Green Vehicle Tax incentives encourage the adoption of eco-friendly cars by reducing tax rates on electric and hybrid models, promoting environmental sustainability and lower emissions. Gas Guzzler Tax targets fuel-inefficient vehicles with high emissions, imposing additional fees to discourage the purchase of cars that consume excessive gasoline. Both tax structures aim to influence consumer behavior, shifting the market towards greener transportation options.

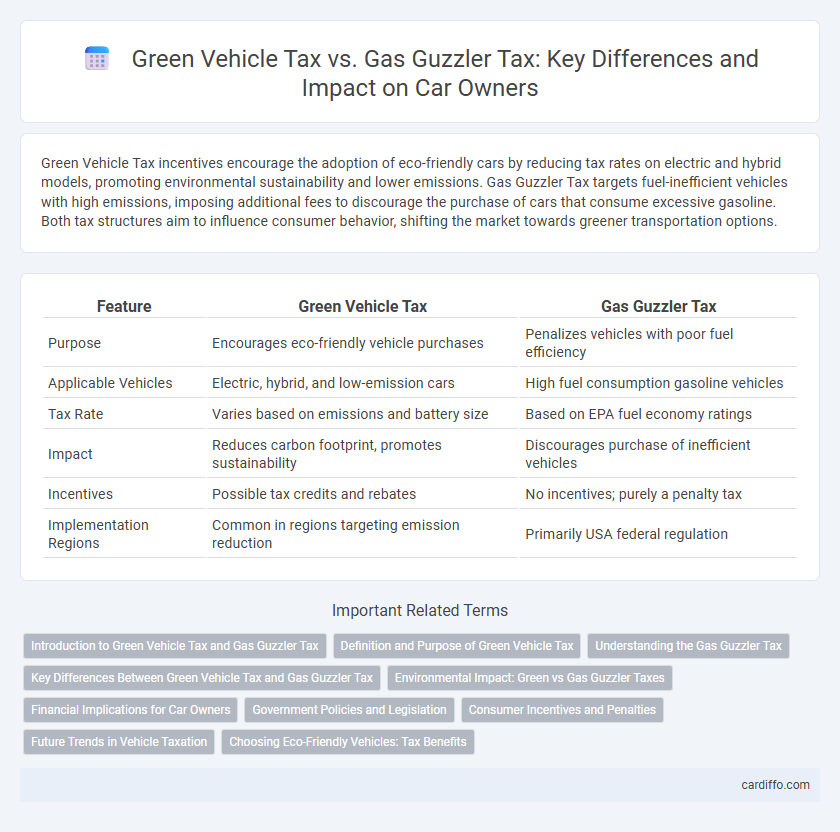

Table of Comparison

| Feature | Green Vehicle Tax | Gas Guzzler Tax |

|---|---|---|

| Purpose | Encourages eco-friendly vehicle purchases | Penalizes vehicles with poor fuel efficiency |

| Applicable Vehicles | Electric, hybrid, and low-emission cars | High fuel consumption gasoline vehicles |

| Tax Rate | Varies based on emissions and battery size | Based on EPA fuel economy ratings |

| Impact | Reduces carbon footprint, promotes sustainability | Discourages purchase of inefficient vehicles |

| Incentives | Possible tax credits and rebates | No incentives; purely a penalty tax |

| Implementation Regions | Common in regions targeting emission reduction | Primarily USA federal regulation |

Introduction to Green Vehicle Tax and Gas Guzzler Tax

Green Vehicle Tax incentivizes eco-friendly transportation by imposing lower taxes on electric, hybrid, and low-emission vehicles to promote environmental sustainability and reduce carbon footprints. Gas Guzzler Tax targets fuel-inefficient cars with poor gas mileage by levying additional fees, encouraging manufacturers and consumers to prioritize fuel economy. These taxes reflect government strategies to influence vehicle choice, reduce pollution, and address climate change through fiscal measures.

Definition and Purpose of Green Vehicle Tax

Green Vehicle Tax incentivizes the purchase and use of environmentally-friendly vehicles by offering tax reductions or credits for low-emission or electric cars, promoting sustainable transportation. This tax aims to reduce carbon emissions and dependence on fossil fuels, aligning with global efforts to combat climate change. In contrast, the Gas Guzzler Tax imposes additional fees on vehicles with poor fuel efficiency to discourage high fuel consumption and environmental harm.

Understanding the Gas Guzzler Tax

The Gas Guzzler Tax applies to new passenger cars with fuel economy ratings below specified EPA standards, targeting vehicles with poor mileage such as large SUVs and luxury sedans. Unlike the Green Vehicle Tax incentives that reward eco-friendly choices, the Gas Guzzler Tax imposes fees ranging from $1,000 to $7,700 based on the vehicle's fuel efficiency deficit. This tax encourages manufacturers and consumers to prioritize fuel-efficient designs, ultimately reducing harmful emissions and dependence on fossil fuels.

Key Differences Between Green Vehicle Tax and Gas Guzzler Tax

Green Vehicle Tax incentivizes eco-friendly cars by offering tax credits or rebates based on low emissions and fuel efficiency, promoting sustainable transportation. Gas Guzzler Tax imposes penalties on vehicles with poor fuel economy, aimed at discouraging the manufacture and purchase of inefficient, high-consumption vehicles. Key differences include the Green Vehicle Tax providing financial benefits to low-emission vehicles, while the Gas Guzzler Tax enforces additional costs on high-emission, fuel-inefficient cars.

Environmental Impact: Green vs Gas Guzzler Taxes

The Green Vehicle Tax incentivizes the adoption of low-emission vehicles by offering tax reductions and rebates aimed at reducing carbon footprints and promoting sustainable transportation. In contrast, the Gas Guzzler Tax imposes additional fees on high fuel consumption vehicles, targeting the reduction of greenhouse gas emissions from inefficient gas-powered engines. Together, these tax policies encourage environmental responsibility by financially motivating consumers to choose cleaner, energy-efficient vehicles over high-emission alternatives.

Financial Implications for Car Owners

Green Vehicle Tax incentives reduce upfront costs and provide significant long-term savings through tax credits for electric and hybrid car owners, encouraging eco-friendly choices. Gas Guzzler Tax imposes additional fees on owners of vehicles with poor fuel efficiency, increasing overall ownership expenses. Understanding these contrasting tax policies helps car buyers optimize financial benefits while considering environmental impact.

Government Policies and Legislation

Government policies increasingly favor Green Vehicle Tax incentives to promote environmentally friendly transportation and reduce carbon emissions. Legislation imposes the Gas Guzzler Tax on fuel-inefficient vehicles to discourage excessive fuel consumption and combat air pollution. These tax frameworks support sustainable mobility goals by encouraging consumers and manufacturers to prioritize energy-efficient vehicle technologies.

Consumer Incentives and Penalties

Green Vehicle Tax offers consumer incentives such as tax credits, rebates, and reduced registration fees to promote the purchase of fuel-efficient and low-emission vehicles. In contrast, the Gas Guzzler Tax imposes penalties on buyers of vehicles with poor fuel economy, increasing the cost for those who choose gas-heavy models. These measures aim to shift consumer behavior towards environmentally friendly transportation options by financially rewarding clean energy adoption and discouraging excessive fuel consumption.

Future Trends in Vehicle Taxation

Future trends in vehicle taxation emphasize shifting from traditional fuel-based taxes like the Gas Guzzler Tax to more sustainable models such as the Green Vehicle Tax. Governments worldwide are increasingly incentivizing electric and hybrid vehicles through reduced tax rates and credits to promote environmental sustainability and reduce carbon emissions. Advances in telematics and real-time emissions tracking are likely to enable dynamic taxation systems, adjusting fees based on actual vehicle usage and environmental impact.

Choosing Eco-Friendly Vehicles: Tax Benefits

Choosing eco-friendly vehicles offers significant tax benefits, including exemptions or reductions under the Green Vehicle Tax, which incentivizes low-emission and electric cars. In contrast, the Gas Guzzler Tax imposes additional fees on vehicles with poor fuel efficiency, discouraging the purchase of high-emission models. These tax policies promote environmental sustainability by financially rewarding consumers who opt for cleaner transportation options while penalizing less efficient vehicles.

Green Vehicle Tax vs Gas Guzzler Tax Infographic

cardiffo.com

cardiffo.com