Zero percent financing allows borrowers to pay no interest over a set period, making it an attractive option for those looking to minimize upfront costs. Rebate offers provide immediate cash back or discounts, which can reduce the overall purchase price but may still involve paying interest on financed amounts. Comparing these options requires evaluating the total cost of credit versus the immediate savings to determine the best financial benefit.

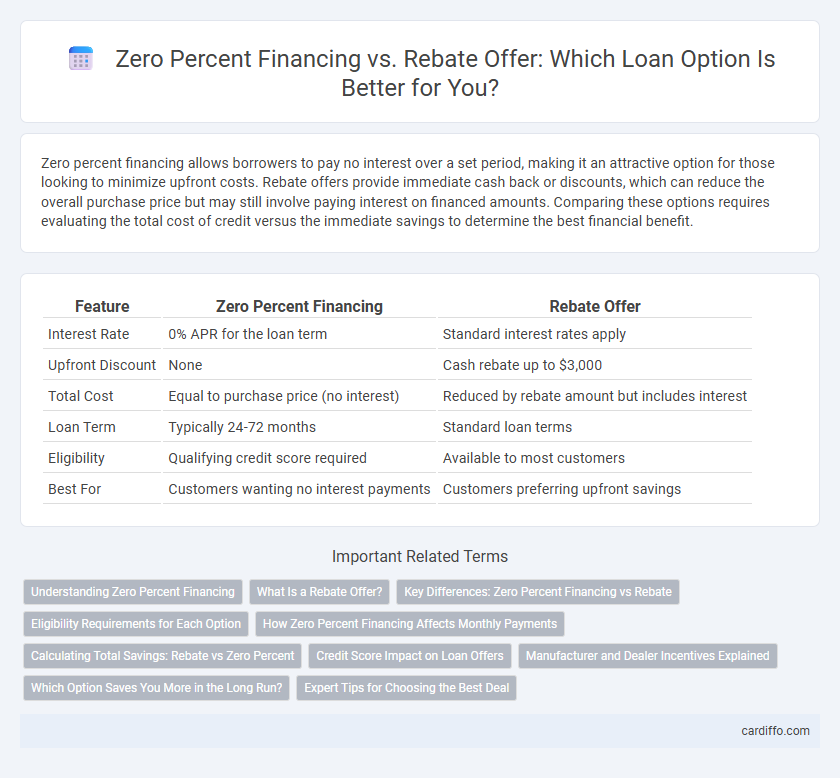

Table of Comparison

| Feature | Zero Percent Financing | Rebate Offer |

|---|---|---|

| Interest Rate | 0% APR for the loan term | Standard interest rates apply |

| Upfront Discount | None | Cash rebate up to $3,000 |

| Total Cost | Equal to purchase price (no interest) | Reduced by rebate amount but includes interest |

| Loan Term | Typically 24-72 months | Standard loan terms |

| Eligibility | Qualifying credit score required | Available to most customers |

| Best For | Customers wanting no interest payments | Customers preferring upfront savings |

Understanding Zero Percent Financing

Zero percent financing allows borrowers to pay no interest on a loan for a specified period, effectively reducing the total cost of financing compared to standard loans with interest rates. This option is particularly beneficial for buyers who can pay off the loan within the promotional period, maximizing savings on interest charges. Understanding the terms, including the loan duration and any potential fees, is crucial to fully leverage zero percent financing over rebate offers, which provide immediate cash discounts but may result in higher financing costs.

What Is a Rebate Offer?

A rebate offer is a post-purchase discount where the buyer receives a partial refund after completing the transaction, typically through mail-in or online submission. Unlike zero percent financing, which reduces the cost of borrowing over time with no interest, a rebate directly lowers the overall purchase price. Rebates provide immediate savings benefits that can be combined with other financing options to maximize affordability on loans or purchases.

Key Differences: Zero Percent Financing vs Rebate

Zero Percent Financing allows borrowers to purchase a loan without paying any interest over the loan term, effectively spreading the cost without additional charges. A Rebate Offer provides an upfront cash discount or rebate, reducing the purchase price but often requires paying regular interest on financing. Evaluating the overall savings depends on the loan amount, duration, and interest rate, with zero percent financing minimizing interest costs while rebates lower initial expenses.

Eligibility Requirements for Each Option

Zero percent financing typically requires excellent credit scores, often above 700, and may be limited to select models or purchase amounts, ensuring borrowers meet stringent creditworthiness criteria. Rebate offers, in contrast, usually have more lenient eligibility requirements and are available to a wider range of customers, including those with lower credit scores, but they may require upfront payment instead of financing. Understanding these eligibility differences helps consumers choose between paying no interest over time or receiving immediate cash discounts on loan purchases.

How Zero Percent Financing Affects Monthly Payments

Zero percent financing reduces monthly payments by eliminating interest charges, effectively spreading the principal loan amount evenly over the term. This results in lower fixed monthly installments compared to traditional loans with interest, making payments more manageable for borrowers. Unlike rebate offers that provide upfront cash discounts, zero percent financing impacts the payment structure directly, often leading to a consistent, affordable monthly budget.

Calculating Total Savings: Rebate vs Zero Percent

Calculating total savings between zero percent financing and rebate offers requires comparing the interest saved against the upfront discount value. Zero percent financing eliminates interest charges over the loan term, effectively reducing the vehicle's cost by that amount, while a rebate provides an immediate price reduction but may finance interest on the remaining balance. Consumers should evaluate the loan duration, interest rates, and rebate amount to determine which option yields greater overall savings.

Credit Score Impact on Loan Offers

Zero percent financing often requires a higher credit score for approval, as lenders view these deals as promotional offers with strict qualification criteria. Rebate offers generally affect the loan amount rather than the credit score, allowing more flexibility for applicants with varying credit profiles. Understanding the credit score impact helps borrowers choose between potentially higher loan costs with rebates or stringent credit requirements with zero percent financing.

Manufacturer and Dealer Incentives Explained

Manufacturer incentives often include zero percent financing, which reduces the cost of borrowing by eliminating interest charges, making new vehicle purchases more affordable through dealer financing programs. Rebate offers provide direct cash discounts funded by manufacturers or dealers, lowering the vehicle's purchase price upfront rather than spreading savings over time. Dealers use these incentives strategically to increase sales volume and move inventory, with zero percent financing appealing to buyers seeking financing savings and rebates attracting cash buyers looking for immediate price reductions.

Which Option Saves You More in the Long Run?

Zero percent financing offers the advantage of no interest charges over the loan term, effectively reducing the total cost of borrowing compared to standard loans. Rebates provide immediate cash discounts that lower the upfront purchase price but may come with higher interest rates if financed, potentially increasing long-term expenses. Carefully comparing the total repayment amounts and interest costs reveals that zero percent financing often saves more money in the long run, especially for buyers who plan to finance the entire purchase price.

Expert Tips for Choosing the Best Deal

Evaluate zero percent financing by calculating the true cost after interest is waived, comparing it against available rebate offers to determine overall savings on your loan. Consider loan term lengths, monthly payment amounts, and eligibility criteria, as rebates can reduce upfront costs while zero percent financing spreads payments without added interest. Prioritize deals that minimize total expenditure rather than just monthly affordability for optimal financial benefit.

Zero Percent Financing vs Rebate Offer Infographic

cardiffo.com

cardiffo.com