Commercial vehicle tax is typically higher than passenger vehicle tax due to the increased wear and tear commercial vehicles impose on infrastructure and their higher potential for revenue generation. Passenger vehicle tax rates are generally lower, reflecting personal use and reduced impact on road maintenance costs. Tax authorities often impose stricter regulations and higher fees on commercial vehicles to offset environmental and road maintenance expenses.

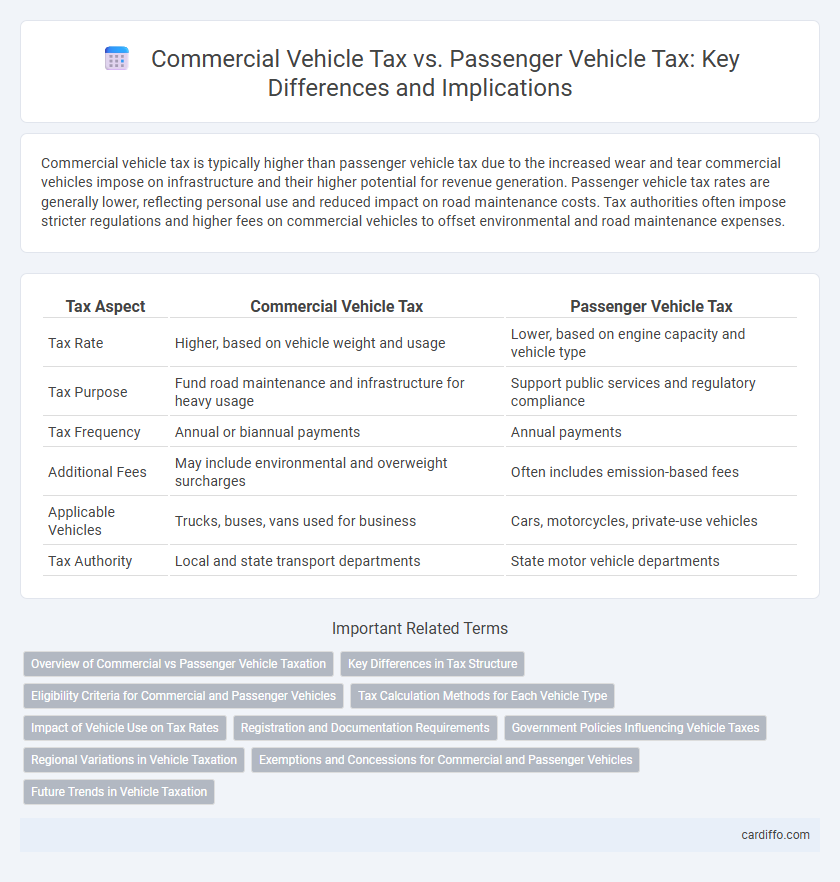

Table of Comparison

| Tax Aspect | Commercial Vehicle Tax | Passenger Vehicle Tax |

|---|---|---|

| Tax Rate | Higher, based on vehicle weight and usage | Lower, based on engine capacity and vehicle type |

| Tax Purpose | Fund road maintenance and infrastructure for heavy usage | Support public services and regulatory compliance |

| Tax Frequency | Annual or biannual payments | Annual payments |

| Additional Fees | May include environmental and overweight surcharges | Often includes emission-based fees |

| Applicable Vehicles | Trucks, buses, vans used for business | Cars, motorcycles, private-use vehicles |

| Tax Authority | Local and state transport departments | State motor vehicle departments |

Overview of Commercial vs Passenger Vehicle Taxation

Commercial vehicle tax structures typically involve higher rates and stricter regulations due to their use in goods transportation and business operations, reflecting factors like weight, mileage, and cargo capacity. Passenger vehicle taxes are generally lower and often based on engine size, emissions, and vehicle type, aimed at individual ownership and daily commuting purposes. These taxation models ensure appropriate revenue allocation and road maintenance funding corresponding to the vehicle's economic impact and usage patterns.

Key Differences in Tax Structure

Commercial vehicle tax rates are generally higher than passenger vehicle taxes due to increased road wear and higher regulatory requirements. Passenger vehicle tax structures often include exemptions or lower rates based on engine size, fuel type, or emission standards, whereas commercial vehicles are frequently taxed based on gross vehicle weight and usage frequency. The tax calculation for commercial vehicles typically involves multiple factors such as payload capacity and mileage, contrasting with passenger vehicles which rely mostly on registration type and engine displacement.

Eligibility Criteria for Commercial and Passenger Vehicles

Commercial vehicle tax eligibility primarily applies to vehicles used for transporting goods or passengers in exchange for payment, including trucks, buses, and taxis registered under business names. Passenger vehicle tax eligibility centers on private vehicles intended for personal use, typically limited to private cars, SUVs, and motorcycles not used for commercial purposes. Eligibility criteria for commercial vehicles often include weight, passenger capacity, and usage for business operations, whereas passenger vehicle taxes focus on engine size, vehicle value, and emissions standards for private ownership.

Tax Calculation Methods for Each Vehicle Type

Commercial vehicle tax is typically calculated based on factors such as weight, load capacity, and mileage, reflecting the vehicle's use for business and transportation of goods. Passenger vehicle tax often relies on engine size, fuel type, and emissions, emphasizing personal use and environmental impact. These distinct calculation methods ensure tax rates correspond to each vehicle category's operational and environmental characteristics.

Impact of Vehicle Use on Tax Rates

Commercial vehicle tax rates are generally higher than passenger vehicle taxes due to increased wear and tear on public infrastructure and higher emissions associated with freight transport. Passenger vehicle tax rates often account for factors such as fuel efficiency and vehicle weight, influencing how personal use impacts taxation. Tax regulations prioritize road maintenance funding and environmental considerations, which significantly differ based on whether the vehicle is used for commercial or personal purposes.

Registration and Documentation Requirements

Commercial vehicle tax requires more extensive registration and documentation, including permits for goods transport and compliance with weight and size regulations, whereas passenger vehicle tax typically demands standard vehicle registration and proof of insurance. Commercial vehicles must also provide operational licenses and detailed ownership documents to validate tax eligibility. Passenger vehicles usually need fewer certifications, focusing primarily on registration certificates and emissions compliance documents.

Government Policies Influencing Vehicle Taxes

Government policies significantly differentiate commercial vehicle tax rates from passenger vehicle taxes, reflecting their distinct purposes and usage patterns. Commercial vehicles often face higher taxes to account for increased road wear, environmental impact, and regulatory compliance, while passenger vehicle taxes tend to emphasize emissions standards and fuel efficiency incentives. These policies aim to balance revenue generation with promoting sustainable transportation and infrastructure maintenance.

Regional Variations in Vehicle Taxation

Regional variations in vehicle taxation significantly affect commercial vehicle tax rates compared to passenger vehicle taxes, with some areas imposing higher levies on commercial vehicles due to their heavier road usage and environmental impact. States like California and New York implement progressive commercial vehicle taxes aligned with vehicle weight and emissions, while many southern states maintain lower passenger vehicle taxes to stimulate consumer spending. These discrepancies influence fleet operating costs and consumer vehicle ownership choices across different U.S. regions.

Exemptions and Concessions for Commercial and Passenger Vehicles

Commercial vehicle tax exemptions often include vehicles used for public transportation, emergency services, and goods transportation, providing relief based on vehicle type and usage frequency. Passenger vehicle tax concessions typically apply to electric and hybrid models, senior citizens, and individuals with disabilities, promoting environmental benefits and social equity. Both categories may benefit from region-specific incentives that reduce tax burdens to encourage compliance and support economic activities.

Future Trends in Vehicle Taxation

Future trends in vehicle taxation indicate a shift towards more differentiated rates for commercial and passenger vehicles, reflecting the growing emphasis on environmental impact and road usage. Commercial vehicle tax structures are expected to incorporate stricter emissions standards and higher fees for heavy freight transport, while passenger vehicle taxes will increasingly favor electric and low-emission models through incentives and reduced rates. Governments are likely to integrate advanced telematics and usage-based taxation systems to enforce fairness and encourage sustainable vehicle operation across both sectors.

Commercial vehicle tax vs passenger vehicle tax Infographic

cardiffo.com

cardiffo.com