The logbook method requires detailed records of each business trip, providing a straightforward way to calculate vehicle expenses based on mileage. The actual expenses method allows taxpayers to deduct the real costs of running a vehicle, including fuel, repairs, insurance, and depreciation, offering potential for larger deductions but demanding thorough documentation. Choosing between these methods depends on record-keeping preferences and potential tax savings, as the actual expenses method typically benefits those with higher vehicle maintenance costs.

Table of Comparison

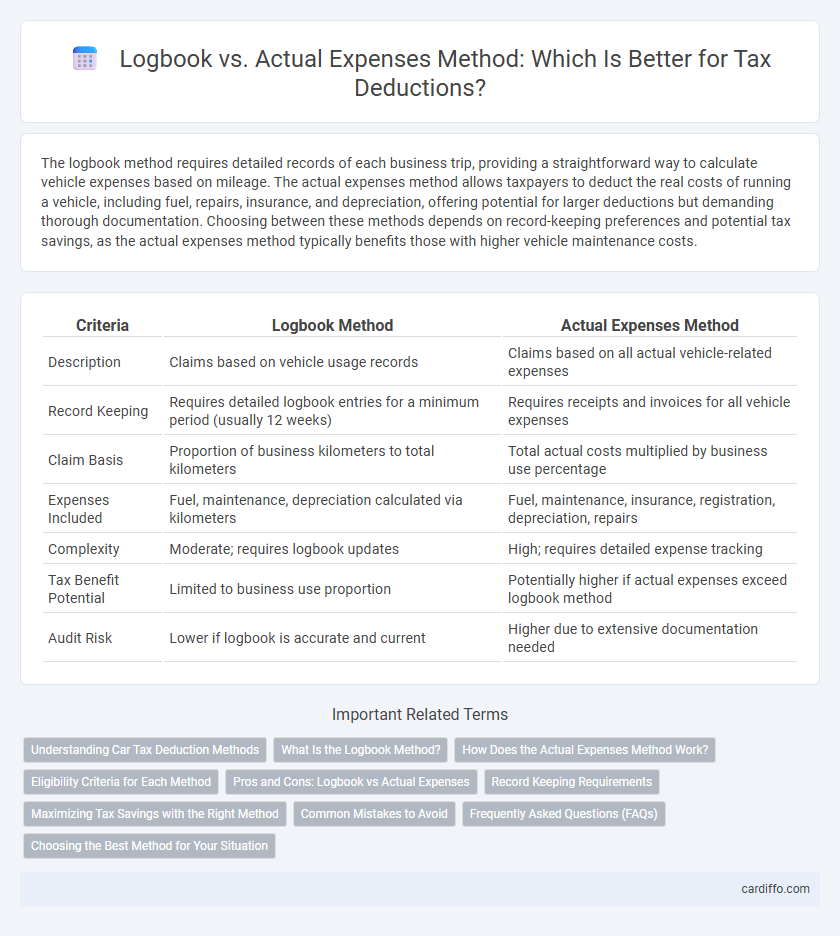

| Criteria | Logbook Method | Actual Expenses Method |

|---|---|---|

| Description | Claims based on vehicle usage records | Claims based on all actual vehicle-related expenses |

| Record Keeping | Requires detailed logbook entries for a minimum period (usually 12 weeks) | Requires receipts and invoices for all vehicle expenses |

| Claim Basis | Proportion of business kilometers to total kilometers | Total actual costs multiplied by business use percentage |

| Expenses Included | Fuel, maintenance, depreciation calculated via kilometers | Fuel, maintenance, insurance, registration, depreciation, repairs |

| Complexity | Moderate; requires logbook updates | High; requires detailed expense tracking |

| Tax Benefit Potential | Limited to business use proportion | Potentially higher if actual expenses exceed logbook method |

| Audit Risk | Lower if logbook is accurate and current | Higher due to extensive documentation needed |

Understanding Car Tax Deduction Methods

The Logbook method requires detailed records of business-related travel, allowing taxpayers to claim a percentage of actual vehicle expenses based on documented mileage. The Actual Expenses method involves tracking all car-related costs such as fuel, maintenance, insurance, and depreciation, with deductions limited to business use only. Choosing the appropriate car tax deduction method depends on accurate record-keeping and the proportion of personal versus business vehicle use to maximize eligible tax benefits.

What Is the Logbook Method?

The Logbook Method requires taxpayers to record all business-related travel by maintaining a detailed logbook that documents dates, destinations, and purposes of each trip. This method allows for the calculation of deductible vehicle expenses based on the percentage of business kilometers traveled compared to total kilometers driven. Accurate and contemporaneous records must be kept, typically for a continuous 12-week period, to substantiate claims with tax authorities.

How Does the Actual Expenses Method Work?

The Actual Expenses Method allows taxpayers to deduct the exact costs incurred for a vehicle, including fuel, maintenance, insurance, and depreciation, by keeping detailed receipts and records. This approach requires accurate tracking of all vehicle-related expenses to calculate the deductible amount accurately. Taxpayers must also maintain records of total mileage to differentiate between personal and business use, ensuring only the business portion of expenses is deducted.

Eligibility Criteria for Each Method

The Logbook method requires maintaining a detailed, dated record of business-related vehicle use, including the total kilometers driven and trips made over a minimum continuous 12-week period to establish the business-use percentage. The Actual Expenses method demands precise documentation of all vehicle-related costs such as fuel, maintenance, insurance, and depreciation, along with accurate records proving the proportion of business use versus private use. Eligibility hinges on the taxpayer's ability to provide consistent, verifiable evidence that aligns with the Australian Taxation Office guidelines for each method, ensuring compliant deduction claims.

Pros and Cons: Logbook vs Actual Expenses

The Logbook method offers simplified record-keeping by tracking business-related mileage, making it ideal for taxpayers with lower vehicle usage but can underestimate deductions if actual expenses are high. The Actual Expenses method allows full deduction of vehicle costs including fuel, maintenance, depreciation, and insurance, maximizing potential savings but requires detailed receipts and rigorous documentation. Choosing between the two depends on balancing administrative effort against potential tax benefits, with the Actual Expenses method generally more advantageous for high usage or costly vehicles.

Record Keeping Requirements

The Logbook method requires detailed mileage tracking, including dates, destinations, and kilometers traveled for vehicle use, maintained for at least five years to substantiate deductions. The Actual Expenses method demands comprehensive records of all vehicle-related costs such as fuel, maintenance, insurance, registration, and depreciation invoices or receipts, also retained for five years. Accurate and organized documentation under both methods ensures compliance with tax authorities and maximizes allowable vehicle expense claims.

Maximizing Tax Savings with the Right Method

Choosing between the logbook method and the actual expenses method significantly impacts maximizing tax savings for vehicle expenses. The logbook method calculates deductions based on the business-use percentage of total kilometers driven, providing a straightforward approach for consistent records, while the actual expenses method allows deduction of all eligible vehicle costs, including fuel, maintenance, insurance, and depreciation, based on precise documentation. Evaluating your vehicle usage pattern and maintaining accurate records ensures selecting the method that yields the highest tax deduction under current tax laws.

Common Mistakes to Avoid

Confusing the logbook and actual expenses methods often leads to inaccurate record-keeping, impacting tax deductions. Failing to maintain a detailed and contemporaneous logbook results in disallowed claims, while neglecting to separate personal and business expenses can distort the actual expenses calculation. Ensuring compliance with Australian Taxation Office (ATO) guidelines on documentation and claiming limits prevents audits and penalties.

Frequently Asked Questions (FAQs)

The Logbook method requires detailed records of business-related vehicle use, capturing mileage for accurate expense claims, while the Actual Expenses method involves tracking all vehicle-related costs, including fuel, maintenance, and depreciation. Taxpayers often ask which method yields higher deductions; the choice depends on vehicle usage patterns and record-keeping diligence. Common FAQs address submission requirements, acceptable record formats, and how to switch methods between tax years for optimal tax benefits.

Choosing the Best Method for Your Situation

Choosing between the logbook and actual expenses methods depends on your vehicle usage and record-keeping habits. The logbook method is ideal for taxpayers who can accurately track business mileage over a representative period, maximizing deductible amounts based on precise usage. The actual expenses method suits those with detailed receipts and higher costs in fuel, maintenance, and depreciation, allowing for comprehensive deduction of all related vehicle expenses.

Logbook vs Actual Expenses Method Infographic

cardiffo.com

cardiffo.com