Personal car tax rates differ significantly from commercial car tax rates due to usage classifications, with personal vehicles typically subject to standard vehicle registration fees and fuel taxes. Commercial car taxes are generally higher, reflecting their business use and include additional charges such as heavier depreciation allowances and possible sales tax exemptions for business expenses. Understanding these distinctions helps taxpayers optimize deductions and comply with relevant tax regulations effectively.

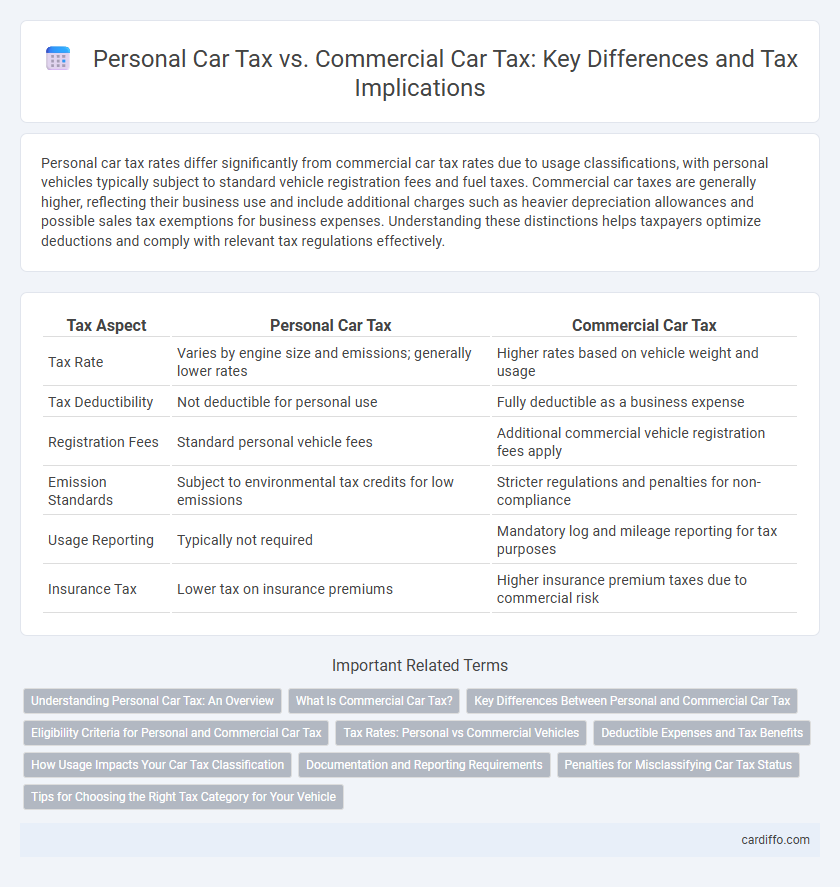

Table of Comparison

| Tax Aspect | Personal Car Tax | Commercial Car Tax |

|---|---|---|

| Tax Rate | Varies by engine size and emissions; generally lower rates | Higher rates based on vehicle weight and usage |

| Tax Deductibility | Not deductible for personal use | Fully deductible as a business expense |

| Registration Fees | Standard personal vehicle fees | Additional commercial vehicle registration fees apply |

| Emission Standards | Subject to environmental tax credits for low emissions | Stricter regulations and penalties for non-compliance |

| Usage Reporting | Typically not required | Mandatory log and mileage reporting for tax purposes |

| Insurance Tax | Lower tax on insurance premiums | Higher insurance premium taxes due to commercial risk |

Understanding Personal Car Tax: An Overview

Personal car tax is calculated based on factors such as vehicle value, engine size, and emissions, typically applying to privately owned vehicles primarily for personal use. Unlike commercial car tax, which may include additional levies related to business usage, personal car tax often benefits from lower rates and exemptions for smaller engines and eco-friendly models. Understanding these distinctions is crucial for accurate tax filing and avoiding penalties related to misclassification between personal and commercial vehicle taxation.

What Is Commercial Car Tax?

Commercial car tax applies to vehicles used primarily for business purposes, such as transporting goods or passengers for profit, and is typically calculated based on factors like vehicle weight, usage, and type of commercial activity. This tax often differs from personal car tax by having higher rates and stricter regulatory requirements, reflecting the vehicle's role in generating revenue. Understanding commercial car tax involves recognizing its role in funding infrastructure maintenance due to the increased wear and tear caused by commercial vehicle operations.

Key Differences Between Personal and Commercial Car Tax

Personal car tax typically involves registration fees, property tax, and occasional emissions testing, with rates based on vehicle value and weight. Commercial car tax often includes higher registration fees, additional road use taxes, and stricter regulations reflecting the vehicle's business use and heavier loads. Key differences arise from tax rates, allowable deductions, and compliance requirements tailored to personal versus commercial usage.

Eligibility Criteria for Personal and Commercial Car Tax

Personal car tax eligibility requires the vehicle to be registered under an individual's name and primarily used for private purposes, including commuting and leisure. Commercial car tax eligibility mandates the vehicle's registration under a business entity or as a commercial asset, with usage centered on transporting goods or passengers for profit. Documentation such as business licenses, proof of commercial activity, and tax identification numbers are essential to validate eligibility for commercial car tax rates.

Tax Rates: Personal vs Commercial Vehicles

Tax rates for personal vehicles generally remain lower compared to commercial vehicles due to differing usage patterns and regulatory frameworks. Commercial car tax often factors in higher depreciation, fuel consumption, and business-related expenses, resulting in increased tax liabilities. Personal vehicle tax rates primarily depend on engine size, emissions, and vehicle age, whereas commercial car tax rates incorporate additional elements like gross vehicle weight and operational purpose.

Deductible Expenses and Tax Benefits

Personal car tax allows limited deductible expenses primarily related to fuel and maintenance if used for business purposes, whereas commercial car tax offers broader deductions including depreciation, insurance, and lease payments. Businesses benefit from commercial car tax deductions by lowering taxable income through expenses fully attributable to business use. Tax benefits for commercial vehicles often include accelerated depreciation and eligibility for specific tax credits, enhancing overall tax savings.

How Usage Impacts Your Car Tax Classification

Personal car tax rates are generally lower than commercial car tax due to the vehicle's primarily private use and mileage limits. Commercial car tax classification applies when a vehicle is used mainly for business purposes, such as deliveries or transporting goods, leading to higher tax rates reflecting increased wear and regulatory costs. Understanding how usage patterns distinguish personal from commercial use can optimize tax liability and ensure compliance with tax regulations.

Documentation and Reporting Requirements

Personal car tax documentation typically includes proof of ownership, vehicle registration, and annual tax payment receipts, with reporting requirements limited to personal tax returns. Commercial car tax demands more extensive documentation such as business registration, detailed mileage logs, expense reports, and compliance with commercial vehicle tax regulations. Accurate record-keeping and periodic submission of reports to tax authorities are essential to differentiate between personal and commercial vehicle tax obligations.

Penalties for Misclassifying Car Tax Status

Misclassifying a personal car as a commercial vehicle or vice versa can result in significant tax penalties, including fines, back taxes, and interest charges imposed by tax authorities. Tax agencies scrutinize vehicle usage records and mileage logs to verify classification accuracy, and discrepancies often trigger audits. Accurate classification is essential to avoid legal issues and ensure compliance with tax regulations governing personal and commercial car usage.

Tips for Choosing the Right Tax Category for Your Vehicle

Evaluate your vehicle's primary use, mileage, and potential business applications to determine whether personal or commercial car tax applies. Personal car tax rates often depend on emissions and engine size, while commercial car tax may offer deductions for business expenses but require more detailed record-keeping. Consult tax regulations and consider anticipated usage patterns to accurately classify your vehicle and optimize tax benefits.

Personal Car Tax vs Commercial Car Tax Infographic

cardiffo.com

cardiffo.com