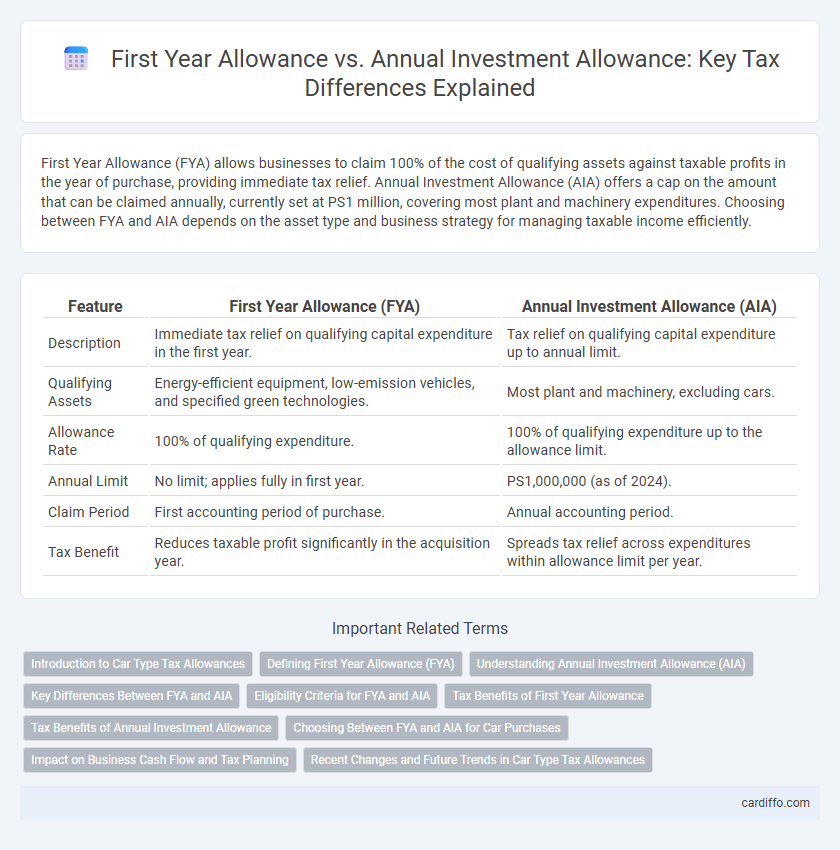

First Year Allowance (FYA) allows businesses to claim 100% of the cost of qualifying assets against taxable profits in the year of purchase, providing immediate tax relief. Annual Investment Allowance (AIA) offers a cap on the amount that can be claimed annually, currently set at PS1 million, covering most plant and machinery expenditures. Choosing between FYA and AIA depends on the asset type and business strategy for managing taxable income efficiently.

Table of Comparison

| Feature | First Year Allowance (FYA) | Annual Investment Allowance (AIA) |

|---|---|---|

| Description | Immediate tax relief on qualifying capital expenditure in the first year. | Tax relief on qualifying capital expenditure up to annual limit. |

| Qualifying Assets | Energy-efficient equipment, low-emission vehicles, and specified green technologies. | Most plant and machinery, excluding cars. |

| Allowance Rate | 100% of qualifying expenditure. | 100% of qualifying expenditure up to the allowance limit. |

| Annual Limit | No limit; applies fully in first year. | PS1,000,000 (as of 2024). |

| Claim Period | First accounting period of purchase. | Annual accounting period. |

| Tax Benefit | Reduces taxable profit significantly in the acquisition year. | Spreads tax relief across expenditures within allowance limit per year. |

Introduction to Car Type Tax Allowances

First Year Allowance (FYA) enables businesses to deduct a significant percentage of qualifying car expenditure from their taxable profits in the initial year, boosting early tax relief. Annual Investment Allowance (AIA) offers a more flexible capital allowance, allowing full deduction of qualifying business asset costs, including cars within specified limits, in the year of purchase. Understanding the distinctions between FYA and AIA is essential for optimizing tax efficiency on company car investments under HMRC regulations.

Defining First Year Allowance (FYA)

First Year Allowance (FYA) enables businesses to deduct a significant percentage of qualifying capital expenditure from taxable profits in the year of purchase, accelerating tax relief. It applies to specific assets like energy-saving equipment, electric vehicles, and certain environmentally friendly technologies, promoting early investment in sustainable business practices. Unlike Annual Investment Allowance (AIA), which has a flat annual limit and broader asset eligibility, FYA offers enhanced upfront relief for targeted investments.

Understanding Annual Investment Allowance (AIA)

Annual Investment Allowance (AIA) enables businesses to claim 100% tax relief on qualifying capital expenditure up to a specified limit in the year of purchase, significantly reducing taxable profits. The current AIA limit stands at PS1 million, covering most plant and machinery acquisitions but excluding certain assets like cars. Understanding AIA's scope and limits helps businesses maximize immediate tax benefits compared to First Year Allowance, which applies selectively to energy-saving or environmentally beneficial equipment.

Key Differences Between FYA and AIA

First Year Allowance (FYA) allows businesses to deduct a significant percentage of the cost of qualifying assets from taxable profits in the year of purchase, often used for energy-efficient or low-emission equipment. Annual Investment Allowance (AIA) provides a 100% deduction on qualifying capital expenditure up to a specific annual limit, covering a broader range of plant and machinery but restricted by a maximum threshold. Key differences include FYA's focus on promoting green technology with no upper limit and AIA's broader asset eligibility constrained by an annual cap, influencing strategic tax planning for capital investments.

Eligibility Criteria for FYA and AIA

First Year Allowance (FYA) eligibility requires businesses to invest in qualifying new and unused plant and machinery, often targeting energy-efficient or environmentally beneficial assets. Annual Investment Allowance (AIA) applies more broadly to tangible capital expenditure on most types of plant and machinery, subject to an annual limit currently set at PS1 million. Both allowances mandate that the assets must be used for business purposes, but FYA focuses on specific categories of equipment to encourage green investment.

Tax Benefits of First Year Allowance

First Year Allowance (FYA) enables businesses to claim 100% tax relief on qualifying capital expenditures in the year of purchase, accelerating tax deductions and improving cash flow. This tax benefit contrasts with the Annual Investment Allowance (AIA), which has a capped limit and applies to a broader range of assets but may defer some relief. FYA specifically targets energy-efficient and environmentally friendly equipment, encouraging faster tax depreciation and reducing taxable profits immediately.

Tax Benefits of Annual Investment Allowance

Annual Investment Allowance (AIA) provides immediate tax relief on qualifying capital expenditures up to a specified limit, allowing businesses to deduct the full cost from their taxable profits in the year of purchase. This allowance significantly reduces the corporation tax liability by accelerating capital cost recovery, thereby improving cash flow and reinvestment capacity. Compared to First Year Allowance (FYA), AIA covers a broader range of assets and offers a more flexible and substantial tax saving opportunity for small to medium-sized enterprises.

Choosing Between FYA and AIA for Car Purchases

Choosing between First Year Allowance (FYA) and Annual Investment Allowance (AIA) for car purchases depends on the vehicle's CO2 emissions and business usage. FYA offers 100% tax relief in the first year for low-emission cars meeting specific criteria, while AIA provides up to PS1 million of immediate relief on qualifying capital expenditure, including cars with higher emissions. Evaluating the car's eligibility for FYA against AIA limits and your company's tax position ensures optimal capital allowance claims and tax efficiency.

Impact on Business Cash Flow and Tax Planning

First Year Allowance (FYA) enables businesses to deduct the full cost of qualifying assets immediately, significantly improving cash flow by reducing taxable profits in the purchase year. Annual Investment Allowance (AIA) caps the amount that can be deducted in a tax year but applies to a broader range of assets, allowing flexible tax planning over multiple years. Strategically balancing FYA and AIA claims helps optimize tax liabilities and enhances business cash flow management by accelerating capital expenditure relief.

Recent Changes and Future Trends in Car Type Tax Allowances

Recent changes in car type tax allowances emphasize stricter emissions criteria for First Year Allowance (FYA), limiting eligibility to ultra-low emission vehicles, while Annual Investment Allowance (AIA) continues to provide relief on a broader range of commercial vehicle purchases. The phased reduction of FYA rates for high-emission cars reflects government policies aimed at promoting greener transport and reducing corporate carbon footprints. Future trends indicate further tightening of emission thresholds and potential integration of electric vehicle incentives within tax regimes to support sustainable business investments.

First Year Allowance vs Annual Investment Allowance Infographic

cardiffo.com

cardiffo.com