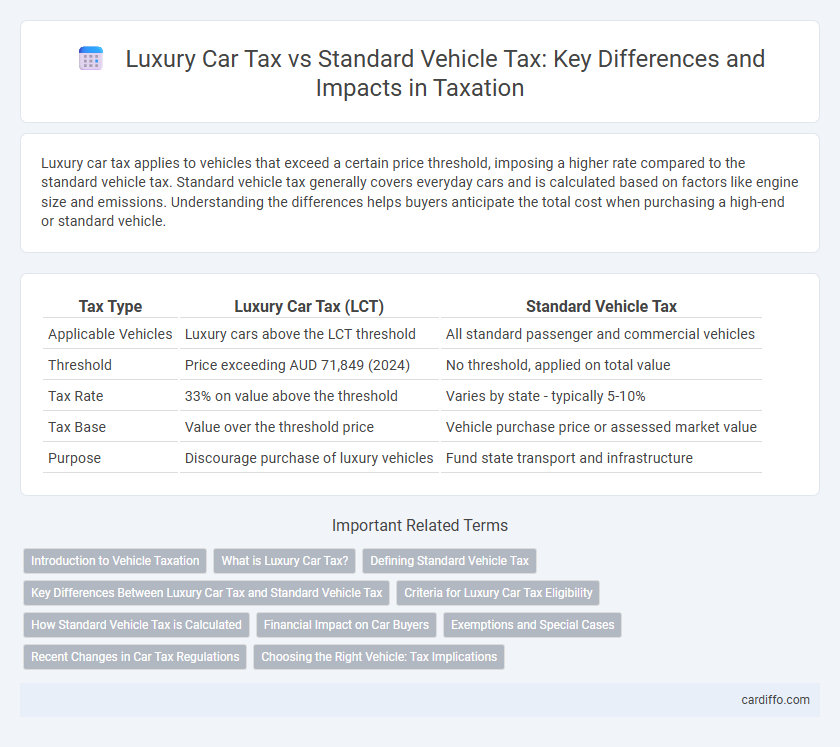

Luxury car tax applies to vehicles that exceed a certain price threshold, imposing a higher rate compared to the standard vehicle tax. Standard vehicle tax generally covers everyday cars and is calculated based on factors like engine size and emissions. Understanding the differences helps buyers anticipate the total cost when purchasing a high-end or standard vehicle.

Table of Comparison

| Tax Type | Luxury Car Tax (LCT) | Standard Vehicle Tax |

|---|---|---|

| Applicable Vehicles | Luxury cars above the LCT threshold | All standard passenger and commercial vehicles |

| Threshold | Price exceeding AUD 71,849 (2024) | No threshold, applied on total value |

| Tax Rate | 33% on value above the threshold | Varies by state - typically 5-10% |

| Tax Base | Value over the threshold price | Vehicle purchase price or assessed market value |

| Purpose | Discourage purchase of luxury vehicles | Fund state transport and infrastructure |

Introduction to Vehicle Taxation

Vehicle taxation encompasses various categories, including luxury car tax which is imposed on high-value automobiles exceeding a specified price threshold, contrasting with standard vehicle tax applicable to regular cars. Luxury car tax rates are significantly higher due to the elevated luxury surcharge designed to target premium vehicles, whereas standard vehicle tax is calculated based on factors such as engine size, vehicle weight, and emissions. Understanding these tax distinctions is crucial for consumers and businesses to manage vehicle acquisition costs and compliance effectively.

What is Luxury Car Tax?

Luxury Car Tax (LCT) is a tax imposed on vehicles priced above a specified threshold, designed to target high-value luxury cars. It is calculated as a percentage of the amount exceeding the threshold, distinguishing it from standard vehicle tax, which applies to all registered vehicles regardless of price. LCT aims to generate revenue from expensive automobiles and influence consumer behavior in the luxury car market.

Defining Standard Vehicle Tax

Standard vehicle tax is a government-imposed fee applied to typical passenger cars based on factors such as engine size, fuel type, and vehicle age. Unlike luxury car tax, which targets high-value and premium vehicles exceeding a specific price threshold, standard vehicle tax rates remain consistent and more affordable for everyday automobiles. This tax revenue supports road maintenance, infrastructure development, and transportation safety programs.

Key Differences Between Luxury Car Tax and Standard Vehicle Tax

Luxury car tax (LCT) is applied to vehicles exceeding a specific value threshold, typically targeting high-end or import luxury vehicles, whereas standard vehicle tax covers all regular passenger vehicles regardless of price. The LCT rate is higher and designed to discourage the purchase of expensive luxury cars, calculated on the amount above the threshold, while standard vehicle tax is generally a fixed rate or based on vehicle weight or engine capacity. Unlike standard tax, LCT impacts vehicle pricing, influencing consumer behavior toward more economical options and affecting importers and manufacturers differently in tax liabilities.

Criteria for Luxury Car Tax Eligibility

Luxury Car Tax (LCT) eligibility is determined by the vehicle's value exceeding the luxury car tax threshold, which is adjusted annually by the Australian Taxation Office based on the car's manufacture date and fuel efficiency. Vehicles classified as passenger cars, excluding commercial vehicles like utes and trucks, are subject to LCT if their GST-inclusive price surpasses the threshold--currently set at $71,849 for most fuel-efficient vehicles and $84,916 for others. Importantly, the calculation of LCT takes into account the GST-inclusive value minus any luxury car price adjustments such as dealer discounts or trade-ins.

How Standard Vehicle Tax is Calculated

Standard vehicle tax is calculated based on factors such as the vehicle's engine size, weight, age, and emissions, with rates varying by jurisdiction. Unlike luxury car tax, which targets high-value vehicles exceeding a specified price threshold, standard vehicle tax typically applies to the broader range of everyday passenger cars. This tax calculation ensures that fees are proportional to the vehicle's environmental impact and road usage.

Financial Impact on Car Buyers

Luxury car tax significantly increases the total purchase cost for high-end vehicles compared to standard vehicles, often adding tens of thousands of dollars to the final price. This tax burden impacts car buyers by reducing affordability, limiting choices, and increasing the financial strain for those seeking premium models. Buyers of standard vehicles face comparatively lower tax rates, resulting in a more manageable overall cost and less impact on their vehicle financing and ownership expenses.

Exemptions and Special Cases

Luxury car tax (LCT) applies to vehicles exceeding a certain value threshold, typically exempting vehicles designed for people with disabilities or approved environmental standards. Standard vehicle tax encompasses regular registration fees and may offer exemptions for low-emission vehicles, agricultural machinery, or government-owned cars. Special cases often include classic cars, non-resident exemptions, and diplomatic vehicles, which can receive tax relief under specific regulations.

Recent Changes in Car Tax Regulations

Recent changes in car tax regulations have increased the Luxury Car Tax (LCT) rates while maintaining steady rates for standard vehicle tax, impacting high-end vehicle purchases significantly. The updated LCT threshold now accounts for inflation adjustments, applying to vehicles priced above $71,849 AUD, which affects luxury sedans and SUVs predominantly. These regulatory adjustments aim to balance luxury vehicle market growth with environmental and revenue objectives.

Choosing the Right Vehicle: Tax Implications

Luxury car tax applies to vehicles exceeding a specific value threshold, significantly increasing the overall cost compared to standard vehicle tax rates. Standard vehicle tax typically includes registration and road use charges based on engine capacity or weight, making it more predictable and generally lower for everyday cars. Understanding these tax differences is crucial for buyers aiming to minimize expenses while selecting a vehicle that meets their needs and financial constraints.

Luxury car tax vs standard vehicle tax Infographic

cardiffo.com

cardiffo.com