Benefit-in-Kind (BIK) represents non-cash compensation provided to employees, such as company cars or private health insurance, which is subject to taxation based on its assessed value. Cash allowances are direct monetary payments to employees that are fully taxable as income and offer greater flexibility in usage. Understanding the tax implications of BIK versus cash allowances helps employers design cost-effective remuneration packages while ensuring compliance with tax regulations.

Table of Comparison

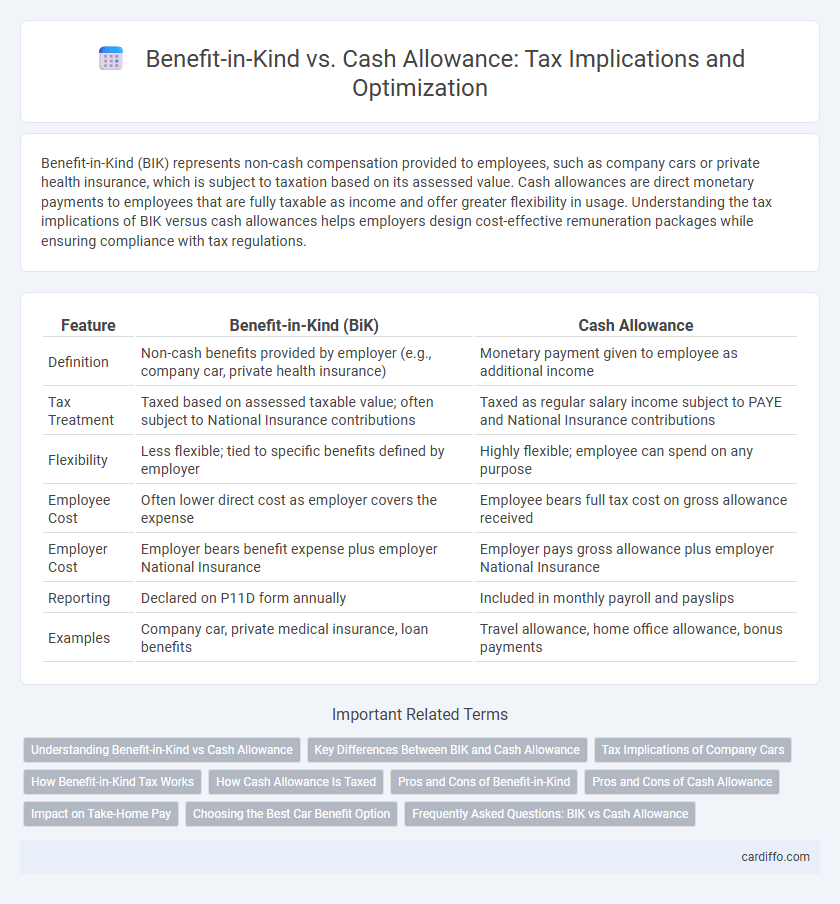

| Feature | Benefit-in-Kind (BiK) | Cash Allowance |

|---|---|---|

| Definition | Non-cash benefits provided by employer (e.g., company car, private health insurance) | Monetary payment given to employee as additional income |

| Tax Treatment | Taxed based on assessed taxable value; often subject to National Insurance contributions | Taxed as regular salary income subject to PAYE and National Insurance contributions |

| Flexibility | Less flexible; tied to specific benefits defined by employer | Highly flexible; employee can spend on any purpose |

| Employee Cost | Often lower direct cost as employer covers the expense | Employee bears full tax cost on gross allowance received |

| Employer Cost | Employer bears benefit expense plus employer National Insurance | Employer pays gross allowance plus employer National Insurance |

| Reporting | Declared on P11D form annually | Included in monthly payroll and payslips |

| Examples | Company car, private medical insurance, loan benefits | Travel allowance, home office allowance, bonus payments |

Understanding Benefit-in-Kind vs Cash Allowance

Benefit-in-Kind (BiK) refers to non-cash benefits provided by employers to employees, such as company cars or private health insurance, which are taxable based on their assessed value. Cash allowances are direct monetary payments made to employees, subject to income tax and National Insurance contributions as regular salary. Understanding the tax implications and reporting requirements for BiK versus cash allowances is crucial for accurate payroll processing and compliance with HMRC regulations.

Key Differences Between BIK and Cash Allowance

Benefit-in-Kind (BIK) represents non-cash perks, such as company cars or private healthcare, taxed based on their assessed value, while cash allowance is a direct payment subject to income tax and National Insurance contributions. BIK taxation relies on the market value of the benefit provided, often resulting in tax efficiencies for employees compared to equivalent cash payments. Employers face different reporting requirements for BIK under HMRC's P11D form, whereas cash allowances are integrated into payroll and taxed at the employee's standard rate.

Tax Implications of Company Cars

Benefit-in-Kind (BIK) company cars attract taxable value based on CO2 emissions, vehicle price, and fuel type, influencing employees' income tax liabilities significantly. Cash allowances offer straightforward taxable income but may result in higher personal tax rates if used to purchase inefficient vehicles. Companies must assess tax efficiency by comparing BIK rates with personal tax brackets and considering National Insurance Contributions implications.

How Benefit-in-Kind Tax Works

Benefit-in-Kind (BIK) tax applies to non-cash benefits provided by employers, such as company cars or private health insurance, which are valued and taxed based on their monetary benefit to the employee. The taxable amount is calculated using specific government-approved valuation methods, often linked to the market value or a percentage of the asset's cost. Employers report BIK values through payroll systems, and the taxable benefits are subject to income tax and National Insurance contributions for employees.

How Cash Allowance Is Taxed

Cash allowance is subject to income tax and National Insurance contributions as part of an employee's taxable earnings. Employers must report cash allowances on the employee's P11D form or include them in the payroll to ensure correct tax treatment. Unlike benefit-in-kind, which is taxed based on its value and specific rates, cash allowances are taxed at the employee's marginal income tax rate.

Pros and Cons of Benefit-in-Kind

Benefit-in-Kind (BIK) offers employees non-cash perks such as company cars, private health insurance, and accommodation, which can enhance job satisfaction without increasing immediate tax liabilities. However, BIK is subject to complex valuation rules, potentially leading to higher tax charges compared to equivalent cash allowances, and it can limit flexibility for both employers and employees. Employers benefit from easier payroll administration and potential National Insurance savings, but face increased reporting obligations and must carefully assess the overall cost-effectiveness compared to cash compensation.

Pros and Cons of Cash Allowance

Cash allowance offers greater flexibility by allowing employees to allocate funds according to personal needs, which can enhance overall satisfaction. However, it is typically subject to income tax and National Insurance contributions, increasing the employee's tax liability compared to tax-advantaged benefits-in-kind. Employers may face higher National Insurance costs with cash allowances, making it a potentially less cost-effective option than providing benefits directly.

Impact on Take-Home Pay

Benefit-in-Kind (BIK) often results in a higher taxable income compared to cash allowances, reducing the net take-home pay due to increased income tax and National Insurance contributions. Cash allowances are treated as part of salary and subject to standard PAYE deductions, allowing for straightforward tax calculations and potentially higher immediate disposable income. Employers and employees should evaluate the tax efficiency of BIK versus cash allowances to optimize post-tax earnings and overall compensation packages.

Choosing the Best Car Benefit Option

Benefit-in-Kind (BIK) offers employees the use of a company car, with tax calculated based on the vehicle's CO2 emissions and list price, often resulting in lower taxable income for low-emission vehicles. Cash allowance provides employees with a cash sum to purchase or lease their own vehicle, giving flexibility but subjecting the full amount to income tax and National Insurance contributions. Choosing the best car benefit option depends on factors such as individual tax brackets, company policy, vehicle preferences, and potential savings from fuel reimbursements or maintenance costs.

Frequently Asked Questions: BIK vs Cash Allowance

Benefit-in-Kind (BIK) and cash allowance differ primarily in taxation; BIK is a non-cash benefit taxed based on the value of the benefit provided, while cash allowance is treated as part of gross salary and taxed accordingly. Employers must consider National Insurance Contributions and Income Tax implications when deciding between providing a BIK or cash allowance to employees. Understanding the tax rates, valuation methods for specific benefits, and employee preferences can optimize tax efficiency and compliance in compensation packages.

Benefit-in-Kind vs Cash Allowance Infographic

cardiffo.com

cardiffo.com