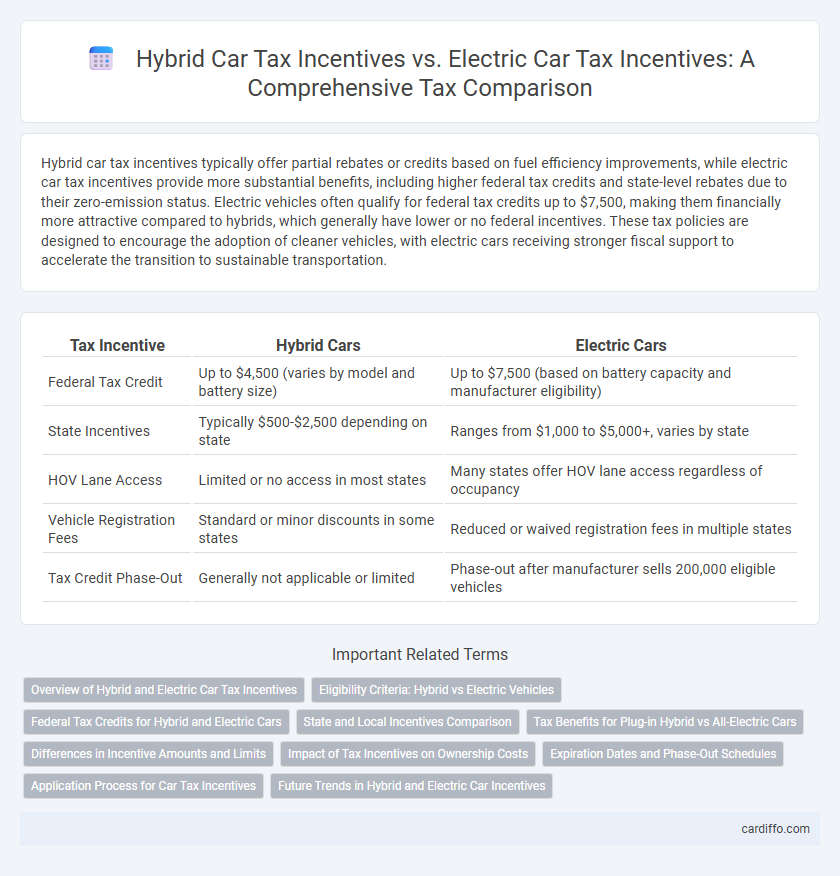

Hybrid car tax incentives typically offer partial rebates or credits based on fuel efficiency improvements, while electric car tax incentives provide more substantial benefits, including higher federal tax credits and state-level rebates due to their zero-emission status. Electric vehicles often qualify for federal tax credits up to $7,500, making them financially more attractive compared to hybrids, which generally have lower or no federal incentives. These tax policies are designed to encourage the adoption of cleaner vehicles, with electric cars receiving stronger fiscal support to accelerate the transition to sustainable transportation.

Table of Comparison

| Tax Incentive | Hybrid Cars | Electric Cars |

|---|---|---|

| Federal Tax Credit | Up to $4,500 (varies by model and battery size) | Up to $7,500 (based on battery capacity and manufacturer eligibility) |

| State Incentives | Typically $500-$2,500 depending on state | Ranges from $1,000 to $5,000+, varies by state |

| HOV Lane Access | Limited or no access in most states | Many states offer HOV lane access regardless of occupancy |

| Vehicle Registration Fees | Standard or minor discounts in some states | Reduced or waived registration fees in multiple states |

| Tax Credit Phase-Out | Generally not applicable or limited | Phase-out after manufacturer sells 200,000 eligible vehicles |

Overview of Hybrid and Electric Car Tax Incentives

Hybrid car tax incentives generally include federal credits up to $4,000 and state-specific rebates aimed at reducing upfront purchase costs. Electric car tax incentives often provide larger federal tax credits up to $7,500, in addition to additional state and local benefits such as reduced registration fees and access to HOV lanes. Both incentive programs are designed to promote greener transportation but differ significantly in the magnitude and eligibility criteria based on vehicle type and battery capacity.

Eligibility Criteria: Hybrid vs Electric Vehicles

Hybrid car tax incentives typically require vehicles to meet a minimum fuel efficiency threshold and use a combination of internal combustion engines and electric motors, while electric car tax incentives are generally reserved for fully electric vehicles with zero tailpipe emissions. Eligibility criteria for hybrids often consider battery capacity and emissions levels, whereas electric vehicles must demonstrate battery capacity above a set kilowatt-hour minimum to qualify for federal or state credits. Some programs exclude plug-in hybrids from electric vehicle incentives, emphasizing the environmental benefits of pure electric propulsion.

Federal Tax Credits for Hybrid and Electric Cars

Federal tax credits for hybrid cars typically offer a maximum credit of up to $4,000, with eligibility based on vehicle battery capacity and emissions reductions. Electric cars qualify for a more substantial federal tax credit, often up to $7,500, depending on factors such as battery size, vehicle price, and manufacturer sales volume. The Inflation Reduction Act further modifies electric vehicle tax credits by imposing domestic manufacturing and critical mineral sourcing requirements to maximize benefits.

State and Local Incentives Comparison

State and local incentives for hybrid cars typically include modest rebates and reduced registration fees, whereas electric vehicles (EVs) receive more substantial benefits such as larger tax credits, access to HOV lanes, and utility bill discounts. States like California and New York lead with robust EV incentives that significantly lower upfront costs and support infrastructure development, contrasting with limited hybrid-specific programs. These variations reflect policy priorities favoring zero-emission vehicles to accelerate clean transportation adoption.

Tax Benefits for Plug-in Hybrid vs All-Electric Cars

Plug-in hybrid cars qualify for federal tax credits up to $4,502, depending on battery capacity, while all-electric vehicles can receive credits up to $7,500, reflecting their zero-emission status. State-level incentives often complement federal benefits, with many states offering additional rebates, reduced registration fees, or HOV lane access specifically for all-electric vehicles. Tax benefits for plug-in hybrids typically phase out faster as their market presence grows, whereas all-electric vehicles maintain broader incentive eligibility due to stricter emissions standards and environmental policies.

Differences in Incentive Amounts and Limits

Hybrid car tax incentives typically offer lower maximum credits compared to electric car incentives, with hybrid credits often capped around $4,000, whereas electric vehicle (EV) credits can reach up to $7,500 depending on battery capacity and vehicle weight. Electric car tax incentives generally have stricter eligibility limits tied to vehicle price, manufacturer sales caps, and income thresholds, whereas hybrid incentives often apply more broadly with fewer restrictions. The disparity in incentive amounts and qualification limits reflects government goals to accelerate the adoption of fully electric vehicles over hybrids.

Impact of Tax Incentives on Ownership Costs

Hybrid car tax incentives reduce upfront ownership costs but typically offer smaller federal tax credits compared to fully electric vehicles, which benefit from more substantial incentives like the federal EV tax credit up to $7,500. These tax credits lower the effective purchase price, significantly affecting total cost of ownership by decreasing loan amounts and monthly payments. State and local incentives further enhance savings for electric car owners, often making EVs more economically attractive over the long term despite higher initial prices.

Expiration Dates and Phase-Out Schedules

Hybrid car tax incentives often have earlier expiration dates compared to electric car tax incentives, reflecting the gradual shift toward fully electric vehicles. Many hybrid incentives phased out or significantly reduced benefits as automakers met specific sales thresholds, while electric car incentives generally feature longer phase-out schedules tied to manufacturer caps. Monitoring IRS updates is essential, as phase-out timelines vary by state and federal programs, influencing eligibility and tax benefit amounts.

Application Process for Car Tax Incentives

Applying for hybrid car tax incentives often requires submitting proof of vehicle purchase and registration along with specific emission certification documents to local tax authorities. Electric car tax incentives typically involve a more streamlined process, frequently integrated into the point-of-sale transaction, reducing the need for extensive paperwork. Both processes may require eligibility verification based on vehicle model, purchase date, and taxpayer residency, but electric car incentives tend to offer faster approval and direct rebate applications through government websites.

Future Trends in Hybrid and Electric Car Incentives

Future trends in hybrid and electric car tax incentives indicate a shift towards greater support for fully electric vehicles as governments worldwide aim to meet stringent carbon reduction targets. Hybrid car incentives may decrease gradually as advancements in battery technology and charging infrastructure make electric vehicles more accessible and cost-effective. Policymakers are increasingly prioritizing long-term environmental benefits by enhancing electric car rebates, tax credits, and infrastructure investments, signaling stronger fiscal encouragement for EV adoption over hybrids.

Hybrid car tax incentives vs electric car tax incentives Infographic

cardiffo.com

cardiffo.com