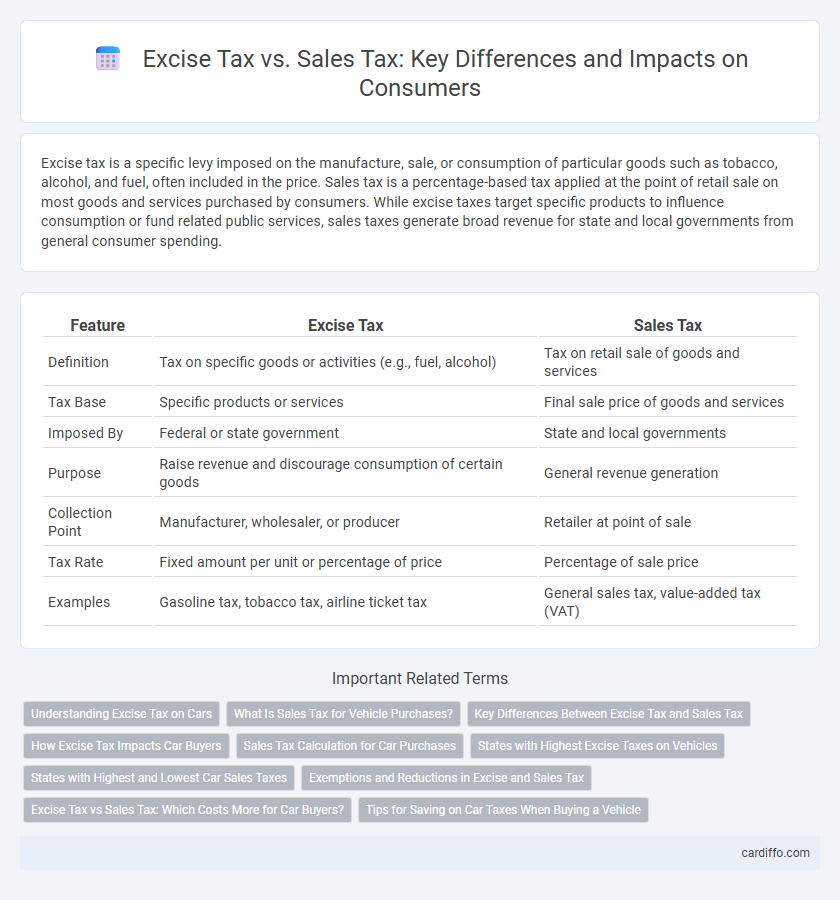

Excise tax is a specific levy imposed on the manufacture, sale, or consumption of particular goods such as tobacco, alcohol, and fuel, often included in the price. Sales tax is a percentage-based tax applied at the point of retail sale on most goods and services purchased by consumers. While excise taxes target specific products to influence consumption or fund related public services, sales taxes generate broad revenue for state and local governments from general consumer spending.

Table of Comparison

| Feature | Excise Tax | Sales Tax |

|---|---|---|

| Definition | Tax on specific goods or activities (e.g., fuel, alcohol) | Tax on retail sale of goods and services |

| Tax Base | Specific products or services | Final sale price of goods and services |

| Imposed By | Federal or state government | State and local governments |

| Purpose | Raise revenue and discourage consumption of certain goods | General revenue generation |

| Collection Point | Manufacturer, wholesaler, or producer | Retailer at point of sale |

| Tax Rate | Fixed amount per unit or percentage of price | Percentage of sale price |

| Examples | Gasoline tax, tobacco tax, airline ticket tax | General sales tax, value-added tax (VAT) |

Understanding Excise Tax on Cars

Excise tax on cars is a specific tax imposed on the manufacture, sale, or use of automobiles, often calculated based on engine size, vehicle weight, or fuel efficiency. Unlike sales tax, which is a percentage of the total purchase price paid at the point of sale, excise tax is typically included in the price or collected periodically, such as annually through vehicle registration. Understanding these distinctions helps consumers and businesses better navigate tax obligations related to car ownership and transactions.

What Is Sales Tax for Vehicle Purchases?

Sales tax for vehicle purchases is a state-imposed tax calculated as a percentage of the vehicle's purchase price, applicable at the time of sale or registration. This tax rate varies by state and sometimes local jurisdictions, significantly affecting the total cost of buying a car. Unlike excise tax, which is an annual fee based on vehicle value or weight, sales tax is a one-time payment required to legally transfer ownership.

Key Differences Between Excise Tax and Sales Tax

Excise tax is a specific tax levied on particular goods such as gasoline, alcohol, and tobacco, often included in the product price, while sales tax is a percentage charged on the final sale price of most goods and services at the point of purchase. Excise taxes are typically fixed amounts per unit or volume, targeting consumption of certain items, whereas sales taxes vary by state or locality and apply broadly to consumer transactions. The primary difference lies in excise tax's targeted application on specific products for regulatory or health reasons, compared to sales tax's general application on total retail sales to generate revenue.

How Excise Tax Impacts Car Buyers

Excise tax on cars increases the overall purchase price by imposing a specific fee on certain vehicle types, often based on fuel efficiency or engine size. This tax influences consumer choices by encouraging the purchase of more fuel-efficient or environmentally friendly vehicles to minimize additional costs. Unlike sales tax, which is a percentage of the total sale price, excise tax is a fixed amount that directly affects affordability and market demand for specific car models.

Sales Tax Calculation for Car Purchases

Sales tax calculation for car purchases typically depends on the vehicle's purchase price, applicable state and local tax rates, and any trade-in allowances or rebates. Unlike excise tax, which is often a fixed amount per unit or weight, sales tax is a percentage applied directly to the sale price, often including additional fees such as documentation or registration charges. Understanding the specific state's tax regulations and exemptions can significantly impact the final amount paid by the buyer during a car transaction.

States with Highest Excise Taxes on Vehicles

States with the highest excise taxes on vehicles impose rates often exceeding 10% of the vehicle's purchase price, significantly increasing the overall cost of ownership. These excise taxes differ from sales taxes by being specifically levied on the privilege of using or owning certain goods, such as motor vehicles, and are often used to fund transportation infrastructure. States like New York, New Jersey, and California consistently rank among those with the steepest vehicle excise taxes, reflecting regional policy priorities in transportation funding.

States with Highest and Lowest Car Sales Taxes

States with the highest car sales taxes include California, where the combined state and local rates can exceed 10%, and Washington, with rates often around 9%. Conversely, states like Delaware and New Hampshire have some of the lowest or no car sales tax, providing significant savings for vehicle buyers. Understanding these tax variations is crucial for consumers planning car purchases, as excise taxes and sales taxes impact the total cost differently depending on state regulations.

Exemptions and Reductions in Excise and Sales Tax

Excise tax exemptions commonly apply to essential goods such as prescription medications, tobacco for medicinal use, and certain agricultural products to reduce consumer burden and encourage specific economic activities. Sales tax reductions often target necessities like groceries, clothing under a certain price, and residential energy to increase affordability and support low-income households. Both tax types utilize these exemptions and reductions strategically to balance revenue generation with social equity and economic policy goals.

Excise Tax vs Sales Tax: Which Costs More for Car Buyers?

Excise tax on cars is typically a fixed amount per unit or a percentage based on factors like engine size or vehicle type, often making it more expensive for luxury or high-performance vehicles compared to sales tax, which is a percentage of the purchase price applied uniformly. Sales tax rates vary by state but generally range from 4% to 10%, directly increasing the total price paid based on the car's value. For high-priced vehicles, excise taxes can surpass sales taxes, while for lower-priced cars, sales tax often results in a higher overall tax burden.

Tips for Saving on Car Taxes When Buying a Vehicle

Excise tax on vehicles is typically based on the car's value and engine size, whereas sales tax is a percentage of the purchase price, impacting overall costs differently. To save on car taxes, consider purchasing vehicles with lower excise tax brackets, such as those with smaller engines or hybrid models that may qualify for tax exemptions. Timing your purchase during tax holidays or negotiating the price below the manufacturer's suggested retail price can also reduce the taxable amount, minimizing both excise and sales taxes.

Excise Tax vs Sales Tax Infographic

cardiffo.com

cardiffo.com