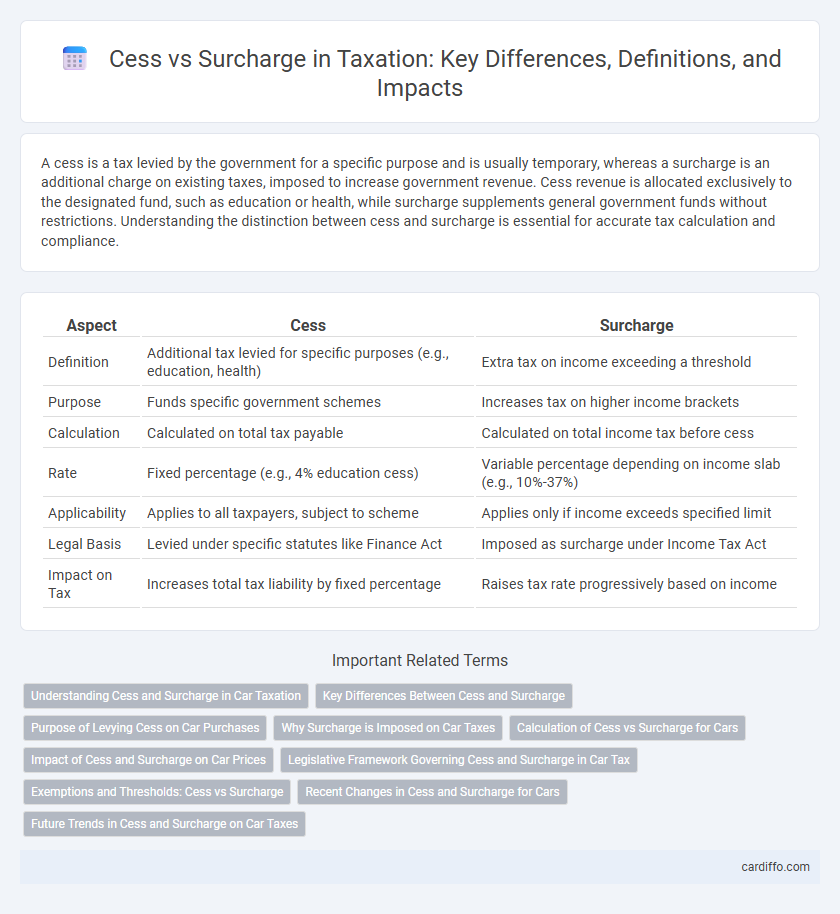

A cess is a tax levied by the government for a specific purpose and is usually temporary, whereas a surcharge is an additional charge on existing taxes, imposed to increase government revenue. Cess revenue is allocated exclusively to the designated fund, such as education or health, while surcharge supplements general government funds without restrictions. Understanding the distinction between cess and surcharge is essential for accurate tax calculation and compliance.

Table of Comparison

| Aspect | Cess | Surcharge |

|---|---|---|

| Definition | Additional tax levied for specific purposes (e.g., education, health) | Extra tax on income exceeding a threshold |

| Purpose | Funds specific government schemes | Increases tax on higher income brackets |

| Calculation | Calculated on total tax payable | Calculated on total income tax before cess |

| Rate | Fixed percentage (e.g., 4% education cess) | Variable percentage depending on income slab (e.g., 10%-37%) |

| Applicability | Applies to all taxpayers, subject to scheme | Applies only if income exceeds specified limit |

| Legal Basis | Levied under specific statutes like Finance Act | Imposed as surcharge under Income Tax Act |

| Impact on Tax | Increases total tax liability by fixed percentage | Raises tax rate progressively based on income |

Understanding Cess and Surcharge in Car Taxation

Cess in car taxation is a specific tax levied over the basic tax rate to fund designated government schemes, often linked to environmental or infrastructural goals. Surcharge is an additional charge applied on the total tax payable, generally introduced to increase revenue or discourage luxury car ownership. Understanding these distinctions is crucial for accurate calculation of total car tax liability and compliance with tax regulations.

Key Differences Between Cess and Surcharge

Cess is a tax imposed for a specific purpose, typically earmarked for welfare activities, while surcharge is an additional charge on existing tax liabilities, primarily levied on higher income brackets. Cess rates are often fixed percentages dedicated to funding schemes like education or health, whereas surcharge rates vary based on income slabs and apply only when income exceeds certain thresholds. Unlike cess, surcharge directly increases the total tax payable and is calculated as a percentage of the base tax amount, not on the total income.

Purpose of Levying Cess on Car Purchases

Cess on car purchases is primarily levied to generate funds for specific social or developmental programs, such as road infrastructure improvements and environmental conservation efforts. Unlike general taxes, cess revenues are earmarked for targeted purposes, ensuring that the collected amount directly supports initiatives linked to the automotive sector or environmental sustainability. This focused allocation contrasts with surcharges, which are additional charges on existing tax liabilities aimed at increasing overall government revenue.

Why Surcharge is Imposed on Car Taxes

Surcharge on car taxes is imposed to generate additional revenue from high-value vehicles, reflecting the ability to pay principle in taxation. This extra levy targets luxury cars that contribute significantly more to road congestion and pollution, helping fund infrastructure and environmental initiatives. The surcharge ensures equitable tax distribution, balancing fiscal demands with social and environmental concerns.

Calculation of Cess vs Surcharge for Cars

Cess on cars is calculated as a percentage of the base tax amount and is primarily levied to fund specific government schemes, often ranging from 1% to 7% depending on the vehicle category. Surcharge is an additional tax imposed on the total tax liability, typically a percentage between 10% and 15%, applied for vehicles exceeding a certain declared value or engine capacity. For luxury cars, cess is directly added to the basic excise duty, while surcharge is calculated on the combined sum of excise and cess, leading to a higher final tax burden.

Impact of Cess and Surcharge on Car Prices

Cess and surcharge significantly influence the final cost of cars by increasing the overall tax burden imposed by the government. Cess is usually levied as a percentage on the base tax amount and is earmarked for specific purposes like infrastructure or environmental funds, directly adding to the vehicle's purchase price. Surcharge applies as an additional tax on the total tax liability, often triggered by higher income brackets or luxury goods, which can substantially raise the price range of premium automobiles.

Legislative Framework Governing Cess and Surcharge in Car Tax

The legislative framework governing cess and surcharge in car tax is established under the Finance Act and relevant state tax laws, which empower governments to impose these levies for specific purposes. Cess is a targeted tax imposed to fund particular developmental activities, while surcharge is an additional charge on the base tax to augment revenue, both regulated by statutes detailing rates, collection, and utilization. Understanding these statutory provisions is essential for compliance in car taxation, ensuring accurate calculation and remittance of cess and surcharge as mandated by law.

Exemptions and Thresholds: Cess vs Surcharge

Cess applies uniformly as a fixed percentage on the tax amount without specific exemptions, primarily aimed at funding designated social sectors, whereas surcharge is an additional charge on the tax payable, levied only when income surpasses defined thresholds, varying by income slab. Exemptions for surcharge kick in below set income levels, for example, no surcharge for income up to Rs50 lakh, while cess has no such income-based exemption and is consistently applied on total tax liability. Understanding these threshold differences is critical for accurate tax planning and compliance, especially for high-income taxpayers subject to surcharge slabs and uniform cess rates.

Recent Changes in Cess and Surcharge for Cars

Recent changes in cess and surcharge on cars include an increase in the road and infrastructure cess by 2% on petrol and diesel cars, raising the total cess to 25%. The surcharge applicable to high-value vehicles exceeding INR 10 lakh has been revised, with luxury cars now attracting a 15% surcharge under income tax. These fiscal adjustments aim to promote environmental sustainability and enhance government revenue from the automobile sector.

Future Trends in Cess and Surcharge on Car Taxes

Future trends in cess and surcharge on car taxes indicate a gradual shift towards more targeted and environment-focused levies, prioritizing emissions reduction and electric vehicle incentives. Governments are expected to increase cess rates on high-polluting vehicles while introducing surcharges aimed at luxury and high-value cars to boost public revenue without burdening middle-income buyers. Enhanced digital reporting and real-time tax adjustments based on vehicle usage and carbon footprints are anticipated to streamline compliance and encourage sustainable automotive choices.

Cess vs Surcharge Infographic

cardiffo.com

cardiffo.com