Hybrid vehicle incentives often provide tax credits and rebates aimed at reducing the upfront cost of vehicles that use both gasoline and electric power, targeting improved fuel efficiency and lower emissions. Electric vehicle incentives typically offer more substantial tax credits and benefits, reflecting government priorities to accelerate the adoption of zero-emission transportation and support environmental sustainability. Understanding the differences in these incentives helps consumers make informed decisions based on cost savings, environmental impact, and eligibility requirements.

Table of Comparison

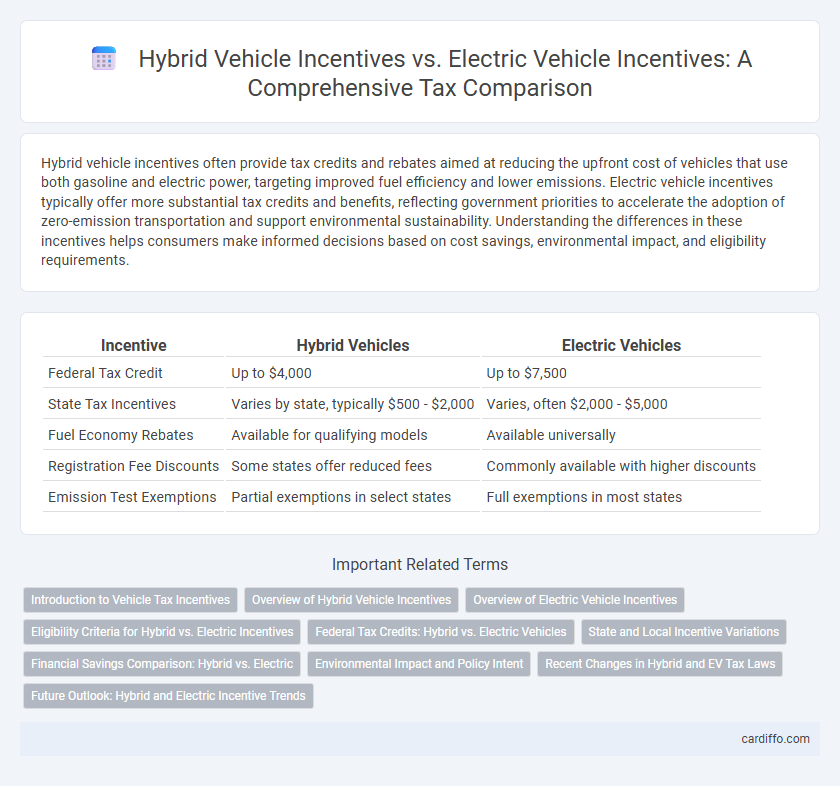

| Incentive | Hybrid Vehicles | Electric Vehicles |

|---|---|---|

| Federal Tax Credit | Up to $4,000 | Up to $7,500 |

| State Tax Incentives | Varies by state, typically $500 - $2,000 | Varies, often $2,000 - $5,000 |

| Fuel Economy Rebates | Available for qualifying models | Available universally |

| Registration Fee Discounts | Some states offer reduced fees | Commonly available with higher discounts |

| Emission Test Exemptions | Partial exemptions in select states | Full exemptions in most states |

Introduction to Vehicle Tax Incentives

Hybrid vehicle incentives often include tax credits and rebates that reduce the overall purchase price by promoting fuel efficiency and lower emissions. Electric vehicle incentives typically offer more substantial tax benefits, reflecting their zero-emission status and contribution to environmental sustainability. Both incentive programs aim to accelerate the adoption of cleaner transportation technologies by providing financial relief through federal, state, and local tax policies.

Overview of Hybrid Vehicle Incentives

Hybrid vehicle incentives often include federal tax credits up to $4,000, state-specific rebates, and reduced registration fees aimed at promoting fuel-efficient technology. These incentives are designed to lower the upfront cost of hybrid vehicles, encouraging adoption as an alternative to traditional gasoline cars. Comparatively, hybrid incentives tend to be less lucrative than electric vehicle tax credits but remain a significant factor in consumer decision-making for eco-friendly transportation.

Overview of Electric Vehicle Incentives

Electric vehicle incentives typically include federal tax credits of up to $7,500, state rebates, and reduced registration fees, aimed at reducing the upfront cost and promoting sustainable transportation. Hybrid vehicles may qualify for smaller or no federal tax credits but often have access to state-specific incentives such as HOV lane access and reduced tolls. These incentives significantly influence consumer choices by lowering total ownership costs and encouraging the shift toward zero-emission electric vehicles.

Eligibility Criteria for Hybrid vs. Electric Incentives

Eligibility criteria for hybrid vehicle incentives typically require the vehicle to meet minimum fuel efficiency standards and emit lower greenhouse gases compared to conventional cars, often targeting models with both combustion engines and electric motors. Electric vehicle incentives generally mandate that the vehicle be fully battery electric or plug-in hybrid with a minimum electric-only driving range, prioritizing zero emissions and advanced battery technology. Income limits, purchase price caps, and residency requirements may apply differently across jurisdictions, affecting the availability and amount of tax credits for each vehicle type.

Federal Tax Credits: Hybrid vs. Electric Vehicles

Federal tax credits for electric vehicles (EVs) currently offer up to $7,500 based on battery capacity and manufacturer eligibility, incentivizing zero-emission transportation. Hybrid vehicles, particularly plug-in hybrids (PHEVs), qualify for smaller federal tax credits that typically range from $2,500 to $4,500 depending on the electric-only driving range. The availability and amount of these credits directly impact consumer adoption rates, with electric vehicles receiving stronger financial support to accelerate the transition to cleaner energy.

State and Local Incentive Variations

State and local incentives for hybrid vehicles typically offer modest tax credits or rebates compared to electric vehicle incentives, which can include substantial income tax credits, reduced registration fees, and access to HOV lanes. Incentive amounts and eligibility criteria vary widely by region, with states like California providing higher EV rebates through programs such as the Clean Vehicle Rebate Project, while some states offer limited or no incentives for hybrids. The disparity in financial benefits reflects differing policy priorities aimed at accelerating EV adoption over hybrid vehicles in many jurisdictions.

Financial Savings Comparison: Hybrid vs. Electric

Tax incentives for hybrid vehicles typically include federal tax credits up to $4,000, while electric vehicles (EVs) qualify for larger federal tax credits up to $7,500, resulting in greater upfront financial savings. State and local incentives often complement these federal benefits, with EVs receiving more substantial rebates and tax exemptions compared to hybrids, further amplifying the total cost reduction. Over time, electric vehicles also benefit from lower operational and maintenance costs, enhancing their long-term financial advantage over hybrids.

Environmental Impact and Policy Intent

Electric vehicle incentives typically emphasize zero tailpipe emissions, aligning with policies aimed at reducing urban air pollution and greenhouse gas levels. Hybrid vehicle incentives focus on transitional technology, encouraging reduced fuel consumption and lower emissions compared to conventional vehicles while supporting broader adoption of cleaner alternatives. Policy intent for both targets climate goals but electric vehicle incentives drive a faster shift toward renewable energy integration and sustainability in transportation.

Recent Changes in Hybrid and EV Tax Laws

Recent changes in hybrid and electric vehicle tax laws have shifted incentives, with many governments reducing or phasing out credits for hybrid vehicles while expanding benefits for fully electric vehicles (EVs). For example, the U.S. Inflation Reduction Act increased the federal tax credit cap to $7,500 for new EVs that meet specific sourcing and assembly requirements, whereas hybrids often receive reduced or no credits. These legislative adjustments aim to accelerate the adoption of zero-emission EVs by encouraging consumers through enhanced tax rebates and stricter eligibility criteria.

Future Outlook: Hybrid and Electric Incentive Trends

Hybrid vehicle incentives focus on fuel efficiency improvements and transitional emission reductions, while electric vehicle incentives prioritize zero-emission technology and infrastructure expansion. Future outlook indicates increasing government support for electric vehicles through enhanced tax credits, rebates, and investment in charging networks, reflecting stricter emission regulations and climate goals. Policy trends suggest gradual phasing out of hybrid-specific incentives as electric vehicle adoption accelerates, driving a shift toward full electrification incentives.

Hybrid vehicle incentives vs electric vehicle incentives Infographic

cardiffo.com

cardiffo.com