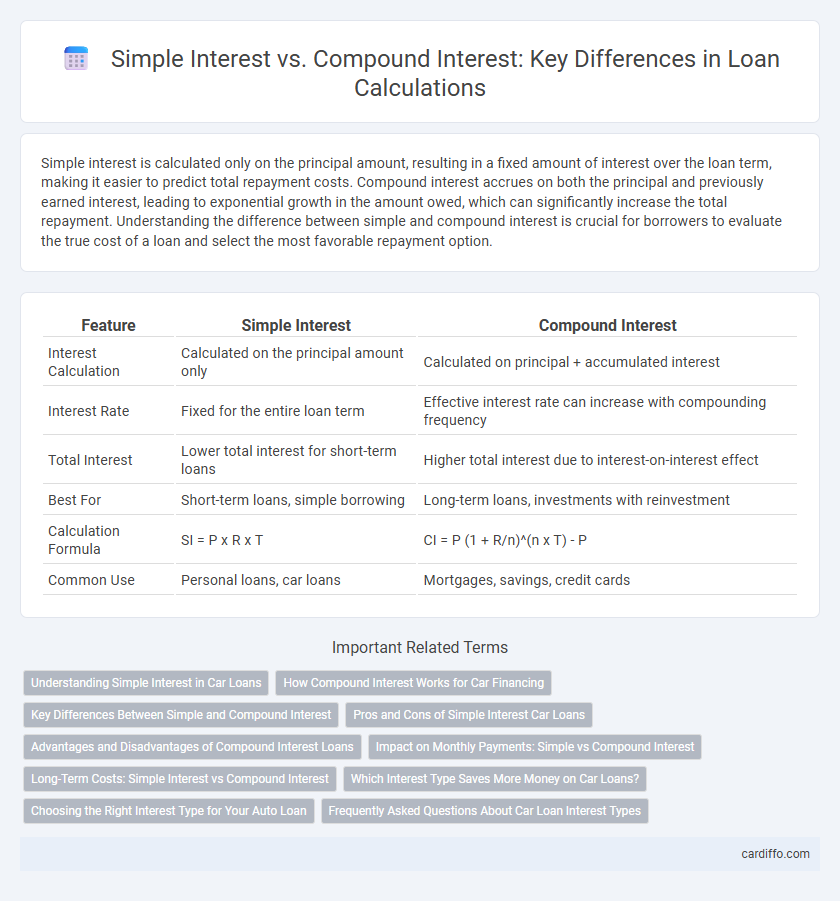

Simple interest is calculated only on the principal amount, resulting in a fixed amount of interest over the loan term, making it easier to predict total repayment costs. Compound interest accrues on both the principal and previously earned interest, leading to exponential growth in the amount owed, which can significantly increase the total repayment. Understanding the difference between simple and compound interest is crucial for borrowers to evaluate the true cost of a loan and select the most favorable repayment option.

Table of Comparison

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Interest Calculation | Calculated on the principal amount only | Calculated on principal + accumulated interest |

| Interest Rate | Fixed for the entire loan term | Effective interest rate can increase with compounding frequency |

| Total Interest | Lower total interest for short-term loans | Higher total interest due to interest-on-interest effect |

| Best For | Short-term loans, simple borrowing | Long-term loans, investments with reinvestment |

| Calculation Formula | SI = P x R x T | CI = P (1 + R/n)^(n x T) - P |

| Common Use | Personal loans, car loans | Mortgages, savings, credit cards |

Understanding Simple Interest in Car Loans

Simple interest in car loans is calculated solely on the principal amount, making it straightforward to understand and predict loan costs. This type of interest does not compound over time, which often results in lower total interest payments if the loan is paid off early. Borrowers benefit from simple interest loans by having transparent payment schedules and easier budgeting compared to compound interest loans.

How Compound Interest Works for Car Financing

Compound interest in car financing calculates interest on both the initial principal and the accumulated interest from previous periods, accelerating the total loan cost over time. This method results in higher interest payments compared to simple interest, especially on longer loan terms or with frequent compounding intervals such as monthly or quarterly. Understanding the compounding effect helps borrowers evaluate the real cost of car loans and make informed decisions about repayment strategies.

Key Differences Between Simple and Compound Interest

Simple interest calculates interest only on the principal amount throughout the loan term, while compound interest is computed on the principal plus all accumulated interest, leading to exponential growth. Simple interest results in a linear increase in the amount owed, making it easier to predict total repayment costs, whereas compound interest causes the loan balance to grow faster due to interest-on-interest effects. Understanding these differences is crucial for borrowers to evaluate loan costs and choose the most cost-effective financial product.

Pros and Cons of Simple Interest Car Loans

Simple interest car loans offer straightforward repayment calculations, making it easier for borrowers to understand the total cost over the loan term. They often result in lower overall interest expenses if the loan is paid off early, as interest is only calculated on the principal amount. However, simple interest loans may not provide the same financial benefits as compound interest loans for long-term financing, potentially leading to higher costs if payments are deferred or extended.

Advantages and Disadvantages of Compound Interest Loans

Compound interest loans offer the advantage of accelerated growth on the principal amount due to interest being calculated on both the initial principal and accumulated interest, which benefits lenders by increasing returns over time. However, borrowers face the disadvantage of higher total repayment amounts compared to simple interest loans, as interest compounds periodically, leading to potentially significant debt accumulation. This mechanism is advantageous for long-term investments but can be costly for borrowers with limited repayment capacity.

Impact on Monthly Payments: Simple vs Compound Interest

Simple interest calculates the interest on the principal amount only, resulting in consistent and often lower monthly payments. Compound interest accrues interest on both the principal and previously earned interest, leading to higher monthly payments as the loan balance grows exponentially. Understanding the impact of simple versus compound interest is essential for accurate loan cost estimation and budgeting effective repayment plans.

Long-Term Costs: Simple Interest vs Compound Interest

Simple interest calculates cost based solely on the original principal, resulting in consistent interest payments over time. Compound interest accrues on both the principal and previously earned interest, causing exponential growth in total loan costs. Over long-term periods, compound interest typically results in significantly higher repayment amounts compared to simple interest, making it crucial to analyze loan terms carefully.

Which Interest Type Saves More Money on Car Loans?

Simple interest calculates interest only on the principal loan amount, resulting in lower overall costs for short-term car loans. Compound interest accrues on both the principal and accumulated interest, increasing the total repayment amount over time. For car loans with shorter durations, simple interest typically saves more money by avoiding interest-on-interest charges.

Choosing the Right Interest Type for Your Auto Loan

Selecting between simple interest and compound interest for your auto loan significantly impacts the total cost. Simple interest calculates interest solely on the principal amount, often resulting in lower overall payments for shorter loan terms. Compound interest accrues interest on both the principal and previously earned interest, increasing the total repayment but potentially offering better rates for longer-term loans or those with fluctuating interest conditions.

Frequently Asked Questions About Car Loan Interest Types

Simple interest on a car loan is calculated only on the principal amount throughout the loan term, resulting in predictable monthly payments. Compound interest, however, accrues on both the principal and the accumulated interest, potentially increasing the total repayment amount over time. Understanding the differences in interest calculation helps borrowers choose the most cost-effective car loan option and avoid higher interest costs.

Simple Interest vs Compound Interest Infographic

cardiffo.com

cardiffo.com