactured or produced goods subject to taxation. The tax rate varies depending on product categories such as alcohol, tobacco, and petroleum, often calculated per unit or as a percentage of the product's retail price. Unlike import duty, which applies to foreign goods upon entry, domestic excise tax focuses on internal production and consumption metrics to determine the taxable amount.

Implications for Car Buyers and Dealers

Import duty on vehicles significantly increases the cost of imported cars, affecting affordability for buyers and profit margins for dealers. Domestic excise tax applies to locally manufactured vehicles, influencing pricing strategies and competitiveness within the domestic market. Understanding the distinct impacts of import duty and excise tax is crucial for car buyers and dealers to navigate costs and optimize financial decisions.

Taxation Trends in the Automotive Sector

Import duty on automotive components significantly influences the cost structure of vehicles by increasing the price of imported parts, prompting manufacturers to localize production and reduce dependency on foreign suppliers. Domestic excise tax, typically levied on the final sale price of vehicles, affects consumer demand and market pricing strategies, with higher rates often leading to a slowdown in vehicle sales. Recent taxation trends in the automotive sector reveal a shift towards incentivizing electric vehicles through reduced import duties and excise taxes, promoting environmental sustainability and industry innovation.

Future Outlook for Import Duty and Excise Tax Policies

Import duty policies are increasingly influenced by globalization trends and trade agreements, with a future shift toward streamlined tariffs and digital trade facilitation expected to boost cross-border commerce. Domestic excise tax frameworks are projected to tighten, emphasizing environmental sustainability by imposing higher rates on carbon-intensive products and promoting green alternatives. Policymakers aim to balance revenue generation with economic growth by integrating advanced data analytics to optimize tax compliance and enforcement in both import duties and excise taxes.

Import Duty vs Domestic Excise Tax Infographic

cardiffo.com

cardiffo.com